FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

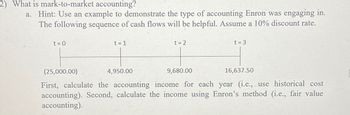

Transcribed Image Text:2) What is mark-to-market accounting?

a. Hint: Use an example to demonstrate the type of accounting Enron was engaging in.

The following sequence of cash flows will be helpful. Assume a 10% discount rate.

t = 0

t = 1

4,950.00

t = 2

9,680.00

t = 3

(25,000.00)

16,637.50

First, calculate the accounting income for each year (i.e., use historical cost

accounting). Second, calculate the income using Enron's method (i.e., fair value

accounting).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Whaley & Whaley has the following data. What is the firm's cash conversion cycle? Inventory conversion period = Average collection period = Payables deferral period = O a. 37 days O b. 31 days O c. 41 days Od: 45 days O e. 34 days 41 days 31 days 38 daysarrow_forwardConsider the following timeline: Date Cash flow $100 OA. $627 OB. $482 OC. $600 OD. $964 2 $200 3 $300 If the current market rate of interest is 10%, then the present value (PV) of this timeline as of year 0 is closest to ICCESSarrow_forwardConsider the following cash flows: Cash Flow Year 0 -$ 33,500 1 14,500 2 17,200 3 11,900 What is the IRR of the cash flows? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Internal rate of return %arrow_forward

- For each of the following annuities, calculate the annual cash flow: Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Cash Flow Present Value Years Interest Rate $ 33,400 6 7% $ 31,150 8 5 $ 174,500 20 10 $ 248,700 22 9 Marrow_forwardBelow is the financial information from thế comparative statements of Pahd ana Company. (In Thousands) PAND CO. EMIC CO. 2019 2018 2019 2018 Sales Cost of Goods Sold Selling expenses Net Income Р 3,400 1,700 1,000 P 700 P 4,400 2,300 1,500 P 600 P 5,300 3,100 1.500 P 700 P 4,900 2,100 1.900 P 900 Accounts receivable Inventory Fixed Assets Total Assets P 3,600 1,000 2,300 P6,500 P 1,900 1,900 1.000 P 4,800 P 500 1,000 Р3,100 2,000 2.000 P 7,100arrow_forward4. A Company has Net Sales of 2,000,000 for 2020, Accounts Recitable for 500,000 in 2020, and Accounts Receivable of 350,000 in 2019. Calculate the Accounts Receivable Turnover Ratio.arrow_forward

- For each of the following annuities, calculate the annual cash flow: Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Cash Flow Present Value Years Interest Rate $ 33,100 6 10 % $ 30,700 8 8 $ 170,000 17 13 $ 243,300 24 12arrow_forwardWhat is the NPV of the following cash flows if the required rate of return is 0.09? Year 0 1 2 3 4 CF -4,529 2,431 572 1,804 3,132 Enter the answer with 2 decimals (e.g. 1000.23).arrow_forwardWhat is the IRR of the following set of cash flows? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Year 0 1 2 3 IRR Cash Flow -$ 15,500 6,200 7,500 6,000 %arrow_forward

- Answer it correctly please. I ll rate accordingly with multiple votes. Typed answer only and explain your steps.arrow_forwardConsider the following timeline: Date 0 i + $500 2 OA. $666. B. $605. C. $500. OD. $650. 3 Cash flow If the current market rate of interest is 10%, then the future value of the cash flows on this timeline is closest to:arrow_forwardSolve this question properly by making a table, calculating all the required values in detail (without using MS-Excel)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education