FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

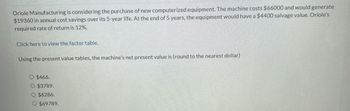

Transcribed Image Text:Oriole Manufacturing is considering the purchase of new computerized equipment. The machine costs $66000 and would generate

$19360 in annual cost savings over its 5-year life. At the end of 5 years, the equipment would have a $4400 salvage value. Oriole's

required rate of return is 12%.

Click here to view the factor table.

Using the present value tables, the machine's net present value is (round to the nearest dollar)

O $466.

O $3789.

O $6286.

O $69789.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tanaka Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $397,000 is estimated to result in $145,000 in annual pretax cost savings. The press qualifies for 100 percent bonus depreciation and it will have a salvage value at the end of the project of $46,000. The press also requires an initial investment in spare parts inventory of $15,100, along with an additional $2,100 in inventory for each succeeding year of the project. The shop's tax rate is 21 percent and its discount rate is 8 percent. Calculate the project's NPV. Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. NPVarrow_forwardPierre’s Hair Salon is considering opening a new location in French Lick, California. The cost of building a new salon is $284,000. A new salon will normally generate annual revenues of $60,490, with annual expenses (including depreciation) of $40,800. At the end of 15 years the salon will have a salvage value of $74,000.Calculate the annual rate of return on the project.arrow_forwardRakesharrow_forward

- Gardner Denver Company is considering the purchase of a new piece of factory equipment that will cost $360,500 and will generate $100,000 per year for 5 years. Calculate the IRR for this piece of equipment. (Click here to see present value and future value tables) fill in the blank 1%arrow_forwardMassey Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $530,000 is estimated to result in $220,000 in annual pretax cost savings. The press falls in the MACRS five-year class, and it will have a salvage value at the end of the project of $89,000. The press also requires an initial investment in spare parts inventory of $26,000, along with an additional $3,100 in inventory for each succeeding year of the project. The shop’s tax rate is 35 percent and its discount rate is 9 percent. Refer to the MACRS schedule. Calculate the NPV of this project.arrow_forwardPierre's Hair Salon is considering opening a new location in French Lick, California. The cost of building a new salon is $270,000. A new salon will normally generate annual revenues of $65,850, with annual expenses (including depreciation) of $39,900. At the end of 15 years the salon will have a salvage value of $76,000. Calculate the annual rate of return on the project. Annual rate of return %arrow_forward

- Sheridan's Hair Salon is considering opening a new location in French Lick, California. The cost of building a new salon is $261,000. A new salon will normally generate annual revenues of $63,650, with annual expenses (including depreciation) of $40,200. At the end of 15 years, the salon will have a salvage value of $74,000. Calculate the annual rate of return on the project. Annual rate of return eTextbook and Media Save for Later % Attempts: 0 of 7 used Submit Answerarrow_forwardRealTurf is considering purchasing an automatic sprinkler system for its sod farm by borrowing the entire $30,000 purchase price. The loan would be repaid with four equal annual payments at an interest rate of 12%/year. It is anticipated that the sprinkler system would be used for 9 years and then sold for a salvage value of $2,000. Annual operating and maintenance expenses for the system over the 9-year life are estimated to be $9,000 per year. If the new system is purchased, cost savings of $15,000 per year will be realized over the present manual watering system. RealTurf uses a MARR of 15%/year for economic decision making. Based on a present worth analysis, is the purchase of the new sprinkler system economically attractive?arrow_forwardA "standard" model of a dozer costs $20,000 and has an annual operating expense of $450. The dozer will be replaced in 6 years when the salvage value is expected to be $2,000. A "super" model can be purchased for $25,000, but will have a salvage value of $7,000 when retired in 6 years. Its operating expenses are also $450 a year. The purchaser's other investment opportunities are 5%. Compare these alternatives by using the annual equivalent method.arrow_forward

- Tanaka Machine Shop is considering a 4-year project to improve its production efficiency. Buying a new machine press for $420,000 is estimated to result in $166,000 in annual pretax cost savings. The press falls in the 5-year MACRS class, and it will have a salvage value at the end of the project of $66,000. The press also requires an initial investment in spare parts inventory of $27,000, along with an additional $3,450 in inventory for each succeeding year of the project. The shop’s tax rate is 22 percent and its discount rate is 9 percent. (MACRS schedule) Calculate the NPV of this project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardTanaka Machine Shop is considering a 4-year project to improve its production efficiency. Buying a new machine press for $445,000 is estimated to result in $181,000 in annual pretax cost savings. The press falls in the 5-year MACRS class, and it will have a salvage value at the end of the project of $73,000. The press also requires an initial investment in spare parts inventory of $32,000, along with an additional $3,700 in inventory for each succeeding year of the project. The shop's tax rate is 22 percent and its discount rate is 11 percent. (MACRS schedule) Calculate the NPV of this project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV Should the company buy and install the machine press? No Yesarrow_forwardTanaka Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $401,000 is estimated to result in $147,000 in annual pretax cost savings. The press qualifies for 100 percent bonus depreciation and it will have a salvage value at the end of the project of $48,000. The press also requires an initial investment in spare parts inventory of $15,300, along with an additional $2,300 in inventory for each succeeding year of the project. The shop's tax rate is 23 percent and its discount rate is 10 percent. Calculate the project's NPV. Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. NPV S 69,414.39arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education