FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I need help getting the Cost of Good Sold. 107,000 is not correct.

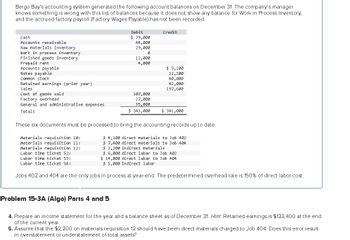

Transcribed Image Text:Bergo Bay's accounting system generated the following account balances on December 31. The company's manager

knows something is wrong with this list of balances because it does not show any balance for Work in Process Inventory,

and the accrued factory payroll (Factory Wages Payable) has not been recorded.

Cash

Accounts receivable

Raw materials inventory

Work in process inventory

Finished goods inventory

Prepaid rent

Accounts payable

Notes payable

Common stock

Retained earnings (prior year)

Sales

Cost of goods sold

Debit

Credit

$ 79,000

48,000

29,000

0

12,000

4,000

$ 9,200

12,200

40,000

82,000

197,600

Factory overhead

General and administrative expenses

107,000

27,000

35,000

Totals

$ 341,000

$ 341,000

These six documents must be processed to bring the accounting records up to date.

Materials requisition 10:

Materials requisition 11:

Materials requisition 12:

Labor time ticket 52:

Labor time ticket 53:

Labor time ticket 54:

$ 4,100 direct materials to Job 402

$ 7,400 direct materials to Job 404

$ 2,200 indirect materials

$ 6,000 direct labor to Job 402

$ 14,000 direct labor to Job 404

$ 5,000 indirect labor.

Jobs 402 and 404 are the only jobs in process at year-end. The predetermined overhead rate is 150% of direct labor cost.

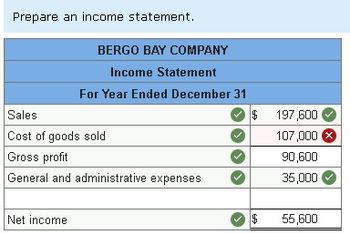

Problem 15-3A (Algo) Parts 4 and 5

4. Prepare an income statement for the year and a balance sheet as of December 31. Hint: Retained earnings is $133,400 at the end

of the current year.

5. Assume that the $2,200 on materials requisition 12 should have been direct materials charged to Job 404. Does this error result

in overstatement or understatement of total assets?

Transcribed Image Text:Prepare an income statement.

BERGO BAY COMPANY

Income Statement

For Year Ended December 31

Sales

Cost of goods sold

Gross profit

General and administrative expenses

Net income

$ 197,600

107,000 ×

90,600

35,000

69

55,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hi, I tried to answer a question for a second time but the response is that I can't get the answer the first time because the question have been unclear and now it have been complex...what exacly that mean? I don't understand why the expert can't solve the question?arrow_forwardPlease do not give solution in image format thankuarrow_forwardh7arrow_forward

- Misu Sheet, owner of the Bedspread Shop, knows his customers will pay no more than $155 for a comforter. Misu Sheet wants to advertise the comforter as "percent markup on cost." a. What is the equivalent rate of percent markup on cost compared to the 20% markup on selling price? Note: Round your answer to the nearest hundredth percent. Rate of percent 96 b. Is this a wise marketing decision? Yes No Help Save & Exitarrow_forwardPlease don't give image based answer.. thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education