Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

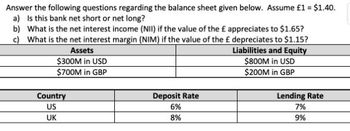

Transcribed Image Text:Answer the following questions regarding the balance sheet given below. Assume £1 = $1.40.

a) Is this bank net short or net long?

b) What is the net interest income (NII) if the value of the £ appreciates to $1.65?

c) What is the net interest margin (NIM) if the value of the £ depreciates to $1.15?

Liabilities and Equity

$800M in USD

$200M in GBP

Assets

$300M in USD

$700M in GBP

Country

US

UK

Deposit Rate

6%

8%

Lending Rate

7%

9%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the accompanying cash flow series at varying interest rates. What is the equivalent present worth of the cash flow series? (a) P = $5,068(b) P = $4,442(c) P = $4.745(d) P = $3.833arrow_forwardPLEASE SOLVEarrow_forwardFor what value of X would the cash flow have a present value of -$4,900 assuming the money was invested in an account earning 4% interest compounded annually? $2,200 O tA $ i = 4% 1 $2,500 2 Click here to access the TVM Factor Table calculator. $3,500arrow_forward

- Assume the value of a bank's average loans is $300 and the value of its average deposits is $400. The bank has liquid assets of $100. What is the bank's financing requirement? Select one: a. $300 – $400 – $100 = –$200 b. $400 – $300 = $100 c. $300 – $400 + $100 = $0 d. $400 – $300 + $100 = $200arrow_forwardIf a bank quintuples the amount of its capital and ROA stays constant, what will happen to ROE? ROE will to of what the ROE was before the bank quintupled the amount of its capital. 500.0% 50.0% 20.0%arrow_forwardFind the value of the interest rate (i) that causes the 2 cash flows below to be equivalent! given in the image. Note:hand written should be avoidedarrow_forward

- Suppose a firm has the following information: Accounts payable =$1 million; notes payable = $1.1 million; short-term debt =$1.4 million; accruals = $500,000; and long-term bonds = $3 million.What is the amount arising from operating current liabilities?($1.5 million)arrow_forwardWhat is the discount rate at which the following cash flows have a NPV of $0? Answer in %, rounding to 2 decimals.Year 0 cash flow = -116,000Year 1 cash flow = 28,000Year 2 cash flow = 43,000Year 3 cash flow = 38,000Year 4 cash flow = 41,000Year 5 cash flow = 40,000Year 6 cash flow = 37,000arrow_forward| Suppose that FirstBank has the following simplified balance sheet. Assume that all other components of the balance sheet are equal to zero. Assets Liabilities reserves 3,920 demand deposits 32,000 loans 28,080 32,000 32,000 Assume that the reserve ratio is r= .10 (10%). a. Does FirstBank have excess reserves? If so, of how much? b. Suppose that FirstBank desires to hold no excess reserves, so it loans out its excess reserves to borrowers. How does the balance sheet change? Either use T-accounts or a new balance sheet to show. c. Starting back in a), what is the maximum deposit outflow that FirstBank can sustain without affecting other parts of the balance sheet?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education