FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

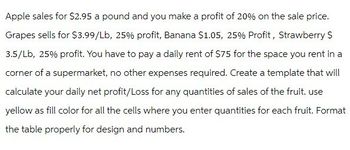

Transcribed Image Text:Apple sales for $2.95 a pound and you make a profit of 20% on the sale price.

Grapes sells for $3.99/Lb, 25% profit, Banana $1.05, 25% Profit, Strawberry S

3.5/Lb, 25% profit. You have to pay a daily rent of $75 for the space you rent in a

corner of a supermarket, no other expenses required. Create a template that will

calculate your daily net profit/Loss for any quantities of sales of the fruit. use

yellow as fill color for all the cells where you enter quantities for each fruit. Format

the table properly for design and numbers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A person sells widgets. It costs 154 to buy the materials today. In a year, the sales of widgets will result in revenues of 899 and costs of 116. if the discount rate is 0.05, what is the npv?arrow_forwardhow to do it in excel?arrow_forwardYou have a business selling and delivering pizzas to businesses for lunch. You pay $4,000 per month in rent, $320 for utilities, and $2,000 a month for salaries. You also have delivery cars that cost $1,000 per month. Your variable costs are $8 per pizza for ingredients and $4 per pizza for delivery costs. You sell the pizzas for $20 each. Round up if necessary What is the number of pizzas you need to sell to break even for the month If you want to make a profit of 2,000 per month, how many pizzas do you need to sell? Round up if necessary Go back to the original numbers If the price of cheese goes up and your variable costs go by $3 what is your new break even in pizzas if you increase your price to $21 Round up if necessary Golden Company has a fleet of delivery trucks and has the following Overhead costs per month with the miles driven Miles Driven Total Costs March 50.000 194.000 Aprill 40.000 170.200 this is the low May 60.000 217.600 June 70.000 241.000 Use the High-Low method to…arrow_forward

- The following list shows the items and prices for a restaurant order. Calculate the total amount if there is an 8% tax and the customer leaves a 20% gratuity. 1 appetizer: $8.59 2 entrees: $10.99 each 1 dessert: $6.59 2 drinks: $2.79 each a. 542.74 b. $46.16 C. $54.71 d.555.90arrow_forwardYou are shopping and see an item that is normally priced for $900 on sale for 45% off. However, you have a coupon for an additional 25% off. (The cashier will apply your coupon to the sale price, not the normal price.) What is the final cost of the item (before sales tax) after the sale and coupon discounts? Ans: The final cost is $arrow_forward1) Margin at the Kiosk You rent a kiosk in the mall for $300 a month and use it to sell T-shirts with college logos from colleges and universities all over the world. You sell each T-shirt for $25, and your cost for each shirt is $15. You also pay your salesperson a commission of $0.50 per T-shirt sold in addition to a salary of $400 per month. Construct a contribution margin income statement for two different months: in one month, assume 100 T-shirts are sold, and in the other, assume 200 T-shirts are sold.arrow_forward

- Help Maximum pay Save You are buying and reselling items found at your local thrift shop. You found an antique pitcher for sale. If you need a 29% markup on cost and know most people will not pay more than $24 for it, what is the most you can pay for the pitcher? Note: Round your answer to the nearest cent.arrow_forwardLook at the question belowarrow_forwardYou run a nail salon. Fixed monthly cost is $5,419.00 for rent and utilities, $5,913.00 is spent in salaries and $1,724.00 in insurance. Also every customer requires approximately $5.00 in supplies. You charge $107.00 on average for each service. You are considering moving the salon to an upscale neighborhood where the rent and utilities will increase to $11,155.00, salaries to $6,372.00 and insurance to $2,220.00 per month. Cost of supplies will increase to $6.00 per service. However you can now charge $171.00 per service. At what point will you be indifferent between your current location and the new location? Submit Answer format: Number: Round to: 2 decimal places. A Restaurant is open only for 25 days in a month. Expenses for the restaurant include raw material for each sandwich at $5.00 per slice, $1,103.00 as monthly rental and $219.00 monthly as insurance. They consider the cost of lost sales as $6.00 per item. They are able to sell any leftover sandwiches for $3. They prepares…arrow_forward

- Currently, Sweet Treats Bakery sells 1,200 cupcakes per month. The owners would like to increase net income above what is currently earned. Fixed costs are $1,500 per month and their contribution margin is $3 per cupcake. What would be a reasonable net income goal? O $1,800 O $2,600 O $2,100 O $5,600arrow_forwardVishnuarrow_forwardYou are considering the purchase of new living room furniture that costs $1,140. The store will allow you to make weekly payments of $25.12 for one year to pay off the loan. What is the EAR of this arrangment? Multiple Choice 27.39% 29.41% 32.99% 31.42%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education