FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

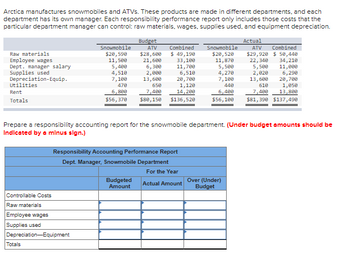

Transcribed Image Text:Arctica manufactures snowmobiles and ATVs. These products are made in different departments, and each

department has its own manager. Each responsibility performance report only includes those costs that the

particular department manager can control: raw materials, wages, supplies used, and equipment depreciation.

Raw materials

Employee wages

Dept. manager salary

Supplies used

Depreciation-Equip.

Utilities

Rent

Totals

Snowmobile

$20,590

11,500

5,400

Controllable Costs

Raw materials

Employee wages

Supplies used

Depreciation Equipment

Totals

Budget

ATV Combined Snowmobile

$20,520

11,870

5,500

4,270

7,100

440

6,400

$56,100

$28,600

21,600

6,300

2,000

13,600

$ 49,190

33,100

11,700

6,510

20,700

1,120

14,200

4,510

7,108

470

650

6,800

7,400

$56,370 $80,150 $136,520

Budgeted

Amount

Prepare a responsibility accounting report for the snowmobile department. (Under budget amounts should be

Indicated by a minus sign.)

Responsibility Accounting Performance Report

Dept. Manager, Snowmobile Department

For the Year

Actual Amount

Actual

ATV

Combined

$29,920 $50,440

22,340

34,210

5,500

11,000

2,020

6,290

13,600 20,700

610

1,050

13,800

7,400

$81,390 $137,490

Over (Under)

Budget

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Woodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating departments, Publishing and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT request) in each department and HR costs on the basis of employees in each department. The following data appear in the company records for the current period: IT tickets Employees Department direct costs From: Service department costs IT HR Total IT $ 0 16 $ 152,000 Required: Allocate the service department costs using the reciprocal method. (Matrix algebra is not required because there are only two service departments.) Note: Amounts to be deducted should be indicated by a minus sign. Do not round intermediate calculations. HR 1,525 0 $ 247,950 152,000 Answer is not complete. Cost Allocation To: IT HR 152,000 $ 247,950 Publishing 2,440 24 $ 431,000 $ 247,950 Publishing $ Binding 2,135 40 $ 392,500 0 Binding 0arrow_forwardMartay Creations produces winter scarves. The scarves are produced in the Cutting and Sewing departments. The Maintenance and Security departments support these production departments, and allocate costs based on machine hours and square feet, respectively. Information about each department is provided in the following table: Department Total Cost Number of Employees Machine Hours Square Feet Maintenance Department $2,200 5 40 600 Security Department 4,500 3 0 500 Cutting Department 21,200 21 3,600 2,400 Sewing Department 24,900 19 5,400 3,000 Using the sequential method and allocating the support department with the highest costs first, allocate all support department costs to the production departments. Then compute the total cost of each production department. Line Item Description CuttingDepartment SewingDepartment…arrow_forwardSupport Department Cost Allocation-Direct Method Charlie's Wood Works produces wood products (e.g., cabinets, tables, picture frames, and so on). Production departments include Cutting and Assembly. The Janitorial and Security departments support the Cutting and Assembly departments. The Assembly Department spans about 48,720 square feet and holds assets valued at about $79,040. The Cutting Department spans about 35,280 square feet and holds assets valued at about $128,960. Charlie's Wood Works allocates support department costs using the direct method. If costs from the Janitorial Department are allocated based on square feet and costs from the Security Department are allocated based on asset value. a. Determine the percentage of Janitorial costs that should be allocated to the Assembly Department. % b. Determine the percentage of Security costs that should be allocated to the Cutting Department. % All work saved. Û ✰ O 0 0 В B Previous Nextarrow_forward

- please answer with proper introduction explanation computation steps clearly and completely answer in text form remember answer with all workingsarrow_forwardWoodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating departments, Publishing and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT request) in each department and HR costs on the basis of employees in each department. The following data appear in the company records for the current period: IT tickets Employees Department direct costs. IT HR 0 16 1,525 0 Publishing 2,440 24 $ 152,000 $ 247,950 $ 431,000 Binding 2,135 40 $ 392,500 Woodstock Binding estimates that the variable costs in the IT Department total $112,500, and in the HR Department variable costs to $142,500. Avoidable fixed costs in the IT Department are $18,250. Required: If Woodstock Binding outsources the IT Department functions, what is the maximum it can pay an outside vendor without increasing total costs? Note: Do not round intermediate calculations. × Answer is complete but not entirely correct. Maximum…arrow_forwardSupport Department Cost Allocation-Direct Method Charlie's Wood Works produces wood products (e.g., cabinets, tables, picture frames, and so on). Production departments include Cutting and Assembly. The Janitori and Security departments support the Cutting and Assembly departments. The Assembly Department spans about 50,400 square feet and holds assets valued at abo $88,000. The Cutting Department spans about 33,600 square feet and holds assets valued at about $132,000. Charlie's Wood Works allocates support department ce using the direct method. If costs from the Janitorial Department are allocated Based on square feet and costs from the Security Department are allocated based on a value. a. Determine the percentage of Janitorial costs that should be allocated to the Assembly Department. % b. Determine the percentage of Security costs that should be allocated to the Cutting Department.arrow_forward

- Need helparrow_forwardPlease organize the list (picture) into the corresponding categories: Product Cost: Direct Materials Product Cost: Direct Labor Product Cost: Manufacturing Overhead Period Cost: Selling Expense Period Cost: Administrative Expensearrow_forwardPlease do not give solution in image format ?arrow_forward

- Please answer with working for this problem and with steps explanation calculation formula answer in text need complete and correct answer for better understandingarrow_forwardEccles Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system: Costs: Wages and salaries $ 349,000 Depreciation 290,000 Utilities 199,000 Total $ 838,000 Distribution of resource consumption: Activity Cost Pools Total Assembly Setting Up Other Wages and salaries 65% 20% 15% 100% Depreciation 35% 20% 45% 100% Utilities 15% 75% 10% 100% How much cost, in total, would be allocated in the first-stage allocation to the Assembly activity cost pool? Multiple Choice $125,700 $544,700 $345,533 $358,200arrow_forwardNn.103. Subject :- Accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education