FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

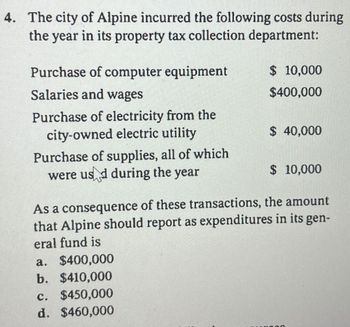

Transcribed Image Text:4. The city of Alpine incurred the following costs during

the year in its property tax collection department:

Purchase of computer equipment

Salaries and wages

Purchase of electricity from the

city-owned electric utility

Purchase of supplies, all of which

were used during the year

$ 10,000

$400,000

a. $400,000

b. $410,000

c. $450,000

d. $460,000

$ 40,000

$ 10,000

As a consequence of these transactions, the amount

that Alpine should report as expenditures in its gen-

eral fund is

4000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please see attachedarrow_forwardCalculate the Treynor measure of the Tiger Fund. O9.71% O 13.1% 8.56% 55.92% O 3.60%arrow_forwardThe followings are cash flows of two mutually exclusive projects: Projects I and II. Project I: Year 0: -200,000, Year 1: 50,000, Year 2: 100,000, Year 3: 150,000, Year 4: 40,000 Project II: Year 0: -100,000, Year 1: 40,000, Year 2: 90,000, Year 3: 30,000, Year 4: 60,000 The cost of capital for the company is the same as what you have estimated in the previous question (use a round number, round to the closet integer). Which project should the company select based on the following criteria? Cost of Capital = 10.9% a. Payback period (The critical payback period is 2.5 years) Payback(Project 1)= Payback(Project 2)= Which one should you choose? (Better) b. Net present value NPV(Project 1)= NPV(Project 2)= Which one should you choose? (Better) c. Internal Rate of Return IRR(Project 1)= IRR(Project 2)= Which one should you choose? (Better) d. Profitability Index PI(Project 1)= PI(Project 2)= Which one should you choose? (Better)arrow_forward

- Attend all partarrow_forwardaccarrow_forwardThe General Fund has a Due from Capital Projects Fund of S48,000 and a Due from Water Enterprise Fund of S120,000. The Capital Projects Fund has a Due to General Fund of S48,000, and the Water Enterprise Fund has a Due to General Fund of $120,000. What will be the amount of internal balances reported in the government-wide statement of net position? O Internal balances of $48,000 O No internal balances are reported. O Internal balances of $148,000 O Internal balances of $120,000arrow_forward

- Evaluate the following capital project proposals, given a capital budget of $750 million. project: IO (millions) PV(NCF 1-n) (millions) A 100 120 B 500 625 C 400 490 D 250 290 please show work. I don't understand how to find the NPV Answer: NPV= 165 million IO = 750 millionarrow_forwardUsing the Balance Sheet in the St. Johns County, Florida 2015 CAFR calculate the following ratios for each of the five (5) funds shown and for the “Total Governmental Funds:”a. Current Ratiob. Net Working Capitalc. Debt Ratio 1d. Debt Ratio 2e. Unrestricted Net Assets Ratiof. Response RatioReconciliation of the Governmental Funds Balance Sheetto the Statement of Net Position September 30, 2015Total fund balances- governmental funds $ 157,315,850Amounts reported for governmental activities in the statement of netposition are different because:Capital assets used in governmental activities are not current financialresources and therefore are not reported in the governmental funds. 1,241,213,205Net OPEB obligations are created through the estimated calculation of the county'semployer contribution toward the retiree's benefits. The amount greater or less than the 5,549,497annual required contribution is posted as an asset/(liability).Deferred outflows for bond refunding losses are…arrow_forwardIf an internal service fund is intended to operate on a cost-reimbursement basis, then user charges should a. cover the full costs, both direct and indirect, of operating the fund. b. cover the full costs of operating the fund and provide for future expansion and replacement of capital assets. c. cover at a minimum the direct costs of operating the fund. d. do all of the above.arrow_forward

- f2arrow_forwardBoa City had the following fixed assets:Fixed assets used in proprietary fund activities . . . . . . . . . . . . . . . . . $1,000,000Fixed assets used in general government activities . . . . . . . . . . . . . . . 9,000,000What aggregate amount should Boa account for in the general fixed assets account group?a. $9,000,000b. $10,000,000c. $10,800,000d. $11,800,000arrow_forwardYou are given the following cash flow information for Project A TV Inflows Year 0 PV Outflows -$150,000.00 1 Project A -$150,000.00 $80,000.00 -$25,000.00 $50,000.00 2 $80,000.00 -$30,000.00 $75,000.00 Totals 3 4 5 6 O 19.33% $75,000.00 Now assume that the project's cost of capital is 16.0 percent, but that its true reinvestment rate is 24.0 percent. Given this information, determine the project's modified internal rate of return (MIRR). Ⓒ 18.56% 5 ptsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education