Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

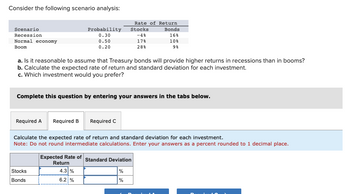

Transcribed Image Text:Consider the following scenario analysis:

Scenario

Recession

Normal economy

Boom

Probability

0.30

0.50

0.20

Required A Required B Required C

a. Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms?

b. Calculate the expected rate of return and standard deviation for each investment.

c. Which investment would you prefer?

Stocks

Bonds

Rate of Return

Stocks

-4%

Complete this question by entering your answers in the tabs below.

Expected Rate of

Return

4.3 %

6.2 %

17%

28%

Calculate the expected rate of return and standard deviation for each investment.

Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 1 decimal place.

Bonds

16%

10 %

98

Standard Deviation

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose you observe the following situation: State of Economy Bust Normal Boom Probability of State .20 .60 .20 Return if State Occurs Stock B -.04 .15 .30 a. Stock A a. Stock B b. Expected market risk premium Stock A -.06 .15 .50 a. Calculate the expected return on each stock. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. Assuming the capital asset pricing model holds and Stock A's beta is greater than Stock B's beta by .47, what is the expected market risk premium? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) % % %arrow_forwardConsider the following scenario analysis: Scenario Recession Normal economy Boom Rate of Return Probability Stocks Bonds 0.20 -6% 17% 0.60 19% 9% 0.20 30% 5% a. Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms? b. Calculate the expected rate of return and standard deviation for each investment. c. Which investment would you prefer? × Answer is not complete.arrow_forwardSuppose you observe the following situation: Security Beta Expected Return Pete Corp. 1.50 0.160 Repete Co. 1.19 0.133 Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Expected Return on Market Pete Corp. % Repete Co. % What is the risk-free rate? (Do not round intermediate calculations. Round the final answer to 3 decimal places.) Risk-free ratearrow_forward

- es Consider the following information on three stocks: State of Economy Boom Normal Bust Probability of State of Economy .20 .40 .40 Rate of Return If State Occurs Stock A .34 .25 .03 Stock B .46 .23 -.25 Stock C .50 .20 - .42 a-1. If your portfolio is invested 35 percent each in A and B and 30 percent in C, what is the portfolio expected return? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a-2. What is the variance? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .32161.) a-3. What is the standard deviation? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If the expected T-bill rate is 4.50 percent, what is the expected risk premium on the portfolio? (Do not round intermediate calculations abd enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c-1. If the expected inflation rate…arrow_forwardConsider the following information about Stocks I and II: State of Economy Recession Normal Irrational exuberance Probability of State of Economy .20 .60 .20 Rate of Return if State Occurs Stock I .04 .26 .10 Stock II -.35 15 .55 The market risk premium is 5 percent, and the risk-free rate is 4 percent. (Do not round intermediate calculations. Enter your standard deviation answers as a percent rounded to 2 decimal places, e.g., 32.16. Round your beta answers to 2 decimal places, e.g., 32.16.)arrow_forwardConsider the following scenario analysis: Rate of Return Scenario Probability Stocks Bonds Recession 0.30 -7% 18% Normal economy Boom 0.60 20% 0.10 26% 10% 3% a. Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms? b. Calculate the expected rate of return and standard deviation for each investment. c. Which investment would you prefer? Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate the expected rate of return and standard deviation for each investment. Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 1 decimal place. Expected Rate of Return Stocks 12.5% Bonds 11.7 % Standard Deviation % %arrow_forward

- Suppose your expectations regarding the stock price are as follows: State of the Market Boom Normal growth Recession Probability Ending Price 0.21 $ 140 0.30 110 0.49 80 Use the equations E (r) = Ep (s) r(s) and o² = Ep (s) [r(s) - E(r)]² to compute the mean and standard deviation of the HPR on S S HPR (including dividends) 50.5% 18.0 -12.5 stocks. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Mean Standard deviation Answer is complete but not entirely correct. 13.65 % 20.48 %arrow_forwardThe payoff table below indicates the returns (in RM thousands) of investments in stock, bond and fixed deposit under different economic situations. Type of Investment Stock Bond Fixed Deposit Table 1 Economic Situation Good 150 50 45 Stable 60 40 45 Poor -30 36 45 The probabilities of good, stable and poor economy are 0.3, 0.5 and 0.2, respectively. What is the best investment based on the expected monetary value criterion? Draw a decision tree.arrow_forwardConsider the following information on Stocks I and II: State of Economy Recession Normal Irrational exuberance. Probability of State) of Econony 15 .70 .15 a. Stock I beta Stock Il beta. b. Stock I standard deviation Stock Il standard deviation Rate of Return if State Occurs. Stock I Stock II 05 18 07 The market risk premium is 7 percent, and the risk-free rate is 3.5 percent. a. Calculate the beta of each stock. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b. Calculate the standard deviation of each stock. c. More systematic nsk d. More unsystematic risk e. "Riskier stock Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. c. Which stock has the most systematic risk? d. Which one has the most unsystematic risk? e. Which stock is "riskler"? -.21 .10 39 % %arrow_forward

- 6) An investor holds a portfolio of stocks and is considering investing in the DBB Company. The firm's prospects look neutral, and you estimate the following probability distribution of possible returns: Conditions Recession P Returns on DBB Returns on DVI 0.12 -33% -12% Below Average 0.15 -18% 7% Average 0.46 12% 11% Above Average 0.15 25% 23% Boom 0.12 37% 25% a) How much is the expected return for DBB? b) How much is the coefficient of variation for DBB? c) Now let's say you want to add another asset, DVI, to your portfolio. You sell 35% of DBB to purchase DVI. How much is your expected return for this portfolio? d) How much is the coefficient of variation for the new portfolio?arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education