FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Assume that a company is considering buying a new piece of equipment for $240,000 that would have a useful life of five years and no salvage value. The equipment would generate the following estimated annual revenues and expenses:

| Revenues | $ 105,500 | |

|---|---|---|

| Less operating expenses: | ||

| Commissions | $ 15,000 | |

| Insurance | 5,000 | |

| 48,000 | ||

| Maintenance | 30,000 | 98,000 |

| Net operating income | $ 7,500 |

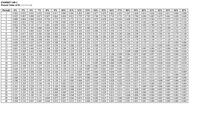

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.

The

Transcribed Image Text:EXHIBIT 14B-1

Present Value of $1; 1 ( 1 + r ) n

Periods

4%

5%

6%

7%

8%

9%

10%

11%

12%

13%

14%

15%

16%

17%

18%

19%

20%

21%

22%

23%

24%

25%

1

0.962

0.952

0.943

0.935

0.926

0.917

0.909

0.901

0.893

0.885

0.877

0.870

0.862

0.855

0.847

0.840

0.833

0.826

0.820

0.813

0.806

0.800

2

0.925

0.907

0.890

0.873

0.857

0.842

0.826

0.812

0.797

0.783

0.769

0.756 | 0.743

0.731

0.718

0.706

0.694

0.683

0.672

0.661

0.650

0.640

3

0.889

0.864

0.840

0.816

0.794

0.772

0.751

0.731

0.712

0.693

0.675

0.658

0.641

0.624

0.609

0.593

0.579

0.564

0.551

0.537

0.524

0.512

4

0.855

0.823

0.792

0.763

0.735

0.708

0.683

0.659

0.636

0.613

0.592

0.572 | 0.552

0.534

0.516

0.499

0.482

0.467

0.451

0.437

0.423

0.410

5

0.822

0.784

0.747

0.713

0.681

0.650

0.621

0.593

0.567

0.543

0.519

0.497

0.476

0.456

0.437

0.419

0.402

0.386

0.370

0.355

0.341

0.328

0.790

0.746

0.705

0.666

0.630

0.596

0.564

0.535

0.507

0.480

0.456

0.432 | 0.410

0.390

0.370

0.352

0.335

0.319

0.303

0.289

0.275

0.262

7

0.760

0.711

0.665

0.623

0.583

0.547

0.513

0.482

0.452

0.425

0.400

0.376

0.354 0.333

0.314 | 0.296

0.279

0.263

0.249

0.235

0.222

0.210

8

0.731

0.677

0.627

0.582

0.540

0.502

0.467

0.434

0.404

0.376

0.351

0.327 | 0.305

0.285

0.266

0.249

0.233

0.218

0.204

0.191

0.179

0.168

9.

0.703

0.645

0.592

0.544

0.500

0.460

0.424

0.391

0.361

0.333

0.308

0.284

0.263

0.243

0.225

0.209

0.194

0.180

0.167

0.155

0.144

0.134

10

0.676

0.614

0.558

0.508

0.463

0.422

0.386

0.352

0.322

0.295

0.270

0.247

0.227

0.208

0.191

0.176

0.162

0.149

0.137

0.126

0.116

0.107

11

0.650

0.585

0.527

0.475

0.429

0.388

0.350

0.317

0.287

0.261

0.237

0.215

0.195

0.178

0.162 | 0.148

0.135

0.123

0.112

0.103

0.094

0.086

12

0.625

0.557

0.497

0.444

0.397

0.356

0.319

0.286

0.257

0.231

0.208

0.187 | 0.168

0.152

0.137

0.124

0.112

0.102

0.092

0.083

0.076

0.069

13

0.601

0.530

0.469

0.415

0.368

0.326

0.290

0.258

0.229

0.204

0.182

0.163

0.145

0.130

0.116

0.104

0.093

0.084

0.075

0.068

0.061

0.055

14

0.577

0.505

0.442

0.388

0.340

0.299

0.263

0.232

0.205

0.181

0.160

0.141

0.125

0.111

0.099 0.088

0.078

0.069

0.062

0.055

0.049

0.044

15

0.555

0.481

0.417

0.362

0.315

0.275

0.239

0.209

0.183

0.160

0.140

0.123

0.108

0.095

0.084

0.074

0.065

0.057

0.051

0.045

0.040

0.035

16

0.534

0.458

0.394

0.339

0.292

0.252

0.218

0.188

0.163

0.141

0.123

0.107

0.093

0.081

0.071

0.062

0.054

0.047

0.042

0.036

0.032

0.028

17

0.513

0.436

0.371

0.317

0.270

0.231

0.198

0.170

0.146

0.125

0.108

0.093

0.080

0.069

0.060 | 0.052

0.045

0.039

0.034

0.030

0.026

0.023

18

0.494

0.416

0.350

0.296

0.250

0.212

0.180

0.153

0.130

0.111

0.095

0.081

0.069

0.059

0.051

0.044

0.038

0.032

0.028

0.024

0.021

0.018

19

0.475

0.396

0.331

0.277

0.232

0.194

0.164

0.138

0.116

0.098

0.083

0.070

0.060

0.051

0.043

0.037

0.031

0.027

0.023 | 0.020

0.017

0.014

20

0.456

0.377

0.312

0.258

0.215

0.178

0.149

0.124

0.104

0.087

0.073

0.061

0.051

0.043

0.037

0.031

0.026

0.022

0.019

0.016

0.014

0.012

21

0.439

0.359

0.294

0.242

0.199

0.164

0.135

0.112

0.093

0.077

0.064

0.053

0.044 | 0.037

0.031

0.026

0.022

0.018

0.015 | 0.013

0.011

0.009

22

0.422

0.342

0.278

0.226

0.184

0.150

0.123

0.101

0.083

0.068

0.056

0.046

0.038

0.032

0.026

0.022

0.018

0.015

0.013

0.011

0.009

0.007

23

0.406

0.326

0.262

0.211

0.170

0.138

0.112

0.091

0.074

0.060

0.049

0.040

0.033

0.027

0.022 | 0.018

0.015

0.012

0.010 | 0.009

0.007

0.006

24

0.390

0.310

0.247

0.197

0.158

0.126

0.102

0.082

0.066

0.053

0.043

0.035

0.028

0.023

0.019

0.015

0.013

0.010

0.008

0.007

0.006

0.005

25

0.375

0.295

0.233

0.184

0.146

0.116

0.092

0.074

0.059

0.047

0.038

0.030 | 0.024 | 0.020

0.016

0.013

0.010

0.009

0.007 | 0.006

0.005

0.004

26

0.361

0.281

0.220

0.172

0.135

0.106

0.084

0.066

0.053

0.042

0.033

0.026

0.021

0.017

0.014

0.011

0.009

0.007

0.006

0.005

0.004

0.003

27

0.347

0.268

0.207

0.161

0.125

0.098

0.076

0.060

0.047

0.037

0.029

0.023

0.018

0.014

0.011

0.009

0.007

0.006

0.005

0.004

0.003

0.002

28

0.333

0.255

0.196

0.150

0.116 | 0.090

0.069

0.054

0.042

0.033

0.026

0.020

0.016

0.012

0.010

0.008

0.006

0.005

0.004

0.003

0.002

0.002

0.029 | 0.022

0.026 | 0.020

29

0.321

0.243

0.185

0.141

0.107

0.082

0.063

0.048

0.037

0.017 | 0.014

0.011

0.008

0.006

0.005

0.004

0.003

0.002

0.002

0.002

30

0.308

0.231

0.174

0.131

0.099

0.075

0.057

0.044

0.033

0.015

0.012

0.009

0.007

0.005

0.004

0.003

0.003

0.002

0.002

0.001

40

0.208

0.142

0.097

0.067

0.046

0.032

0.022

0.015

0.011

0.008

0.005

0.004 | 0.003

0.002

0.001

0.001

0.001

0.000

0.000

0.000

0.000

0.000

![EXHIBIT 14B-2

Present Value of an Annuity of $1 in Arrears; 1 r[1-1 (1 +r) n ]

Periods

4%

5%

6%

7%

8%

9%

10%

11%

12%

13%

14%

15%

16%

17%

18%

19%

20%

21%

22%

23%

24%

25%

1

0.962

0.952

0.943

0.935

0.926

0.917

0.909

0.901

0.893

0.885

0.877

0.870

0.862

0.855

0.847

0.840

0.833

0.826

0.820

0.813

0.806

0.800

2

1.886

1.859

1.833

1.808

1.783

1.759

1.736

1.713

1.690

1.668

1.647

1.626

1.605

1.585

1.566

1.547

1.528

1.509

1.492

1.474

1.457

1.440

3

2.775

2.723

2.673

2.624

2.577

2.531

2.487

2.444

2.402

2.361

2.322

2.283

2.246

2.210

2.174

2.140

2.106

2.074

2.042

2.011

1.981

1.952

4

3.630

3.546

3.465

3.387

3.312

3.240

3.170

3.102

3.037

2.974

2.914

2.855

2.798

2.743

2.690| 2.639

2.589 | 2.540

2.494

2.448

2.404

2.362

5

4.452

4.329

4.212

4.100

3.993

3.890

3.791

3.696

3.605

3.517

3.433

3.352

3.274

3.199

3.127

3.058

2.991

2.926

2.864

2.803

2.745

2.689

6.

5.242

5.076

4.917

4.767

4.623

4.486

4.355

4.231

4.111

3.998

3.889

3.784

3.685

3.589

3.498

3.410

3.326

3.245

3.167

3.092

3.020

2.951

7

6.002

5.786

5.582

5.389

5.206

5.033

4.868

4.712

4.564 | 4.423

4.288

4.160

4.039

3.922

3.812

3.706

3.605

3.508

3.416

3.327

3.242

3.161

8

6.733

6.463

6.210

5.971

5.747

5.535

5.335

5.146

4.968

4.799

4.639

4.487

4.344

4.207

4.078

3.954

3.837

3.726

3.619

3.518 | 3.421

3.329

9.

7.435

7.108

6.802

6.515

6.247

5.995

5.759

5.537

5.328

5.132

4.946

4.772 | 4.607

4.451

4.303

4.163

4.031

3.905

3.786| 3.673

3.566

3.463

10

8.111

7.722

7.360

7.024

6.710

6.418

6.145

5.889

5.650

5.426

5.216

5.019

4.833

4.659

4.494| 4.339

4.192

4.054

3.923

3.799

3.682

3.571

11

8.760

8.306

7.887

7.499

7.139

6.805

6.495

6.207

5.938

5.687

5.453

5.234

5.029

4.836

4.656

4.486

4.327

4.177

4.035

3.902

3.776

3.656

12

9.385

8.863

8.384

7.943

7.536

7.161

6.814

6.492

6.194

5.918

5.660

5.421

5.197

4.988

4.793

4.611

4.439

4.278

4.127 | 3.985

3.851

3.725

13

9.986

9.394

8.853

8.358

7.904

7.487

7.103

6.750

6.424

6.122

5.842 | 5.583

5.342

5.118

4.910

4.715

4.533

4.362

4.203

4.053

3.912

3.780

10.563 9.899

11.118 10.380 | 9.712

11.652 10.838 10.106 9.447

12.166 | 11.274 | 10.477 9.763

12.659 11.690 | 10.828 | 10.059 9.372

13.134 12.085 | 11.158 | 10.336| 9.604

13.590 12.462 | 11.470 | 10.594| 9.818

14.029 12.821 | 11.764 | 10.836 | 10.017 9.292

14.451 13.163 | 12.042 11.061 | 10.201 | 9.442

14.857 13.489 | 12.303 11.272 | 10.371| 9.580

15.247 13.799 | 12.550 | 11.469 | 10.529| 9.707

15.622 14.094 | 12.783 | 11.654 | 10.675| 9.823

15.983 14.375 | 13.003 | 11.826 | 10.810| 9.929

16.330 14.643 | 13.211 | 11.987 | 10.935 | 10.027 9.237

16.663 14.898 | 13.406 | 12.137 | 11.051 | 10.116 | 9.307

16.984 | 15.141 | 13.591 | 12.278 | 11.158 | 10.198| 9.370 | 8.650

17.292 15.372 | 13.765 | 12.409 | 11.258 | 10.274 9.427

19.793 | 17.159 | 15.046 13.332 11.925 10.757 9.779

14

9.295

8.745

8.244

7.786

7.367

6.982

6.628

6.302

6.002

5.724

5.468

5.229

5.008

4.802

4.611

4.432

4.265

4.108

3.962

3.824

15

9.108

8.559

8.061

7.606

7.191

6.811

6.462

6.142

5.847

5.575

5.324

5.092

4.876

4.675

4.489

4.315 | 4.153

4.001

3.859

16

8.851

8.313

7.824

7.379

6.974

6.604

6.265

5.954

5.668

5.405

5.162 | 4.938

4.730

4.536

4.357

4.189

4.033

3.887

17

9.122

8.544

8.022

7.549

7.120

6.729

6.373

6.047

5.749 | 5.475

5.222

4.990

4.775

4.576 | 4.391

4.219

4.059

3.910

18

8.756

8.201

7.702

7.250

6.840

6.467

6.128

5.818

5.534

5.273

5.033

4.812

4.608

4.419

4.243

4.080

3.928

19

8.950

8.365

7.839

7.366

6.938

6.550

6.198

5.877

5.584

5.316

5.070

4.843

4.635

4.442 4.263

4.097

3.942

20

9.129

8.514

7.963

7.469

7.025

6.623

6.259

5.929

5.628

5.353

5.101

4.870

4.657

4.460

4.279

4.110

3.954

21

8.649

8.075

7.562

7.102

6.687

6.312

5.973

5.665

5.384

5.127

4.891

4.675

4.476 | 4.292 | 4.121

3.963

22

8.772

8.176

7.645

7.170

6.743

6.359

6.011

5.696

5.410

5.149

4.909

4.690

4.488

4.302

4.130

3.970

23

8.883

8.266

7.718

7.230

6.792

6.399

6.044

5.723

5.432

5.167

4.925

4.703

4.499

4.311

4.137

3.976

24

8.985

8.348

7.784

7.283

6.835

6.434

6.073

5.746

5.451

5.182

4.937

4.713

4.507

4.318

4.143

3.981

25

9.077

8.422

7.843

7.330

6.873

6.464

6.097

5.766

5.467

5.195 | 4.948 | 4.721

4.514 | 4.323

4.147

3.985

26

9.161

8.488

7.896

7.372

6.906

6.491

6.118

5.783

5.480

5.206

4.956

4.728

4.520

4.328

4.151

3.988

6.514| 6.136 | 5.798

6.152 | 5.810

6.166 | 5.820

27

8.548

7.943 | 7.409

6.935

5.492

5.215

4.964

4.734

4.524 4.332 | 4.154

3.990

28

8.602 | 7.984

7.441

6.961

6.534

5.502

5.223

4.970

4.739

4.528

4.335

4.157

3.992

29

8.022

7.470

6.983

6.551

5.510

5.229

4.975

4.743

4.531

4.337

4.159

3.994

30

8.694

8.055

7.496

7.003

6.566

6.177

5.829

5.517

5.235

4.979

4.746

4.534

4.339

4.160

3.995

40

8.951

8.244| 7.634

7.105

6.642

6.233

5.871

5.548

5.258

4.997

4.760

4.544 | 4.347

4.166

3.999](https://content.bartleby.com/qna-images/question/16afad9b-824d-42b7-9e40-175f68ea31da/3ef42b35-de94-4bdd-848c-40b15d40be0e/s227l1v_thumbnail.png)

Transcribed Image Text:EXHIBIT 14B-2

Present Value of an Annuity of $1 in Arrears; 1 r[1-1 (1 +r) n ]

Periods

4%

5%

6%

7%

8%

9%

10%

11%

12%

13%

14%

15%

16%

17%

18%

19%

20%

21%

22%

23%

24%

25%

1

0.962

0.952

0.943

0.935

0.926

0.917

0.909

0.901

0.893

0.885

0.877

0.870

0.862

0.855

0.847

0.840

0.833

0.826

0.820

0.813

0.806

0.800

2

1.886

1.859

1.833

1.808

1.783

1.759

1.736

1.713

1.690

1.668

1.647

1.626

1.605

1.585

1.566

1.547

1.528

1.509

1.492

1.474

1.457

1.440

3

2.775

2.723

2.673

2.624

2.577

2.531

2.487

2.444

2.402

2.361

2.322

2.283

2.246

2.210

2.174

2.140

2.106

2.074

2.042

2.011

1.981

1.952

4

3.630

3.546

3.465

3.387

3.312

3.240

3.170

3.102

3.037

2.974

2.914

2.855

2.798

2.743

2.690| 2.639

2.589 | 2.540

2.494

2.448

2.404

2.362

5

4.452

4.329

4.212

4.100

3.993

3.890

3.791

3.696

3.605

3.517

3.433

3.352

3.274

3.199

3.127

3.058

2.991

2.926

2.864

2.803

2.745

2.689

6.

5.242

5.076

4.917

4.767

4.623

4.486

4.355

4.231

4.111

3.998

3.889

3.784

3.685

3.589

3.498

3.410

3.326

3.245

3.167

3.092

3.020

2.951

7

6.002

5.786

5.582

5.389

5.206

5.033

4.868

4.712

4.564 | 4.423

4.288

4.160

4.039

3.922

3.812

3.706

3.605

3.508

3.416

3.327

3.242

3.161

8

6.733

6.463

6.210

5.971

5.747

5.535

5.335

5.146

4.968

4.799

4.639

4.487

4.344

4.207

4.078

3.954

3.837

3.726

3.619

3.518 | 3.421

3.329

9.

7.435

7.108

6.802

6.515

6.247

5.995

5.759

5.537

5.328

5.132

4.946

4.772 | 4.607

4.451

4.303

4.163

4.031

3.905

3.786| 3.673

3.566

3.463

10

8.111

7.722

7.360

7.024

6.710

6.418

6.145

5.889

5.650

5.426

5.216

5.019

4.833

4.659

4.494| 4.339

4.192

4.054

3.923

3.799

3.682

3.571

11

8.760

8.306

7.887

7.499

7.139

6.805

6.495

6.207

5.938

5.687

5.453

5.234

5.029

4.836

4.656

4.486

4.327

4.177

4.035

3.902

3.776

3.656

12

9.385

8.863

8.384

7.943

7.536

7.161

6.814

6.492

6.194

5.918

5.660

5.421

5.197

4.988

4.793

4.611

4.439

4.278

4.127 | 3.985

3.851

3.725

13

9.986

9.394

8.853

8.358

7.904

7.487

7.103

6.750

6.424

6.122

5.842 | 5.583

5.342

5.118

4.910

4.715

4.533

4.362

4.203

4.053

3.912

3.780

10.563 9.899

11.118 10.380 | 9.712

11.652 10.838 10.106 9.447

12.166 | 11.274 | 10.477 9.763

12.659 11.690 | 10.828 | 10.059 9.372

13.134 12.085 | 11.158 | 10.336| 9.604

13.590 12.462 | 11.470 | 10.594| 9.818

14.029 12.821 | 11.764 | 10.836 | 10.017 9.292

14.451 13.163 | 12.042 11.061 | 10.201 | 9.442

14.857 13.489 | 12.303 11.272 | 10.371| 9.580

15.247 13.799 | 12.550 | 11.469 | 10.529| 9.707

15.622 14.094 | 12.783 | 11.654 | 10.675| 9.823

15.983 14.375 | 13.003 | 11.826 | 10.810| 9.929

16.330 14.643 | 13.211 | 11.987 | 10.935 | 10.027 9.237

16.663 14.898 | 13.406 | 12.137 | 11.051 | 10.116 | 9.307

16.984 | 15.141 | 13.591 | 12.278 | 11.158 | 10.198| 9.370 | 8.650

17.292 15.372 | 13.765 | 12.409 | 11.258 | 10.274 9.427

19.793 | 17.159 | 15.046 13.332 11.925 10.757 9.779

14

9.295

8.745

8.244

7.786

7.367

6.982

6.628

6.302

6.002

5.724

5.468

5.229

5.008

4.802

4.611

4.432

4.265

4.108

3.962

3.824

15

9.108

8.559

8.061

7.606

7.191

6.811

6.462

6.142

5.847

5.575

5.324

5.092

4.876

4.675

4.489

4.315 | 4.153

4.001

3.859

16

8.851

8.313

7.824

7.379

6.974

6.604

6.265

5.954

5.668

5.405

5.162 | 4.938

4.730

4.536

4.357

4.189

4.033

3.887

17

9.122

8.544

8.022

7.549

7.120

6.729

6.373

6.047

5.749 | 5.475

5.222

4.990

4.775

4.576 | 4.391

4.219

4.059

3.910

18

8.756

8.201

7.702

7.250

6.840

6.467

6.128

5.818

5.534

5.273

5.033

4.812

4.608

4.419

4.243

4.080

3.928

19

8.950

8.365

7.839

7.366

6.938

6.550

6.198

5.877

5.584

5.316

5.070

4.843

4.635

4.442 4.263

4.097

3.942

20

9.129

8.514

7.963

7.469

7.025

6.623

6.259

5.929

5.628

5.353

5.101

4.870

4.657

4.460

4.279

4.110

3.954

21

8.649

8.075

7.562

7.102

6.687

6.312

5.973

5.665

5.384

5.127

4.891

4.675

4.476 | 4.292 | 4.121

3.963

22

8.772

8.176

7.645

7.170

6.743

6.359

6.011

5.696

5.410

5.149

4.909

4.690

4.488

4.302

4.130

3.970

23

8.883

8.266

7.718

7.230

6.792

6.399

6.044

5.723

5.432

5.167

4.925

4.703

4.499

4.311

4.137

3.976

24

8.985

8.348

7.784

7.283

6.835

6.434

6.073

5.746

5.451

5.182

4.937

4.713

4.507

4.318

4.143

3.981

25

9.077

8.422

7.843

7.330

6.873

6.464

6.097

5.766

5.467

5.195 | 4.948 | 4.721

4.514 | 4.323

4.147

3.985

26

9.161

8.488

7.896

7.372

6.906

6.491

6.118

5.783

5.480

5.206

4.956

4.728

4.520

4.328

4.151

3.988

6.514| 6.136 | 5.798

6.152 | 5.810

6.166 | 5.820

27

8.548

7.943 | 7.409

6.935

5.492

5.215

4.964

4.734

4.524 4.332 | 4.154

3.990

28

8.602 | 7.984

7.441

6.961

6.534

5.502

5.223

4.970

4.739

4.528

4.335

4.157

3.992

29

8.022

7.470

6.983

6.551

5.510

5.229

4.975

4.743

4.531

4.337

4.159

3.994

30

8.694

8.055

7.496

7.003

6.566

6.177

5.829

5.517

5.235

4.979

4.746

4.534

4.339

4.160

3.995

40

8.951

8.244| 7.634

7.105

6.642

6.233

5.871

5.548

5.258

4.997

4.760

4.544 | 4.347

4.166

3.999

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Wizard Company has an old machine that is fully depreciated but has a current salvage value of $10,000. The company wants to purchase a new machine that would cost $60,000 and have a five-year useful life and zero salvage value. Expected changes in annual revenues and expenses if the new machine is purchased are: Increased revenues Increased expenses Salary of additional operator $56,000 Supplies 14,000 Depreciation Maintenance Increased net income 12,000 8,000 $120,000 90,000 $30,000 (Ignore income taxes in this problem.) Required: 1. What is the payback period on the new equipment? 2. What is the simple rate of return on the new equipment?arrow_forwardPalmer Corporation is considering the purchase of a new plece of equipment. The cost savings from the equipment would result in an annual increase in net income of $152,000. The equipment will have an initial cost of $494,000 and a 8 year useful life. If the salvage value of the equipment is estimated to be $78,000, what is the payback period? Multiple Choice 2.42 years 3.25 years 8.00 years 4.00 yearsarrow_forwardAssume that a company purchased a new machine for $26,000 that has no salvage value. The machine is expected to save the company $6,000 a year in cash operating costs for seven years. The company also expects the machine to provide annual intangible benefits that are difficult to quantify. Assuming the company’s hurdle rate is 24%, the minimum value of the intangible benefits that would be required to make this investment acceptable is closest to:arrow_forward

- Sandhill Corp, is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided here. Original cost Estimated life Salvage value Estimated annual cash inflows Estimated annual cash outflows Machine A $77,300 8 years 0 $20,200 $4,970 Machine B $180,000 8 years 0 $40,000 $9,860arrow_forwardRequired Information [The following information applies to the questions displayed below.] Project A requires a $365,000 initial investment for new machinery with a five-year life and a salvage value of $42,000. The company uses straight-line depreciation. Project A is expected to yield annual net income of $25,300 per year for the next five years. Compute Project A's payback period. Choose Numerator: Payback Period 7 Choose Denominator: = Payback Period Payback period =arrow_forwardA profitable company making earth-moving equipment is considering an investment of $100,000 on equipment, which will have a 5-year useful life and, no salvage value. If money is worth 10%, which one of the following three methods of depreciation would be preferable? a. Straight line method b. SOYD method c. Two and half declining balance d. MACRS methodarrow_forward

- Please help mearrow_forwardGIVEN: Project C requires $800,000 net initial investment for new machinery with a 8-year life and a Salvage Value of $40,000. The company uses straight-line depreciation. Project C is expected to yield an annual Net Income of $65,000 per year. What is the Payback Period using the above information? A) 5 years B) 6 years C) 7 years D) 8 years E) None of the abovearrow_forwardRequired Information [The following information applies to the questions displayed below.] Project A requires a $365,000 initial investment for new machinery with a five-year life and a salvage value of $42,000. The company uses straight-line depreciation. Project A is expected to yield annual net income of $25,300 per year for the next five years. Compute Project A's accounting rate of return. Choose Numerator: Accounting Rate of Return I Choose Denominator: = Accounting Rate of Return Accounting rate of returnarrow_forward

- BAK Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided below. Machine A Machine B Original cost $ 77,500 $ 186,000 Estimated life 8 years 8 years Salvage value $ 19,500 $ 39,600 Estimated annual cash inflows $ 5,040 $ 9,800 Estimated annual cash outflows Click here to view the factor table. Calculate the net present value and profitability index of each machine. Assume a 9% discount rate. (If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round answer for present value to 0 decimal places, e.g. 125 and profitability index to 2 decimal places, e.g. 10.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Machine A Machine B Net present value Profitability index Which machine should be purchased? should be…arrow_forwardAn automated assembly robot that cost $300,000 has a recovery period of five years with an expected $50,000 salvage value. If the MACRS depreciation rates for years 1, 2, and 3 are 20.0%, 32.0%, and 19.2%, respectively, what is the depreciation recapture, capital gain, or capital loss, provided the robot was sold after 3 years for $80,000?arrow_forwardCrane Corp. is considering purchasing one of two new processing machines. Either machine would make it possible for the company to produce its products more efficiently than it is currently equipped to do. Estimates regarding each machine are provided below: Machine A Machine B Original cost $113,900 $278,300 Estimated life 10 years 10 years Salvage value -0- -0- Estimated annual cash inflows $29,700 $60,100 Estimated annual cash outflows $7,600 $14,800 Calculate the net present value and profitability index of each machine. Assume an 8% discount rate. Machine A Machine B Net present value top row, profitability index bottom row Which machine should be purchased? Crane Corp. should purchase select a machine .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education