Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

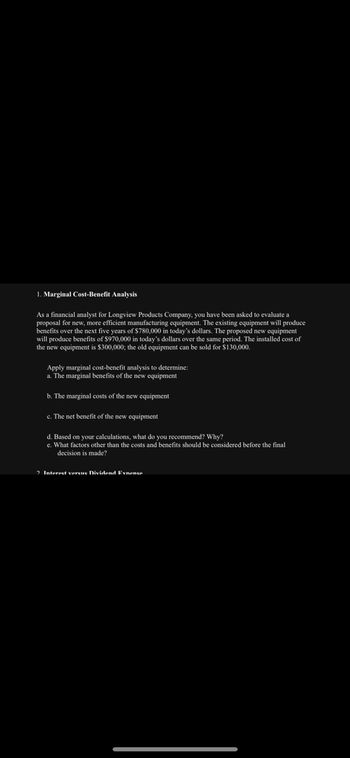

Transcribed Image Text:1. Marginal Cost-Benefit Analysis

As a financial analyst for Longview Products Company, you have been asked to evaluate a

proposal for new, more efficient manufacturing equipment. The existing equipment will produce

benefits over the next five years of $780,000 in today's dollars. The proposed new equipment

will produce benefits of $970,000 in today's dollars over the same period. The installed cost of

the new equipment is $300,000; the old equipment can be sold for $130,000.

Apply marginal cost-benefit analysis to determine:

a. The marginal benefits of the new equipment

b. The marginal costs of the new equipment

c. The net benefit of the new equipment

d. Based on your calculations, what do you recommend? Why?

e. What factors other than the costs and benefits should be considered before the final

decision is made?

2. Interest verens Dividend Exnence

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider equipment for the expansion of a production line that will cost $600,000 up front (i.e., today, t = 0). The production line will be depreciated using a 3-year straight-line schedule. At the end of Year 3, the used equipment will have no value. The new line will generate earnings according to the schedule below. What is the Average Accounting Return (AAR) of the new production facility? Answer with a number rounded to three decimal places, e.g., 4.0877% should be entered as 4.088. Year 01 Earnings = $24,500 Year 02 Earnings = $26,000 Year 03 Earnings = $27,250arrow_forward(engineering economic) a company considers purchasing a machine for $3000. The tool is planned to be used for 10 years and after that it will be sold for 25% of its purchase price. With the purchase of the tool, the company must incur operating costs of $ 400 per year. If the owner of the company wants a return of 10% annually on the investment made, what is the uniform annual income for at least 10 years that must be obtained from the heavy equipment so that the wishes of the owner of the company are fulfilled?arrow_forwardAssume that you are thinking about starting your own small business. You have made the following estimates regarding this opportunity: You can rent a location for your business at a cost of $36, 000 per year. The equipment costs incurred to start the business would total $250,000. The equipment would have a 5-year useful life and a salvage value of S 25,000. Your company's estimated sales per year would equal $350,000 and its variable cost of goods sold would be 30% of sales. Other operating costs would include $56, 000 per year in salaries, S4, 000 per year for insurance, $25, 000 per year for utilities, and a 3% sales commission. The payback period for this investment opportunity is closest to: Multiple Choice 4.08 years, 2.20 years. 3.80 years. 3.08 years.arrow_forward

- Assume that a company is considering purchasing a machine for $100,000 that will have a seven-year useful life and no salvage value. The machine will lower operating costs by $18,000 per year. The company also expects this investment to provide qualitative benefits that it is struggling to incorporate into its financial analysis. Assuming the company's required rate of return is 17% and the net present value of the investment before considering the qualitative benefits is $(29,404), the minimum dollar value per year that must be provided by the machine's qualitative benefits to justify the $100,000 investment is closest to: Multiple Choice O O о O $7,787. $8,247. $7,497. $8,067.arrow_forwardA company is considering the purchase of new testing equipment that is expected to produce 8000 profit during the first year of operation. The amount will decrease by 500 per year for each additional year of ownership. The equipment cost 20000 and will have a salvage value of 3000 after 8 years of use. The minimum attractive rate of return is 18%. You are required to adivice the company whether they will go ahead with the purchasearrow_forwardSuppose Canadian Tire is considering investing in warehouse-management software that costs $500,000, has $50,000 residual value, and should lead to cost savings of $120,000 per year for its five-year life. In calculating the ARR, which of the following figures should be used as the equation's denominator?arrow_forward

- Assume that you are thinking about starting your own small business. You have made the following estimates regarding this opportunity: • You can rent a location for your business at a cost of $36,000 per year. The equipment costs incurred to start the business would total $250,000. The equipment would have a 5-year useful life and a salvage value of $25,000 Your company's estimated sales per year would equal $350,000 and its variable cost of goods sold would be 30% of sales. • Other operating costs would include $58,000 per year in salaries, $4,000 per year for insurance, $25,000 per year for utilities, and a 3% sales commission The simple rate of return for this investment opportunity is closest to: Multiple Choice 22.0% 19.0% 26.6% 15.7%arrow_forwardThe manager of an electronics manufacturing plant was asked to approve the purchase of a surface mount placement (SMP) machine having an initial cost of $500,000 in order to reduce annual operating and maintenance costs by $92,500 per year. At the end of the 10-year planning horizon, it was estimated that the SMP machine would be worth $50,000. Using a 10% MARR and internal rate of return analysis, should the investment be made?arrow_forwardThe Fence Company is setting up a new production line to produce top rails. The relevant data for two alternatives are shown below. Solve, a. Based on MARR of 8%, determine the annual rate of production for which the alternatives are equally economical. b. If it is estimated that production will be 300 top rails per year, which alternative is preferred and what will be the total annual cost?arrow_forward

- Jones Company is considering investing in a new piece of equipment that costs $600,000. The new equipment should provide cost savings of $150,000 per year over its 5-year useful life. What is the payback period (in years) for the new equipment?arrow_forwardOriole Manufacturing is considering the purchase of new computerized equipment. The machine costs $66000 and would generate $19360 in annual cost savings over its 5-year life. At the end of 5 years, the equipment would have a $4400 salvage value. Oriole's required rate of return is 12%. Click here to view the factor table. Using the present value tables, the machine's net present value is (round to the nearest dollar) O $466. O $3789. O $6286. O $69789.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education