Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:M

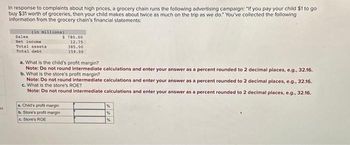

In response to complaints about high prices, a grocery chain runs the following advertising campaign:"If you pay your child $1 to go

buy $31 worth of groceries, then your child makes about twice as much on the trip as we do." You've collected the following

information from the grocery chain's financial statements:

(in millions)

Sales

Net income

Total assets

Total debt

$ 780.00

12.75

a. Child's profit margin

b. Store's profit margin

c. Store's ROE

385.00

159.00

a. What is the child's profit margin?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

b. What is the store's profit margin?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

c. What is the store's ROE?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Bill is planning to sell either coffee or lemonade at a corner stand during his upcoming Easter break. He must decide today whether to purchase $24 in coffee or $19 in lemonade. Projected sales revenue based on the weather are given in the table below. Сool $55 Warm Coffee Lemonade $6 Calculate the projected profit associated with a choice to sell lemonade on a warm day. $8 $39arrow_forwardIn response to complaints about high prices, a grocery chain runs the following advertising campaign: “If you pay your child $1 to go buy $32 worth of groceries, then your child makes about twice as much on the trip as we do.” You’ve collected the following information from the grocery chain’s financial statements: (millions) Sales $ 764.00 Net income 11.95 Total assets 345.00 Total debt 155.00 a. What is the child’s profit margin? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the store’s profit margin? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the store's ROE? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardRandy buys a lawn tractor costing $935.90. The store charges $35 for assembly and $30 for delivery. State taxesare 4% and local sales taxes are 2%. What is the total purchase price? (Round your answer to the nearest centif necessary) Group of answer choices $1,060.95 $1,057.05 $1,040.94 $1,000.90arrow_forward

- You decide to open a Lil Miss B's Bakery. You will only make whole wheat bread and sell it as a whole loaf. You were able to purchase the store and pay a monthly mortgage note payment of $1600 (this includes your taxes, insurance and loan payment). You placed your bills on levelized billing so you pay monthly $500 for electricity and $300 for water. Your secret whole wheat bread recipe makes one load of bread. The recipe calls for 3 cups of whole wheat flour (cost is 78 cents), 2 tablespoons of yeast (cost is 34 cents), 3 eggs (cost is 20 cents), one cup of milk (cost is 98 cents) and 2 tablespoons of honey (cost is $1.15). How many loaves of whole wheat bread does Lil Miss B's Bakery need to sell each month to breakeven if we charge $4.50 per loaf? choose the options.. Between 2,283 and 2,284 loaves.Between 2,285 and 2,286 loaves.Between 2,287 and 2,288 loaves.Between 2,289 and 2,290 loaves.arrow_forwardPlease help with questions, thanks much.arrow_forwardYour mother received an offer from a bank. The flier is offering your mother to open a credit card with that bank. The advertised rate on the flier is only 15%, which is considerably lower compared to other rates offered by competing banks. Then, in the fine print, it said that interest is paid monthly. Your mother asked you what that meant or what would be the effect of that if any. What would you tell her? Compute for the EFF %. How would you explain to her why there is a difference between the 15% and the rate that you computed? Dont use excelarrow_forward

- You purchase a backpack for $24.95, a calculator for $34.55, and a notebook for $1.50. If the sales tax rate is 12%, how much will you pay in total including tax?arrow_forwardExercise 3. A discount shoe store always runs a ’buy one, get one free (limit one free pair per customer)’ campaign. A customer asked a clerk if he would sell her one pair for half price. The clerk answered, ”I’m sorry, I can’t do that.” but when the customer decided to leave the store, the clerk hastily offered, “However, I think I can give you a 40% discount on any pair in the store.” Assuming the consumer has $200 to spend on shoes (X) or all other goods (Y ), and that shoes cost $100 per pair:a. Illustrate the consumer’s opportunity set with the ”buy one, get one free” deal and with a 50 percent discount.b. Why was the 40 percent discount offered only after the consumer rejected the ”buy one, get one free” deal and started to leave the store?c. Why was the clerk willing to offer a “buy one, get one free” deal, but unwilling to sell a pair of shoes for half price?arrow_forwardPharoah Inc. developed a new sales gimmick to help sell its inventory of new cars. Because many new car buyers need financing. Pharoah offered a low down payment at the time of purchase and low car payments for the first year after purchase. It believes that this promotion will bring in some new buyers. On January 1, 2023, a customer purchased a new $34,900 automobile, making a down payment of $1,500. The customer signed a note indicating that the annual rate of interest would be 8% and that quarterly payments would be made over 3 years. For the first year, Pharoah required a $490 quarterly payment to be made on April 1, July 1, October 1, and January 1, 2024. After this one-year period. the customer was required to make regular quarterly payments that would pay off the loan as of January 1, 2026. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Prepare a note amortization schedule for the first year. (Round…arrow_forward

- Easley-O'Hara Office Equipment sells furniture and technology solutions to consumers and to businesses. Most consumers pay for their purchases with credit cards and business customers make purchases on open account with terms 1/10, net 30. Costs of furniture Inventory purchases have generally been rising and costs of computer Inventory purchases have generally been declining. The company's Income tax rate is 20 percent. Casey Easley, the general manager, was particularly Interested in the financial statement effects of the following facts related to first quarter operations. a. Credit card sales (discount 2 percent) were $39,000. b. Sales on account were $116,000. The company expects one-half of the accounts to be paid within the discount period. c. The company computed cost of goods sold for the transactions in (a) and (b) above under FIFO and LIFO for Its two product lines and chose the method for each product that minimizes Income taxes: Furniture Computer equipment FIFO $ 28,600…arrow_forward12. You find a $50 USD bill in one of your parent's old coats and they let you keep it. You decide to spend it on a pair of pants that normally cost $59.99 but are on sale for 30% off. Of course, you will also have to pay 8% tax. How much change (if any) will you get from the $50 USD bill? Previous ▸ 40arrow_forwardsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education