Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

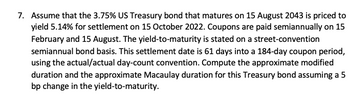

Transcribed Image Text:7. Assume that the 3.75% US Treasury bond that matures on 15 August 2043 is priced to

yield 5.14% for settlement on 15 October 2022. Coupons are paid semiannually on 15

February and 15 August. The yield-to-maturity is stated on a street-convention

semiannual bond basis. This settlement date is 61 days into a 184-day coupon period,

using the actual/actual day-count convention. Compute the approximate modified

duration and the approximate Macaulay duration for this Treasury bond assuming a 5

bp change in the yield-to-maturity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A bond that settles on June 7, 2016, matures on July 1, 2036, and may be called at any time after July 1, 2026, at a price of 105. The coupon rate on the bond is 6 percent and the price is 115.00. What are the yield to maturity and yield to call on this bond? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Yield to maturity Yield to call 4.82 % %arrow_forwardID is 4521arrow_forwardA Treasury bill that settles on May 18, 2022, pays $100,000 on August 21, 2022. Assuming a discount rate of 3.87 percent, what are the price and bond equivalent yield? Use Excel to answer this question. Note: Round your price answer to 2 decimal places. Enter your yield answer as a percent rounded to 3 decimal places.arrow_forward

- A bond is issued with a coupon of 4% paid annually, a maturity of 36 years, and a yield to maturity of 7%. What rate of return will be earned by an investor who purchases the bond for $608.94 and holds it for 1 year if the bond’s yield to maturity at the end of the year is 8%? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Negative amount should be indicated by a minus signarrow_forwardA bond, with a par value of $1000 and is redeemable at par, pays semiannual coupons at a coupon rate 12%. The bond is priced to yield 8% compounded semiannually. The bond matures on 4/1/22 and is purchased with a settlement date of 9/22/19. Use the Semi - Theoretical Method to calculate the following as of the settlement date. Check to see if you are calculating the number of days between the last book value and the settlement date correctly. Give your answers to two decimal places. (A) Flat price(full price) = 87.61 Incorrect: Your answer is incorrect. (B) Accrued Coupon (accrued interest) = (C ) Market Price(clean price) =arrow_forwardImagine a 4 year bond issued by the Treasury with a nominal value of 1000€ and 2,5% coupon paid annually. Calculate the price of the bond (€), on the same day of issuance, knowing that the relevant interest rate for the discount is 1,9% Round to the closest second decimal.arrow_forward

- Please do not give solution in image formate thanku.arrow_forwardA Treasury bill that settles on May 18, 2022, pays $100,000 on August 21, 2022. Assuming a discount rate of 5.23 percent, what are the price and bond equivalent yield? Use Excel to answer this question. Note: Round your price answer to 2 decimal places. Enter your yield answer as a percent rounded to 3 decimal places. Price Bond equivalent yield %arrow_forwardA Treasury bill matures in 81 days and has a bond equivalent yield of 2.79 percent. What is the effective annual rate (EAR)? What is the EAR if the Treasury bill matures in 8.523 months with a bond equivalent yield of 1.113%?arrow_forward

- A bond with a face value of 100 pays an annual coupon of 12% and matures on Ad14 August 2007. It uses the actual/actual day count convention. For a settlement date of 23 December 2002 and an annual YTM of 9.75%, what is the full price? Assume an actual/actual day count. A. 107.964 B. 103.657 C. 112.271arrow_forwardIf a bond issued on March 23, 2023 has par or face value of $1000.The bond will mature on March 22, 2032. The coupon rate is 7%, and coupons are paid semi-annually. If the market interest rate is 10%, what is the bond price when issued?arrow_forwardA bond that settles on June 7, 2022, matures on July 1, 2042, and may be called at any time after July 1, 2032, at a price of 185. The coupon rate on the bond is 6.6 percent and the price is 200.50. What are the yield to maturity and yield to call on this bond?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education