Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

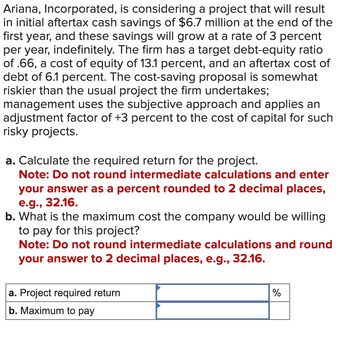

Transcribed Image Text:Ariana, Incorporated, is considering a project that will result

in initial aftertax cash savings of $6.7 million at the end of the

first year, and these savings will grow at a rate of 3 percent

per year, indefinitely. The firm has a target debt-equity ratio

of .66, a cost of equity of 13.1 percent, and an aftertax cost of

debt of 6.1 percent. The cost-saving proposal is somewhat

riskier than the usual project the firm undertakes;

management uses the subjective approach and applies an

adjustment factor of +3 percent to the cost of capital for such

risky projects.

a. Calculate the required return for the project.

Note: Do not round intermediate calculations and enter

your answer as a percent rounded to 2 decimal places,

e.g., 32.16.

b. What is the maximum cost the company would be willing

to pay for this project?

Note: Do not round intermediate calculations and round

your answer to 2 decimal places, e.g., 32.16.

a. Project required return

b. Maximum to pay

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- ABC Corp is considering a new project: the project requires an initial cost of $375,000, and will not produce any cash flows for the first two years. Starting in year 3, the project will generate cash inflows of $528,000 a year for three years. This project has higher risk compared to other projects the firm has, so it is assigned with a discount rate of 18%. What is the project's net present value? $773,016.1 $218,693.6 $449,487.3 $824,487.3 Oa b. C₂ d.arrow_forwardConsider a project with free cash flows in one year of $90,000 in a weak economy or $117,000 in a strong economy, with each outcome being equally likely. The initial investment required for the project is $80,000, and the project's cost of capital is 15%. The risk-free interest rate is 5%. Suppose that to raise the funds for the initial investment the firm borrows $40,000 at the risk-free rate and issues new equity to cover the remainder. In this situation, the cost of capital for the firm's levered equity is closest to:arrow_forwardHerman Co. is considering a four-year project that will require an initial investment of $5,000. The base-case cash flows for this project are projected to be $12,000 per year. The best-case cash flows are projected to be $20,000 per year, and the worst-case cash flows are projected to be –$1,000 per year. The company’s analysts have estimated that there is a 50% probability that the project will generate the base-case cash flows. The analysts also think that there is a 25% probability of the project generating the best-case cash flows and a 25% probability of the project generating the worst-case cash flows. What would be the expected net present value (NPV) of this project if the project’s cost of capital is 13%?arrow_forward

- Pharoah Company is considering a long-term investment project called ZIP. ZIP will require an investment of $123,338. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $82,500, and annual cash outflows would increase by $41,250. The company's required rate of return is 12%. Click here to view the factor table. Calculate the internal rate of return on this project. (Round answers to O decimal places, e.g. 15%.) Internal rate of return on this project is between Determine whether this project should be accepted? The project be accepted. % and %.arrow_forwardLible, Incorporated, is considering a project that will result in initial aftertax cash savings of $1.74 million at the end of the first year, and these savings will grow at a rate of 1 percent per year indefinitely. The firm has a target debt-equity ratio of .75, a cost of equity of 11.4 percent, and an aftertax cost of debt of 4.2 percent. The cost-saving proposal is somewhat riskier than the usual project the firm undertakes; management uses the subjective approach and applies an adjustment factor of +2 percent to the cost of capital for such risky projects. What is the maximum initial cost the company would be willing to pay for the project? (Do not round intermediate calculations and enter your answer in dollars, not millions, rounded to the nearest whole number, e.g., 1,234,567.)arrow_forwardSubject:- financearrow_forward

- A project that costs $1000 today is expected to have cash flows of $200/year for 10 years. Under these projections, this is a positive NPV project: if your cost of capital is 10%/year, investing $1000 today and earning $200 per year for 10 years yields an NPV of $228.91 (you can verify this yourself, or take my word for it). However, those annual cash flows of $200 are based on the following expectations: A 50% probability that business will be good and the project will earn $300/year, and a 50% probability that business will be bad and the project will earn $100/year. (Note that the expected annual cash flows will be: [0.5 * $300] + [0.5 * $100] = $200/year, as stated above.) Unfortunately, you will not know which state of the world you will be in until you spend the $1000 and start the business; in year 1, after the business opens, you will find out. Obviously, if you open for business and business is good, you will want to stay open for the entire 10 years; if your cost of capital…arrow_forwardYou are considering opening a new plant. The plant will cost $96.2 million upfront and will take one year to build. After that, it is expected to produce profits of $30.2 million at the end of every year of production. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is 8.2%. Should you make the investment? Calculate the IRR. Does the IRR rule agree with the NPV rule?arrow_forwardYour answer is partially correct. Sunland Company is considering a long-term investment project called ZIP. ZIP will require an investment of $123,600. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $82,400, and annual cash outflows would increase by $41,200. The company's required rate of return is 12%. Click here to view the factor table. Calculate the internal rate of return on this project. (Round answers to whole number (e.g., 15%).) Internal rate of return on this project is between 3 % and 1539 % Determine whether this project should be accepted? The project should be accepted.arrow_forward

- You are considering opening a new plant. The plant will cost $97.5 million up front and will take one year to build. After that it is expected to produce profits of $29.1 million at the end of every year of production. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is 8.8%. Should you make the investment? Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. The NPV of the project will be $ million. (Round to one decimal place.)arrow_forwardYou are evaluating a project that requires an investment of $97 today and garantees a single cash flow of $115 one year from now. You decide to use 100% debt financing, that is, you will borrow $97. The risk-free rate is 6% and the tax rate is 30%. Assume that the investment is fully depreciated at the end of the year, so without leverage you would owe taxes on the difference between the project cash flow and the investment, that is, $18. a. Calculate the NPV of this investment opportunity using the APV method. b. Using your answer to part (a), calculate the WACC of the project. c. Verify that you get the same answer using the WACC method to calculate NPV. d. Finally, show that flow-to-equity method also correctly gives the NPV of this investment opportunity.arrow_forwardCarla Vista Company is considering a long-term investment project called ZIP. ZIP will require an investment of $118,665. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $81,000, and annual cash outflows would increase by $40,500. The company's required rate of return is 12%. Click here to view the factor table. Calculate the internal rate of return on this project. (Round answers to whole number (e.g., 15%).) Internal rate of return on this project is between Determine whether this project should be accepted? % and %. The project should be accepted.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education