Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

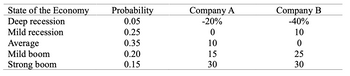

From the table given, how can I compute 1. the covariance of returns and 2. the correlation between Company A and B? Thanks!

Transcribed Image Text:State of the Economy

Deep recession

Mild recession

Average

Mild boom

Strong boom

Probability

0.05

0.25

0.35

0.20

0.15

Company A

-20%

0

10

15

30

Company B

-40%

10

0

25

30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Explain Key Statistical Relationships between Covariance and Correlation of Returns?arrow_forwardChoose a financial ratio, describe what financial statement each variable in the ratio comes from, and then explain how to interpret the ratio.arrow_forwardGive typing answer with explanation and conclusion Financial analysis is more meaningful if the ratios can be compared to an appropriate benchmark such as Select one: a. Industry averages b. Economic industry sector c. Changes over time d. All of the options are appropriate benchmarksarrow_forward

- Define financial statement analysis and how do users use liquidity and efficiency, solvency, profitability, and market prospect? In other words are are the building blocks of analysis used?arrow_forwardWith respect to the CVP analysis, which one of the following formulas is correct? a) px=vx+fc+Profit b) Profit = vx+px-fc c) FC=px-vxarrow_forwardWhat is the purpose of looking at financial ratios and other data as a financial analyst? What other ways can you do data analysis?arrow_forward

- An analyst who is interested in assessing a company’s fi nancial position is most likely to focus on which fi nancial statement? B . Income statement.arrow_forwardThe returns on assets C and D are strongly correlated with a correlation coefficient of 0.80. The variance of returns on C is 0.0009, and the variance of returns on D is 0.0036. What is the covariance of returns on C and D? Give typing answer with explanation and conclusionarrow_forwardTo evaluate a company’s performance, investors need a benchmark to which they can compare its financial ratios. What are some of the problems associated with these comparisons?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education