Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

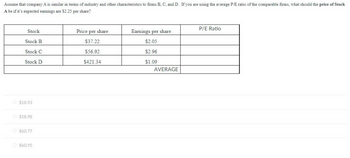

Transcribed Image Text:Assume that company A is similar in terms of industry and other characteristics to firms B, C, and D. If you are using the average P/E ratio of the comparable firms, what should the price of Stock

A be if it's expected earnings are $2.25 per share?

Stock

Stock B

Stock C

Stock D

$18.93

$18.98

$60.77

$60.95

Price per share

$37.22

$56.92

$421.34

Earnings per share

$2.05

$2.96

$1.09

AVERAGE

P/E Ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Only need last 2 parts of the problem.arrow_forwardb) Indicate which of the following companies are likely to have share prices increases by placing the number in the marked square Expected Cash Returns Required Return Company A Company B Company C Company D Company E 10% 9% 11% 13% 12% 10% 13% 12% 14% 14% 1 A 2 A and B 3 В 4 A, C and D Earrow_forwardColonel Motors (C) Separated Edison (S) Expected Return 10% 8% Standard Deviation 6% 3% Please represent graphically all potential combinations of stocks C and S, if the correlation coefficient between the returns of stocks C and S is: A) 1 B) 0 C) -1 Please report these investment opportunity sets in the corresponding Excel sheets.arrow_forward

- Compare the year end price of Dollar Inc. and Target Corp. As an investor, what would these two charts tell you, and who would you choose to invest in and why?arrow_forward1. stock EPS share price Growth rate A $0.30 $4.80 4% B $0.40 $5.50 6% C $0.50 $7.50 7% D $0.60 $8.00 5% Using the PEG ratio, rank the stocks in order of investment opportunity, the first having the best, the last having the worst. A. C,B,D,A B. A,D,B,C C. C,D,B,A D. B,D,C,A 2.Which of the following not true regarding financial statement A.Group financial statement be produced by each subsidiary as well as the parent entity B.Profit must be separated between members of the parent company and that of minority interest C.Minority interest share of equity represents that ‘part of a subsidiary’s equity not allocated to members of the parent company. D.Group financial statements must be produced by the parent entity only. E.None of the options provided.arrow_forwardPlz. Solve botharrow_forward

- classified stock founders’ shares American depository receipts (ADRs) Euro stock Yankee stock market price (value), intrinsic (theoretical) value, growth rate, g required rate of return, dividend yield capital gains yield expected rate of return, constant growth model nonconstant growth P/E ratio economic value added (EVA) Define All Wordsarrow_forwardUSE EXCEL and show cell references.arrow_forwardConsidering the following stock return information for Goya Foods and Bloomingdales, State of Economy Return onGoya Foods Return onBloomingdales Bear .108 −.051 Normal .109 .154 Bull .079 .239 If each state of the economy is equally likely to occur, the covariance between the two stocks is: a. -0.014820 b. 0.705700 c. -0.013900 d. 0.000190 e. -0.001195 NOTE: Indicate a negative answer with a minus sign.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education