Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

Need Answer of this Question please get answr

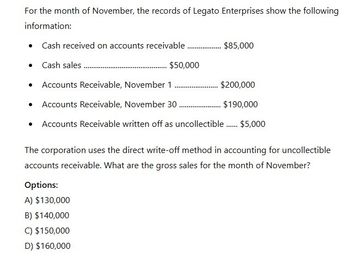

Transcribed Image Text:For the month of November, the records of Legato Enterprises show the following

information:

• Cash received on accounts receivable

........... $85,000

• Cash sales.

$50,000

Accounts Receivable, November 1

_ $200,000

$190,000

• Accounts Receivable, November 30 ..............

• Accounts Receivable written off as uncollectible...... $5,000

The corporation uses the direct write-off method in accounting for uncollectible

accounts receivable. What are the gross sales for the month of November?

Options:

A) $130,000

B) $140,000

C) $150,000

D) $160,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Catherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?arrow_forwardi need the answer quicklyarrow_forwardsanjuarrow_forward

- What are the gross sales for the month of December on these accounting question?arrow_forwardjjjarrow_forwardThe following information relates to a company’s accounts receivable: gross accounts receivable balance at the beginning of the year, $300,000; allowance for uncollectible accounts at the beginning of the year, $25,000 (credit balance); credit sales during the year, $1,500,000; accounts receivable written off during the year, $16,000; cash collections from customers, $1,450,000. Assuming the company estimates that future bad debts will equal 10% of the year-end balance in accounts receivable. 1. Calculate bad debt expense for the year.2. Calculate the year-end balance in the allowance for uncollectible accounts.arrow_forward

- Burlywood Corp.'s ledger balance of cash as on December 31 is $4,425. It provides the following details for the month of December: Note collected (principal, $800.00; interest, $8.00, signed by Johnson) $808 Error in recording check No. 2234 payable to Beta, Inc.* 50 Bank service and collection charges 15 *The amount of $445, check No. 2234 payable to Beta, Inc., was recorded as $495 ($495 − $445)Determine the adjusted ledger balance of cash as on December 31. a.$3,682 b.$5,268 c.$3,582 d.$5,168arrow_forwardFor the month of December, the records of ABC Corporation show the following information: Gross sales – 120,000; Cash received on accounts receivable - P 70,000; Cash sales - 60,000; Accounts Receivable, December 1 - 160,000; Accounts Receivable written off as uncollectible - 2,000. The corporation uses the direct write-off method in accounting for uncollectible accounts receivable. What is the balance of accounts receivable as of December 31?arrow_forwardRedlam Company provided the following data for the month of December: November 30 December 31 2,032,000 1,890,000 3,160,000 2,900,000 1,080,000 Cash in bank account balance Bank statement balance Bank debits Bank credits Book debits Book credits Outstanding checks Deposit in transit Check erroneously charged by bank against entity's account and corrected in subsequent month Bank service charge Note recorded as cash receipt by entity when placed with bank for collection and note is actually collected by bank in subsequent month and credited by bank to entity's account in same month 1,440,000 180,000 80,000 592,000 498,000 40,000 2,000 50,000 4,000 200,000 300,000 Required: a. Prepare a four-column reconciliation showing adjusted balances. b. Prepare one adjusting entry only on December 31.arrow_forward

- The following information relates to a company’s accounts receivable: gross accounts receivable balance at the beginning of the year, $350,000; allowance for uncollectible accounts at the beginning of the year, $24,000 (credit balance); credit sales during the year, $1,200,000; accounts receivable written off during the year, $15,000; cash collections from customers, $1,100,000. Assuming the company estimates that future bad debts will equal 12% of the year-end balance in accounts receivable.1. Calculate bad debt expense for the year.2. Calculate the year-end balance in the allowance for uncollectible accounts.arrow_forward4.arrow_forwardThe bank statement for Jeffrey Co. indicates a balance of $8,785 on October 31. After the journal entries for October had been posted, the cash account had a balance of $8,998. Cash sales of $945 had been erroneously recorded in the cash receipts journal as $495. Deposits in transit not recorded by bank, $778. Bank debit memo for service charges, $40. Bank credit memo for note collected by bank, $23,985 plus $885 interest. Bank debit memo for $756 NSF (not sufficient funds) check from Calin Sams, a customer. Checks outstanding, $1,860. Record the appropriate journal entries that would be necessary for Jeffrey Co. If an amount box does not require an entry, leave it blank. - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select -arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning