FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

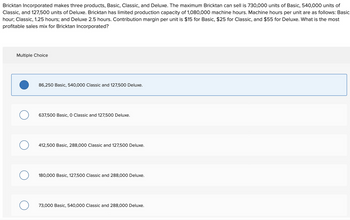

Transcribed Image Text:Bricktan Incorporated makes three products, Basic, Classic, and Deluxe. The maximum Bricktan can sell is 730,000 units of Basic, 540,000 units of

Classic, and 127,500 units of Deluxe. Bricktan has limited production capacity of 1,080,000 machine hours. Machine hours per unit are as follows: Basic

hour; Classic, 1.25 hours; and Deluxe 2.5 hours. Contribution margin per unit is $15 for Basic, $25 for Classic, and $55 for Deluxe. What is the most

profitable sales mix for Bricktan Incorporated?

Multiple Choice

86,250 Basic, 540,000 Classic and 127,500 Deluxe.

о

637,500 Basic, O Classic and 127,500 Deluxe.

О

412,500 Basic, 288,000 Classic and 127,500 Deluxe.

180,000 Basic, 127,500 Classic and 288,000 Deluxe.

73,000 Basic, 540,000 Classic and 288,000 Deluxe.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rosie’s Company has three products, P1, P2, and P3. The maximum Rosie’s can sell is 72,000 units of P1, 45,000 units of P2, and 33,000 units of P3. Rosie’s has limited production capacity of 30,000 hours. It can produce 12 units of P1, 6 units of P2, and 3 units of P3 per hour. Contribution margin per unit is $5 for the P1, $15 for the P2, and $25 for the P3. What is the most profitable sales mix for Rosie’s Company? Multiple Choice 138,000 P1, 45,000 P2, 33,000 P3. 29,700 P1, 45,000 P2, 138,000 P3. 138,000 P1, 41,000 P2, 138,000 P3. 31,500 P1, 41,000 P2, 33,000 P3. 29,700 P1, 46,000 P2, 29,700 P3.arrow_forwardSubject: acountingarrow_forwardJov Co sells three products: A, B and C. It can either make the products itself or purchase them from a subcontractor. The following information is available: Machine hours to manufacture Product A B C O 0 O 2,500 5 3 2 O 4,500 Variable cost ($) 30 20 15 For the coming period, Jov Co has received orders from its customers for 5,000 units of each product but it only has 20,000 machine hours available. What is the optimum number of units of product B which Jov Co should purchase from the subcontractor? O 5,000 Purchase cost from subcontractor ($) 40 35 20arrow_forward

- Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0-1,900 units, and monthly production costs for the production of 1,600 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Suppose it sells each birdbath for $24. Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. Complete the contribution margin income statement assuming that Morning Dove produces and sells 1,800 units.arrow_forwardDragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $554,200, and the sales mix is 40% bats and 60% gloves. The unit selling price and the unit variable cost for each product are as follows: Products Unit Selling Price Unit Variable Cost Bats 50 40 Gloves 130 80 a. Compute the break-even sales (units) for the overall enterprise product, E. units b. How many units of each product, baseball bats and baseball gloves, would be sold at the break-even point? Baseball bats units Baseball gloves unitsarrow_forwardEdge Company produces two models of its product with the same machine. The machine has a capacity of 154 hours per month. The following information is available. Selling price per unit Variable costs per unit Contribution margin per unit Machine hours per unit Maximum unit sales per month Required: Contribution margin per unit 노래 Contribution margin per machine hour Standard Hours dedicated to the production of each product Units produced for most profitable sales mix Contribution margin per unit Total contribution margin $ 140 55 1. Determine the contribution margin per machine hour for each model. Product Contribution Margin Hours dedicated to the production of each product Units produced for most profitable sales mix Contribution margin per unit Total contribution margin $85 1 hour 500 units Deluxe $ 170 102 $ 68 2 hours 200 units Standard 2. How many units of each model should the company produce? How much total contribution margin does this mix produce per month? Standard Deluxe…arrow_forward

- The machining division of Cullumber International has a capacity of 2,000 units. Its sales and cost data are: Selling price per unit $80 Variable manufacturing costs per unit 25 Variable selling costs per unit 3 Total fixed manufacturing overhead 183,200 The machining division is currently selling 1,800 units to outside customers, and the assembly division of Cullumber International wants to purchase 400 units from machining. If the transaction takes place, the variable selling costs per unit on the units transferred to assembly will be $0/unit, and not $3/unit. If Cullumber's assembly division is currently buying from an outside supplier at $75 per unit, what will be the effect on overall company profits if internal sales for 400 units take place at the optimum transfer price? The company profits would by $arrow_forwardSurf Company can sell all of the two surfboard models it produces, but it has only 416 direct labor hours available. The Glide model requires 2 direct labor hours per unit. The Ultra model requires 4 direct labor hours per unit. Contribution margin per unit is $216 for Glide and $332 for Ultra. (a) Compute the contribution margin per direct labor hour for each product. (b) Determine the best sales mix and the resulting contribution margin. Complete this question by entering your answers in the tabs below. Required A Required B Compute the contribution margin per direct labor hour for each product. Glide Ultra Contribution margin per direct labor hour $ $arrow_forwardDragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $251,600, and the sales mix is 40% bats and 60% gloves The unit selling price and the unit variable cost for each product are as follows: Products Unit Selling Price Unit Variable Cost Bats $50 $40 Gloves 130 80 a. Compute the break-even sales (units) for the overall enterprise product, E. units b. How many units of each product, baseball bats and baseball gloves, would be sold at the break-even point? Baseball bats units Baseball gloves unitsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education