Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

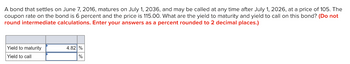

Transcribed Image Text:A bond that settles on June 7, 2016, matures on July 1, 2036, and may be called at any time after July 1, 2026, at a price of 105. The

coupon rate on the bond is 6 percent and the price is 115.00. What are the yield to maturity and yield to call on this bond? (Do not

round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.)

Yield to maturity

Yield to call

4.82 %

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A Treasury bond that settles on August 10, 2022, matures on November 5, 2029. The coupon rate is 6.8 percent and the 11811 32 quoted price is What is the bond's yield to maturity? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Yield to maturity A Treasury bond that settles on August 10, 2022, matures on November 5, 2029. The coupon rate is 6.8 percent and the quoted price is 118 11/32. What is the bond's yield to maturity? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Yield to maturityarrow_forwardRequired: Find the duration of a bond with settlement date May 29, 2018, and maturity date November 19, 2027. The coupon rate of the bond is 6%, and the bond pays coupons semiannually. The bond is selling at a yield to maturity of 7%. (Do not round intermediate calculations. Round your answers to 4 decimal places.) Macaulay duration Modified durationarrow_forwardFind the YTM of a Treasury bond which you are considering purchasing. The settlement date is Oct. 1, 2023. The bond matures on Dec. 15, 2026 and has a 4.25% coupon rate (the maturity date tells you when the coupon payments are made). The quoted price for the bond is 102:12.arrow_forward

- You find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate 22 6.052 6.143 Maturity Month/Year May 32 May 37. May 47 Coupon rate Asked Bid 103.5410 103.6288 104.4900 22 104.6357 22 Change +.3248 +.4245 +.5353 In the above table, find the Treasury bond that matures in May 2032. What is the coupon rate for this bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. 2.80% Ask Yield 2.249 77 3.951arrow_forwardAssume that today's date is February 15, 2015. Robin Hood Inc. bond is an annual-coupon bond. Par value of the bond is $1,000. How much you will pay for the bond if you purchased the bond today? The answer should be calculated to two decimal places Company Price Robin Hood 88.401 Your Answer: Answer Coupon Rate 6.148 Maturity Date 2-15-2034 YTM Current Yield Rating Darrow_forwardYou find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate 22 6.052 6.143 Maturity Month/Year: May 33 May 36 May 42 Bid 103,4560 104.4900 22 Yield to maturity Asked 103.5288 104.6357 ?? Change Ask Yield. +.3248 +4245 +.5353 5.919 ?? 3.951 In the above table, find the Treasury bond that matures in May 2036. What is your yield to maturity if you buy this bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.arrow_forward

- You find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 5.424 6.183 Maturity: Month/Year May 32 May 35 May 41 Yield to maturity Asked Bid 103.4664 103.5392 104.5004 104.6461 +.4341 ?? ?? +.5457 Change Ask Yield. 6.079 +.3867 77 4.111 In the above table, find the Treasury bond that matures in May 2035. What is your yield to maturity if you buy this bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. %arrow_forwardThe answers I got were wrongarrow_forwardYou find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 6.052 6.143 Maturity Month/Year Bid Asked Change May 33 May 36 May 42 103.4560 103.5288 104.4900 104.6357 ?? ?? +.3248 Ask Yield 5.919 +.4245 +.5353 ?? 3.951 In the above table, find the Treasury bond that matures in May 2036. What is your yield to maturity if you buy this bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Yield to maturity %arrow_forward

- Calculate the purchase price of the $1,000 face value bond using the information given below. (Do not round the intermediate calculations. Round your final answer to 2 decimal places.) Issue date Dec 15, 2013 Maturity date Dec 15, 2043 Purchase date June 15, 2023 Coupon rate (%) Market rate (%) 5.00 6.4 Assume that • Bond interest is paid semiannually. . The bond was originally issued at its face value. Bonds are redeemed at their face value at maturity. • Market rates of return are compounded semiannually. Bond pricearrow_forwardNonearrow_forwardYou find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 6.252 6.163 Maturity Month/Year May 36 May 41 May 51 Bid 103.5462 104.4952 ?? Asked 103.6340 104.6409 ?? Change Ask Yield +.3015 2.329 +.4293 +.5405 ?? 4.031 In the above table, find the Treasury bond that matures in May 2036. What is the coupon rate for this bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education