FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Please show work: The Heating Division of Pronghorn International produces a heating element that it sells to its customers for $46 per unit. Its unit variable cost is $26, and its unit fixed cost is $6. Top management of Pronghorn International

would like the Heating Division to transfer 14,600 heating units to another division within the company at a price of $27. Assume that the Heating Division has sufficient excess capacity to provide the 14,600 heating units to the other division.

What is the minimum transfer price that the Heating Division should accept? Minimum transfer price $

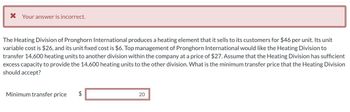

Transcribed Image Text:The Heating Division of Pronghorn International produces a heating element that it sells to its customers for $46 per unit. Its unit

variable cost is $26, and its unit fixed cost is $6. Top management of Pronghorn International would like the Heating Division to

transfer 14,600 heating units to another division within the company at a price of $27. Assume that the Heating Division has sufficient

excess capacity to provide the 14,600 heating units to the other division. What is the minimum transfer price that the Heating Division

should accept?

× Your answer is incorrect.

Minimum transfer price

$

20

20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Pharoah International Corporation has two divisions, beta and gamma. Beta produces an electronic component that sells for $75 per unit, with the following costs based on its capacity of 213,000 units: Direct materials $22 Direct labour 17 Variable overhead 4 Fixed overhead 12 Beta is operating at 74% of normal capacity and gamma is purchasing 14,500 units of the same component from an outside supplier for $69 per unit. (a) Calculate the benefit, if any, to beta in selling to gamma 14,500 units at the outside supplier's price. Benefit $ per unitarrow_forwardFoc Give me correct answer with explanation.arrow_forwardPorter Division is part of the Hurry Group. It produces a machine spare part at a cost of $20 which is then transferred to Hermy Division within the group which has additional costs of $10. Hermy Division sells externally at $32. The spare part is also produced in other divisions within the Hurry Group and a limited quantity can be purchased from outside the group. Hurry Group has a policy of transfer price at cost plus 20%. Question: Analyse the result above and problem arise on the current transfer pricing method used by the company.arrow_forward

- The Heating Division of Swifty International produces a heating element that it sells to its customers for $38 per unit. Its unit variable cost is $23, and its unit fixed cost is $8. Top management of Swifty International would like the Heating Division to transfer 15,400 heating units to another division within the company at a price of $31. The Heating Division is operating at full capacity. What is the minimum transfer price that the Heating Division should accept? Minimum transfer price 23arrow_forwardThe materials used by Hibiscus Company Division A are currently purchased from outside supplier at $53 per unit. Division B is able to supply Division A with 12,400 units at a variable cost of $47 per unit. The two divisions have recently negotiated a transfer price of $48 per unit for the 12,400 units. (a) By how much will each division's income increase as a result of this transfer? Enter an increase as a positive number and a decrease as a negative number. Division A $fill in the blank 1 Division B $fill in the blank 2 (b) What is the total increase in income for Hibiscus Company? $fill in the blank 3arrow_forwardThe materials used by the North Division of Horton Company are currently purchased from outside suppliers at $29 per unit. These same materials are produced by Horton’s South Division. The South Division can produce the materials needed by the North Division at a variable cost of $14 per unit. The division is currently producing 126,000 units and has capacity of 180,000 units. The two divisions have recently negotiated a transfer price of $20 per unit for 54,000 units. By how much will each division's income increase as a result of this transfer? South Division $ North Division $arrow_forward

- The process-control division expects to sell 1,250 process-control units this year. From the viewpoint of Sierra Inc. as a whole, should 1,250 Xcel-chips be transferred to the process-control division to replace circuit boards? Show your computations.arrow_forwardDivision A has the capacity to produce 120,000 units. The normal selling price of each unit is P80. The variable cost incurred for each unit is P42. Total direct fixed cost for the relevant range is P1,150,000. Division B can use the products of Division A as an input in its manufacturing process but is currently acquiring the said products from an outside supplier. The price per unit is P75. Total annual demand is 30,000 units. Assuming sufficient capacity, what is the minimum acceptable transfer price to Division A? Assuming only 22,500 excess capacity, what is the minimum acceptable transfer price to Division A? Assuming only 22,500 excess capacity and that Division A can avoid variable selling cost per unit of P4 but will incur a one-time fixed cost of P30,000 for the order, what is the minimum acceptable transfer price to Division A? Assuming no excess capacity, what is the minimum acceptable transfer price to Division A? What is the maximum acceptable transfer…arrow_forwardAssume you are the department B manager for Marleys manufacturing. Marley’s operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales) Assume the market price for the items your department purchase is 15% below what you are being charged by department A of Marley’s manufacturing. Determine the operating income for department B, assuming department A “sold” department B 1,000 unit during the month and department A reduced the selling price to the market price. Round your percentage answer to one decimal.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education