FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

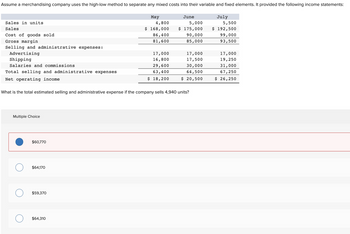

Transcribed Image Text:Assume a merchandising company uses the high-low method to separate any mixed costs into their variable and fixed elements. It provided the following income statements:

Sales in units.

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses:

Advertising

Shipping

Salaries and commissions

Total selling and administrative expenses

Net operating income

Multiple Choice

O

$60,770

$64,170

What is the total estimated selling and administrative expense if the company sells 4,940 units?

$59,370

May

4,800

$ 168,000

86,400

81,600

$64,310

17,000

16,800

29,600

63,400

$ 18,200

June

5,000

$ 175,000

90,000

85,000

17,000

17,500

30,000

64,500

$ 20,500

July

5,500

$ 192,500

99,000

93,500

17,000

19,250

31,000

67,250

$ 26,250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 2arrow_forwardRequired: 1. Prepare a contribution format income statement for the month based on the actual sales data. 2. Compute the break-even point in dollar sales for the month based on your actual data. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a contribution format income statement for the month based on the actual sales data. Gold Star Rice, Limited Contribution Income Statement Product White Percentage of total sales % Fragrant % Loonzain % % % % % % $ 0 0% $ 0 0 % $ 0 0% Total % % % 0 0% $ 0arrow_forwardPlease Do not Give image format Allocate manufacturing, ordering, and selling costs to the two customer groups by using an activity-based management (ABM) allocation basis. Calculate the net profit before tax (NPBT) for each customer group using an ABM allocation basis.arrow_forward

- Todrick Company is a merchandiser that reported the following information based on 1,000 units sold: Sales Beginning merchandise inventory Purchases Ending merchandise inventory Fixed selling expense Fixed administrative expense Variable selling expense Variable administrative expense Contribution margin Net operating income Required: 1. Prepare a contribution format income statement. 2. Prepare a traditional format income statement. 3. Calculate the selling price per unit. 4. Calculate the variable cost per unit. 5. Calculate the contribution margin per unit. $ 480,000 $ 32,000 $ 320,000 $ 16,000 ? $ 19,200 $ 24,000 ? $ 96,000 $ 28,800 6. Which income statement format (traditional format or contribution format) would be more useful to managers in estimating how net operating income will change in response to changes in unit sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 to Required 6 5 Prepare a contribution format income…arrow_forwardSales Selling price per pair of skis Variable selling expense per pair of skis Variable administrative expense per pair of skis Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases Required: 1. Prepare a traditional income statement for the quarter ended March 31. 2. Prepare a contribution format income statement for the quarter ended March 31. 3. What was the contribution margin per unit? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a traditional income statement for the quarter ended March 31. The Alpine House, Incorporated Traditional Income Statement 138 25 Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses Administrative expenses 1 Required 3 Net operating income $ 1,470,000 $ 420 49 $16 $ 135,000 $ 110,000 HON 1.470 000 $ 65,000 $ 115,000 $ 320,000 0arrow_forwardDO not give solution in imagearrow_forward

- Please do not give solution in image format thankuarrow_forwardPlease do not give solution in image format thankuarrow_forwardAssume the following information for a merchandising company: Number of units sold 20,000 Selling price per unit $ 30 Variable selling expense per unit $ 3.60 Variable administrative expense per unit $ 3.10 Fixed administrative expenses $ 50,000 Beginning merchandise inventory $ 24,000 Ending merchandise inventory $ 19,000 Merchandise purchases $ 340,000 What is the contribution margin?arrow_forward

- Dress Designers, Inc., a clothing retailer, had the following total costs categorized by the value chain concept: Research and development Design Purchases Marketing Distribution Customer service What were the company's period costs? OA. $207,500 B. $101,000 C. $136,700 D. $279,700 $53,000 $17,800 $72,200 $42,300 $58,700 $35,700 ...arrow_forwardGiven help with questionarrow_forwardAssume the following information for a merchandising company: Number of units sold Selling price per unit. Variable selling expense per unit Variable administrative expense per unit Fixed administrative expenses Beginning merchandise inventory Ending merchandise inventory Merchandise purchases What is the amount of total variable expenses? 20,700 $ 30 $ 3 $2 $ 50,000 $ 24,000 $ 19,000 $ 341,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education