Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

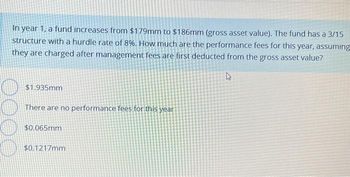

Transcribed Image Text:In year 1, a fund increases from $179mm to $186mm (gross asset value). The fund has a 3/15

structure with a hurdle rate of 8%. How much are the performance fees for this year, assuming

they are charged after management fees are first deducted from the gross asset value?

4

$1.935mm

There are no performance fees for this year

$0.065mm

$0.1217mm

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- QuantAlpha fund charges a 12b-1 fee of 1% and maintains an expense ratio of 0.75%. Assume the rate of return on fund portfolio (before any taxes) is 6% per year. How much will an investment of $1000 in the fund grow to after 10 years?arrow_forwardYou invest $1500 today and another $2000 18-months from today in a fund earning j4 = 8% for the first 18 months followed by j₂ = 6% thereafter. How much do you have at the end of 4 years? OA. $4007.79 OB. $4377.73 OC. $4274.59 OD. $4276.84 27arrow_forwardAyayai Corporation wants to withdraw $125,900 (including principal) from an investment fund at the end of each year for 9 years. What should be the required initial investment at the beginning of the first year if the fund earns 11%? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Required initial investment %24arrow_forward

- Leon Inc. will deposit $53,700 in a 15% fund at the end of each year for 10 years beginning December 31, 2020. Click here to view factor tables What amount will be in the fund immediately after the last deposit? (Round factor values to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, eg. 458,581.) Amount in fund %$4arrow_forward6. Consider the following (incomplete) sinking fund schedule (table). Note that there is no payment at t = 2. You MUST show your work to answer each of the two parts of this problem. Time Interest Sinking Interest S.F. Bal. After Net in on Fund on Balance Years Loan Deposit $0 S.F. $0 Deposit on Loan $0 $0 $100 $2,000 1 $700 3 $795 $35.44 4. $0 (a) Find the net balance on loan at t = 3. (b) Find the sinking fund deposit at t= 4.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education