Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

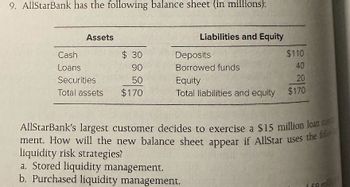

Transcribed Image Text:9. AllStarBank has the following balance sheet (in millions):

Assets

$ 30

90

50

Total assets $170

Cash

Loans

Securities

Liabilities and Equity

$110

40

Equity

20

Total liabilities and equity $170

Deposits

Borrowed funds

AllStarBank's largest customer decides to exercise a $15 million loan co

ment. How will the new balance sheet appear if AllStar uses the fol

liquidity risk strategies?

a. Stored liquidity management.

b. Purchased liquidity management.

mi

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- If a bank has a positive repricing gap (RSAs > RSLs), then: Does this bank have reinvestment or refinancing risk? If interest rates increase, net interest income will: A. Reinvestment risk, increase B. Reinvestment risk, decrease C. Refinancing risk, increase D. Refinancing risk, decreasearrow_forwardYou are an employee at XYZ Bank. Your Bank is trying the construct an investment portfolio that matches its resources and goals. To do so, you and your team are required to evaluate the investment options available for your Bank and decide what is the best option to choose. A B C D E Value of the 1,400,500 1,370,050 750,000 450,300 1,700,650 position Duration 5 4 6 YTM 4% 3% 7% 8% 5.50% Potential adverse move 0.30% 0.26% 0.43% 0.56% 0.37% in yield Correlation A. В D E A 1. 0.5 0.3 0.1 -0.2 B 1 0.2 -0.3 0.4 1 0.2 -0.3 D 1. -0.4 E Weight А В D E Scenario I 30.00% 10.00% 60.00% Scenario II 50.00% 30.00% 20.00% Scenario III 50.00% 50.00%arrow_forwardDrag the tiles to the table. Each tile can be used more than once. Determine the most likely action that an investor will take for each scenario. 10,000 Price per Share ($) 5,000 buy 1997 hold sell Select the correct answer. ● A. ● B. Scenario An investor is waiting until it is clearer whether a stock will do well after a purchase. An investor thinks that a particular stock is not performing and worries the price of the shares may drop in the future. An investor doesn't own a particular stock but is considering adding it to her portfolio depending on how well it does in the near future. An investor who tracks market trends notices that a bull market is starting. Based on this stock price model, what is the best prediction of what the price will do next? 1998 1999 Time (years) start increasing keep decreasing C. hold value D. no way to predict 2000 Drag each tile to the correct box. Reset 2001 Next Actionarrow_forward

- A bank has $400 million in demand deposits and desires a 20 percent reserve ratio. How much will it hold as reserves? O a. $200 million O b. $120 million O c. $80 million O d. $500 millionarrow_forward1. How banks evaluate credit risk Your Bear Co. is a company that makes teddy bears. It applies for a loan from North Bank to expand its business. Which of the following most accurately explains why the bank requires Your Bear to provide information about the company's assets and debt as well as how much money the owners of the firm themselves have put into the firm? The bank is trying to assess Your Bear's liquidity risk. O The bank is trying to assess Your Bear's operational risk. The bank needs to assess Your Bear's capital to evaluate its credit risk. The bank needs to assess Your Bear's income to evaluate its credit risk.arrow_forwardMr. Aiman, Treasurer of AJ Finance Berhad, has just completed a Maturity Bucket Analysis based on the a 6-month horizon. a) If the market expectation is increase in interest rates, find the maturity bucket should Mr. Aiman, worries most about. Explain why the particular bucket matters. b) Outline an appropriate hedge strategy for Mr. Aiman,.arrow_forward

- The table below shows balance sheet data, in £m, for a phone-based bank, Android Bank: £m loans to corporati ons 50 loans to households 600 300 AndroidBank's holdings of shares and bonds, etc retail current account deposits (deposits by general public with AndroidBank) commercial current account deposits (deposits by companies with AndroidBank) tangible assets and property 1500 50 500 cash in vaults 50 reserve deposits with Bank of England (deposits by AndroidBank) borrowing by AndroidBank in money market 300 25arrow_forwardWrite an essay about: How is risk described in finance? What methods can be used by financial services firms to manage risk? Provide in text references. Cannot exceed 500 wordsarrow_forwardEf 321.arrow_forward

- Quantitative Problem: You own a security with the cash flows shown below. 0 1 2 3 4 0 690 395 230 320 If you require an annual return of 12%, what is the present value of this cash flow stream? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardConstruct a bank balance sheet with the following items : reserves , deposits , loans , securities , capital , and debt . Choose values so that the reserve -deposit ratio is 10 percent and the leverage ratio is 10. Give an example of a change in asset values that would push bank capital to zero . What happens when bank capital is gone ?arrow_forwardD1. Please redraw the balanced T-account.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education