Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

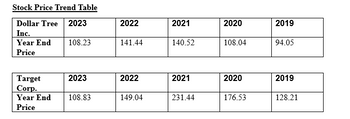

Compare the year end price of Dollar Inc. and Target Corp. As an investor, what would these two charts tell you, and who would you choose to invest in and why?

Transcribed Image Text:**Stock Price Trend Table**

**Dollar Tree Inc.**

- **2023**: Year End Price - 108.23

- **2022**: Year End Price - 141.44

- **2021**: Year End Price - 140.52

- **2020**: Year End Price - 108.04

- **2019**: Year End Price - 94.05

**Target Corp.**

- **2023**: Year End Price - 108.83

- **2022**: Year End Price - 149.04

- **2021**: Year End Price - 231.44

- **2020**: Year End Price - 176.53

- **2019**: Year End Price - 128.21

**Analysis:**

This table illustrates the year-end stock prices for Dollar Tree Inc. and Target Corp. from 2019 to 2023. The data reveals trends over a five-year period, highlighting changes in stock prices that can be crucial for financial analysis and investment decision-making. Notable is the overall peak for Target Corp. in 2021 and the subsequent decline by 2023. Similarly, Dollar Tree Inc. shows a peak in 2022, followed by a decrease in 2023.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Describe and compare (i) the Simple Earnings Capitalisation Model, (ii) Burgstahler & Dichev's option-style valuation model, and (ii) Ohlson's Unbiased Accounting Model for evaluating share prices. What is your assessment of the three models?arrow_forwardAfter researching the competitors of EJH Enterprises, you determine that most comparable firms have the following valuation ratios: E. EJH Enterprises has EPS of $1.80, EBITDA of $290 million, $28 million in cash, $45 million in debt, and 105 million shares outstanding. What range of prices is consistent with both sets of multiples? ..... The range of prices will be: Lowest price within both ranges, the P/E and EV/EBITDA ranges, is $ . (Round to two decimal places.) Highest price within both ranges, the P/E and the EV/EBITDA ranges, is $ (Round to two decimal places.)arrow_forward(b) Use Allscripts Healthcare and McKesson as comparables, along with the price to NOA ratios from part a, and then estimate for Cerner its company intrinsic value, its equity intrinsic value, and its equity intrinsic value per share. (Round the intrinsic value and equity intrinsic value to the nearest million and the value per share to the nearest cent.)Average of the two rounded ratios in (a) aboveAnswer (Round to two decimal places.) Using the rounded average calculation above, calculate the following:Intrinsic valuearrow_forward

- How do you identify and record key profitability ratios, including ROE for a company like Walmart?arrow_forward← After researching the competitors of EJH Enterprises, you determine that most comparable firms have the following valuation ratios: EJH Enterprises has EPS of $2.00, EBITDA of $300 million, $27 million in cash, $42 million in debt, and 104 million shares outstanding. What range of prices is consistent with both sets of multiples? + The range of prices will be: Lowest price within both ranges, the P/E and EV/EBITDA ranges, is $. (Round to two decimal places.) Highest price within both ranges, the P/E and the EV/EBITDA ranges, is $. (Round to two decimal places.)arrow_forwardAfter researching the competitors of EJH Enterprises, you determine that most comparable firms have the following valuation ratios: . EJH Enterprises has EPS of $1.90, EBITDA of $300 million, $30 million in cash, $40 million in debt, and 102 million shares outstanding. What range of prices is consistent with both sets of multiples? The range of prices will be: Lowest price within both ranges, the P/E and EV/EBITDA ranges, is $ (Round to two decimal places.) Highest price within both ranges, the P/E and the EV/EBITDA ranges, is $ (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) EV/EBITDA P/E Comp 1 12 Comp 2 11 Comp 3 12.5 19 18 20 Comp 4 10 17 Print Done -arrow_forward

- If we divide users of ratios into short-term lenders, long-term lenders, and stockholders, in which ratios would each group be most interested, and for what reasons?arrow_forwardYou are given the three EPS estimates and the following estimates related to the market earnings multiple: EPS D/E Nominal RFR Risk premium ROE One shoul✓ -Select- a. Based on the three EPS and P/E estimates, compute the high, low, and consensus intrinsic market value for the S&P Industrials Index in 2018. Do not round intermediate calculations. Round your answers to the nearest cent. High intrinsic market value: $ Low intrinsic market value: $ underweight overweight Consensus intrinsic market value: $ b. Assuming that the S&P Industrials Index at the beginning of the year was priced at 2,050, compute your estimated rate of return under the three scenarios from Part a. Do not round intermediate calculations. Round your answers to one decimal place. Use a minus sign to enter negative rates of return, if any. Rate of return (optimistic scenario): Rate of return (pessimistic scenario): Rate of return (consensus scenario): Assuming your required rate of return is equal to the consensus,…arrow_forwardThe profitability index is another method to evaluate capital investments. If you are trying to compare investments of different sizes, why is the profitability index a better way to do this when compared to the net present value method?arrow_forward

- Suppose you, a stock analyst, are performing a ratio analysis and comparing a discount merchandiser with a high-end merchandiser. Suppose further that both companies have identical ROEs. If you apply the DuPont equation to both firms, would you expect the three components to be the same for both companies? If not, explain what balance sheet and income statement items might lead to the differences in the DuPont equation components.arrow_forwardPlease also explain why other options are incorrectarrow_forwardWhich of the following best describes the market capitalization of a company? Select one: a. it represents the total value of the company b. it is the product of the numbers of shares and the price per share c. it represents the total wealth associated with the company's earnings d. it is the most someone would pay for the stockarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education