FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

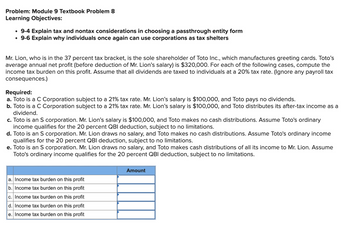

Transcribed Image Text:Problem: Module 9 Textbook Problem 8

Learning Objectives:

• 9-4 Explain tax and nontax considerations in choosing a passthrough entity form

⚫ 9-6 Explain why individuals once again can use corporations as tax shelters

Mr. Lion, who is in the 37 percent tax bracket, is the sole shareholder of Toto Inc., which manufactures greeting cards. Toto's

average annual net profit (before deduction of Mr. Lion's salary) is $320,000. For each of the following cases, compute the

income tax burden on this profit. Assume that all dividends are taxed to individuals at a 20% tax rate. (Ignore any payroll tax

consequences.)

Required:

a. Toto is a C Corporation subject to a 21% tax rate. Mr. Lion's salary is $100,000, and Toto pays no dividends.

b. Toto is a C Corporation subject to a 21% tax rate. Mr. Lion's salary is $100,000, and Toto distributes its after-tax income as a

dividend.

c. Toto is an S corporation. Mr. Lion's salary is $100,000, and Toto makes no cash distributions. Assume Toto's ordinary

income qualifies for the 20 percent QBI deduction, subject to no limitations.

d. Toto is an S corporation. Mr. Lion draws no salary, and Toto makes no cash distributions. Assume Toto's ordinary income

qualifies for the 20 percent QBI deduction, subject to no limitations.

e. Toto is an S corporation. Mr. Lion draws no salary, and Toto makes cash distributions of all its income to Mr. Lion. Assume

Toto's ordinary income qualifies for the 20 percent QBI deduction, subject to no limitations.

a. Income tax burden on this profit

b. Income tax burden on this profit

c. Income tax burden on this profit

d. Income tax burden on this profit

e. Income tax burden on this profit

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Problem 6-39 (Algorithmic) (LO. 1) Julio Gonzales is in the 32% tax bracket. He acquired 4,000 shares of stock in Gray Corporation seven years ago at a cost of $140 per share. In the current year, Julio received a payment of $420,000 from Gray Corporation in exchange for 2,000 of his shares in Gray. Gray has E & P of $6,000,000. What income tax liability would Julio incur on the $420,000 payment in each of the following situations? Assume that Julio has no capital losses and taxpayers in the 32% tax bracket are subject to the long-term capital gains and qualified dividends tax rate of 15%. a. The stock redemption qualifies for sale or exchange treatment. Julio has of $ Julio's tax liability would be $ b. The stock redemption does not qualify for sale or exchange treatment. of $ Julio has Julio's tax liability would be $ c. For part (b), prepare Julio's Schedule B (Form 1040) to reflect the tax reporting required of the transaction.arrow_forwardDo not give image formatarrow_forwardSubject:Accountingarrow_forward

- Problem 7-1 Child Tax Credit (LO 7.1) Calculate the total 2021 child and other dependent credit for the following taxpayers. Round any division "up" to the nearest whole number. a. Jeremy is a single (head of household) father with $80,100 of AGI and has a dependent 8-year-old son: 3,000 ✓ Feedback ►Check My Work b. Jerry and Ann have $100,000 of AGI, file jointly, and claim two dependent preschool (under the age of 6) children: 5,000 X Feedback ►Check My Work c. James and Apple have AGI of $430,300, file jointly, and claim three dependent children (ages 7, 10, and 19): 2,950 ✓ Feedback Check My Workarrow_forwardPlease answer fast please without plagiarism pleasearrow_forwardSh1arrow_forward

- Question 1: (4 parts @ 0.5 marks = 2 marks) Alan earns net income before taxes of $10,000 from his small business corporation (SBC) in the year ending December 31, 2017. He is considering reinvesting the business earnings (net of corporate income taxes) into zero-dividend common shares that are expected to appreciate in value by 8% per annum commencing January 1, 2018. Alan's personal marginal tax rate is 40% (federal provincial combined) on regular income and 27% on non-eligible dividends (net of dividend tax credit ). Assume that the investment income earned by the SBC will be considered merely ancillary to its active business and therefore the 16% SBC rate will continue to apply to all income earned within the corporation Required : (A) (B) . If Alan earns the $10,000 directly as self-employment or professional income in 2017 and invests it, what will be his (after-tax) consumable wealth on 31, 2018? December pay If Alan earns the $10,000 through his SBC in 2017, has the corporation…arrow_forwardDividends received from a domestic corporation 50,000 Dividends received from a resident foreign corporation 40,000 Dividends received from a non-resident foreign corp 30,000 • The domestic corporation is doing 40% of its business outside the Philippines. • The resident foreign corporation has been doing 60% of its business in the Philippines. • The taxpayer is a resident citizen How much dividend income is taxable? . How much is the final tax on his dividend income? Assuming taxpayer is domestic corporation, how much dividend income is taxable?arrow_forwardIndividuals Schedule X-Single The tax is $11.000 Chuck, a single taxpayer, earns $79,200 in taxable income and taxable income in over. But not over $15,000 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) 10% of taxable income $ 44,725 $1,100 plus 12% of the excess over $11,000 $95,375 $5,147 plus 22% of the excess over $44,725 $182,100 $16,290 plus 24% of the excess over $95,375 $231,250 $37,104 plus 32% of the excess over $152.100 $578,125 $52,832 plus 35% of the excess over $231,250 | $174,258.25 plus 37% of the excess over $578,12 Required: a. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? b. What is his marginal rate if, instead, he had $40,000 of additional deductions? Note: For all requirements, do not round intermediate calculations. Round percentage answers to 2 decimal places. a. Marginal tax rate b. Marginal tax rate 24.00 % 22.00 % $ 11,000 $ 44,725 $ 95,375 $182,100 $231.250…arrow_forward

- Macmillan Learning Tax Bracket Tax Rate $0.00+ 10% $11,600.00+ 12% $47,150.00+ 22% $100,525.00+ 24% $191,950.00+ 32% $243,725.00+ 35% $609,350.00+ 37% Given this Federal Income Tax schedule, what would your income tax be if you had a taxable income of $20,000? $2,400 $3,233 $2,000 $2,168 es fro (32 rating.arrow_forwardSee Attached 5.36arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education