FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

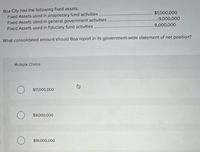

Transcribed Image Text:Boa City had the following fixed assets:

Fixed Assets used in proprietary fund activities

Fixed Assets used in general government activities

Fixed Assets used in fiduciary fund activities

$1,000,000

.9,000,000

8,000,000

What consolidated amount should Boa report in its government-wide statement of net position?

Multiple Choice

$17,000,000

O $9,000,000

O $18,000,000

身

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following statement is true regarding the net approach of presentinggovernment grants?A. Government grant related to income has a deferred income from governmentgrant account.B. Government grant related to asset has a deferred income from government grantaccount.C. For grants related to asset, depreciation expense is higher as compared togross approach (unearned income from government grant approach).D. Government grant related to asset has to recognize an income from governmentgrant. From the below statements, which of them is a false statement regarding FSRSC?A. The chairman should be a senior practitioner of any scope of the accountancyprofession.B. FSRSC members serve without compensation for a term of three years, which canbe renewed for another three years.C. Not all members of FSRSC should be CPAs.D. FSRSC is the current standard setting-body in the Philippines. Its currentpronouncements are PASs. Which of the following statements is correct concerning the…arrow_forwardthe account deffered inflows of resources-unavailable revenues is used in governmental funds to record?arrow_forwardWhen a government orders equipment which is to be used by an activity accounted within the General Fund, it should be recorded in the General Fund as a(an): Multiple Choice Encumbrance. Capital asset. Expenditure. None of the choices are correct, the General Fund does not record capital assets purchases..arrow_forward

- Discuss the differences between governmental statements of cash flows prepared for proprietary funds and cash flow statements prepared by nonprofit entities.arrow_forward8) Governmental fund financial statements are prepared on the ________ basis of accounting. Proprietary fund financial statements are prepared on the ________ basis of accounting. A) modified accrual; modified accrual B) accrual; fund C) modified accrual; accrual D) blended; discretearrow_forwardcustodial fund assets and liabilities are to be recognized: When the earnings process is complete and collection is reasonably assured At the time the government becomes responsible for assets. When they are available and measurable Only in the government wide financial statements.arrow_forward

- Grant money received from another level of government represents which of the following classes of non-exchange transactions for governmental funds? O A) Government-mandated non-exchange transactions. B) Derived tax revenues. Imposed non-exchange revenues. D) Voluntary non-exchange transactions.arrow_forwardDO NOT GIVE SOLUTION IN IMAGEarrow_forwardAll of the following statements are true concerning the conversion of governmental funds to governmental activities except a. Depreciation expenditure reported in governmental funds simply becomes depreciation expense in governmental activities. b. A decrease in the long-term liability for compensated absences will result in expenses of various functions at the government-wide level being less than expenditures at the governmental fund level. c. Assuming capital outlay expenditures all reflect purchases of capital assets as per the government's capitalization threshold policy, capital outlay expenditures simply become additions to capital assets. d. Bonds payable are not reported in the governmental funds financial statemarrow_forward

- The focus of governmental funds in fund accounting is a(n): a. Economic Resource Measurement Focus. b. Financial Resources Measurement Focus. c. Cash Flow Measurement Focus. d. Accrual Measurement Focus.arrow_forwardHow is depreciation handled in the federal government’s General Fund? How does it differ from how depreciation is handled in the General Fund of a state or local government?arrow_forward6) Which pronouncements have the highest level of authority for state and local governments? A) Financial Accounting Standards Board Statements B) GASB Statements C) Consensus Positions of GASB Emerging Issues Task Force D) GASB Technical Bulletins 7) The key focus of government fund accounting concerns A) capital expenditures. B) intergovernmental transfers from the general fund. C) income measurement. D) the current ability to provide and fund services and goods. 8) Governmental fund financial statements are prepared on the ________ basis of accounting. Proprietary fund financial statements are prepared on the ________ basis of accounting. A) modified accrual; modified accrual B) accrual; fund C) modified accrual; accrual D) blended; discrete 9) Governmental accounting differs from corporate financial accounting primarily because A) the size of the government and the various levels would make it unreasonable to use corporate GAAP. B) governments lack a profit motive and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education