FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Weller Industries has six divisions. Its Electrical Division (which is operating at capacity) produces a variety of electrical items, including an X52 electrical fitting that it sells to regular customers for $10.40 each. The fitting has a variable manufacturing cost of $5.35.

The company’s Brake Division wants the Electrical Division to provide a large quantity of X52 fittings for $8.40 each. The Brake Division, which is operating at 50% of capacity, will put the fitting into a brake unit it produces and sells to an airplane manufacturer. The cost of the brake unit being built by the Brake Division follows:

Purchased parts (from outside vendors) $ 25.00

Electrical fitting X52 8.40

Other variable costs 15.09

Fixed overhead and administration 9.10

Total cost per brake unit $ 57.59

Although the Brake Division’s proposed price of $8.40 for the X52 fitting is well below the Electrical Division’s regular price of $10.40, the manager of the Brake Division believes the price concession is necessary for his division to win the contract for the airplane brake units. He has heard “through the grapevine” the airplane manufacturer will reject his bid if it is more than $59 per brake unit. Thus, if the Brake Division is forced to pay the regular $10.40 price for the X52 fitting, it will either not get the contract or suffer a substantial loss. The manager of the Brake Division believes the price concession benefits his division and the company as a whole.

Weller Industries uses return on investment (ROI) to measure divisional performance.

Required:

1. Assume that you are the manager of the Electrical Division.

* What is the lowest acceptable transfer price for the Electrical Division?

* Would you supply the X52 fitting to the Brake Division for $8.40 each as requested?

2. Assuming the airplane brakes can be sold for $59, what is the financial advantage (disadvantage) for the company (on a per-unit basis) if the Electrical Division supplies fittings to the Brake Division?

3. In principle, within what range would the transfer price lie?

Note: For all requirements, enter your "Financial Disadvantage" amounts as a negative value and round your final answers to 2 decimal places.

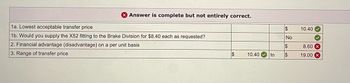

Transcribed Image Text:Answer is complete but not entirely correct.

1a. Lowest acceptable transfer price

1b. Would you supply the X52 fitting to the Brake Division for $8.40 each as requested?

2. Financial advantage (disadvantage) on a per unit basis

3. Range of transfer price

$

10.40 to

$

No

$

$

10.40

8.60 x

19.00 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Desks Unlimited makes all types of office desks. The Computer Desk Division is currently producing 10,000 desks per year with a capacity of 15,000 desks. The variable costs assigned to each desk are $400 and annual fixed costs of the division are $900,000. The computer desk has a market price of $600. The Executive Division wants to buy 5,000 desks from the Computer division at $460 for its custom office design business. The Computer Division manager knows that the division will save $50 of the Variable costs since there will be no variable shipping or commissions to be paid on the transfer order. However, the Computer Desk manager refused the order because the price is below full cost. The Executive Division manager argues that the order should be accepted because it will lower the fixed cost per desk from $90 to $60 and will take the division to its capacity, thereby causing operations to be at their most efficient level. [This is how he came up with the offered $460 transfer…arrow_forwardFyodor Corporation has a Parts Division that does work for other Divisions in the company as well as for outside customers. The company's Machine Division has asked the Parts Division to provide it with 6,000 special parts each year. The special parts would require $21 per unit in variable production costs. The Machine Division has a bid from an outside supplier for the special parts at $31.20 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the QR4 that it presently is producing. The QR4 sells for $40 per unit and requires $20 per unit in variable production costs. Packaging and shipping costs of the QR4 are $2 per unit. Packaging and shipping costs for the new special part would be only $0.50 per unit. The Parts Division is now producing and selling 30,000 units of the QR4 each year. Production and sales of the QR4 would drop by 5% if the new special part is produced for the Machine Division.…arrow_forwardHercules Steel Company produces three grades of steel: high, good, and regular grade. Each of these products (grades) has high demand in the market, and Hercules is able to sell as much as it can produce of all three. The furnace operation is a bottleneck in the process and is running at 100% of capacity. Hercules wants to improve steel operation profitability. The variable conversion cost is $15 per process hour. The fixed cost is $200,000. In addition, the cost analyst was able to determine the following information about the three products: Category High Grade Good Grade Regular Grade Budgeted units produced 4,900 4,900 4,900 Total process hours per unit 11 10 9 Furnace hours per unit 4 3 2.5 Unit selling price $270 $260 $240 Direct materials cost per unit $85 $81 $75 The furnace operation is part of the total process for each of these three products. Thus, for example, 4.0 of the 12.0 hours required to process…arrow_forward

- Sunland Company manufactures and sells high-priced motorcycles. The Engine Division produces and sells to other motorcycle companies and internally to its Production Division. It has been decided that the Engine Division will sell 28000 units to the Production Division ar $1050 a unit. The Engine Division, currently operating at fall capacity, has a selling price of $3250 amd unit variable costs and unit fixed costs of $1050 and $650, respectively. The Production Division is currently paying $3000 per unit to an outside supplier. Of this amount, $110 per unit can be saved on internal sales from reduced selling expenses. What is the minimum transfer price that the Engine Division should accept? - $3140 - $ 2200 $3000 - $3250arrow_forwardIPort Products makes cases for portable music players in two processes, cutting and sewing. The cutting process has a capacity of 115,000 units per year; sewing has a capacity of 150,000 units per year. Cost information follows. Inspection and testing costs $ 47,500 Scrap costs (all in the cutting dept.) 147,500 Demand is very strong. At a sales price of $15.00 per case, the company can sell whatever output it can produce. IPort Products can start only 115,000 units into production in the Cutting Department because of capacity constraints. Defective units are detected at the end of production in the Cutting Department. At that point, defective units are scrapped. Of the 115,000 units started at the cutting operation, 17,250 units are scrapped. Unit costs in the Cutting Department for both good and defective units equal $11.30 per unit, including an allocation of the total fixed manufacturing costs of $264,500 per year to units. Direct…arrow_forwardRapid Industries has multiple divisions. One division, Iron Products, makes a component that another division, Austin, is currently purchasing on the open market. Iron Products currently has a capacity to produce 505,000 components at a variable cost of $5.50 and a full cost of $9.00. Iron Products has outside sales of 460,000 components at a price of $13.50 per unit. Austin currently purchases 55,000 units from an outside supplier at a price of $11.50 per unit. Assume that Austin desires to use a single supplier for its component. a. What will be the effect on Rapid Industries operating profit if the transfer is made internally? Assume the 55,000 units Austin needs are either purchased 100% internally or 100% externally b. What is the minimum transfer price? (Round your answer to 2 decimal places.) Minimum Transfer Price c. What is the maximum transfer price? (Round your answer to 2 decimal places.) Maximum Transfer Price 47arrow_forward

- Steven oversees the production department for a factory that makes plastic outdoor chairs. department sells all of its production to external parties, and the department has an overall production capacity of 150,000 chairs. Their sales data is as follows: Sales (90,000 chairs) a $460,000, Variable Costs are $206,200, and Fixed Costs are $194,350. The internal Resale would like to purchase 26,700 chairs from the Production Department. They will be selling external retailers for $15.49 per chair. If the Resale Division negotiates a deal with the Pro Department to purchase each chair for its absorption cost plus a 2.4% markup, then what amount of Operating Income the Resale Division would report for their sale of 26,700 cha per unit cost to nearest cents. O $291,831 O $351,105 O $198,235 O $3,612arrow_forwardMemanarrow_forwardFederated Manufacturing Incorporated (FMl) produces electronic components in three divisions: industrial, commercial, and consumer products. The commercial products division annually purchases 10,000 units of part 23-6711, which the industrial division produces for use in manufacturing one of its own products. The commercial division is growing rapidly; it is expanding its production and now wants to increase its purchases of part 23-6711 to 15,000 units per year. The problem is that the industrial division is at full capacity. No new investment in the industrial division has been made for some years because top management sees little future growth in its products, so its capacity is unlikely to increase soon. The commercial division can buy part 23-6711 from Advanced Micro Incorporated or from Admiral Electric, a customer of the industrial division now purchasing 650 units of part 88-461. The industrial division's sales to Admiral would not be affected by the commercial division's…arrow_forward

- Youngstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass that it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $160,000 for the company as a whole. In addition, the following information is available about the three products: Large Medium Small Unit selling price $353 $253 $133 Unit variable cost (278) (207) (117) Unit contribution margin $ 75 $ 46 $ 16 Autoclave hours per unit 6 4 2 Total process hours per unit 12 8 6 Budgeted units of production 2,600 2,600 2,600 a. Determine the contribution margin by glass type and the total company operating income for the budgeted units of production. Large Medium Small Total Units…arrow_forwardYoungstown Glass Company manufactures three types of safety plate glass: large, medium, and small. All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass it can make. The production process includes an autoclave operation, which is a pressurized heat treatment. The autoclave is a production bottleneck. Total fixed costs are $293,000 for the company as a whole. In addition, the following information is available about the three products: Large Medium Small Unit selling price $179 $396 $191 Unit variable cost 141 324 168 Unit contribution margin $ 38 $72 $23 Autoclave hours per unit 4 6 2 Total process hours per unit 12 12 6 Budgeted units of production 4,900 4,900 4,900 a. Determine the contribution margin by glass type and the total company income from operations for the budgeted units of production. Large Medium Small Total Units produced fill in the blank 1 fill in the blank 2…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education