FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

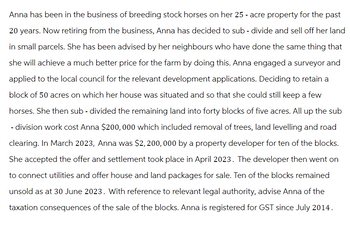

Transcribed Image Text:Anna has been in the business of breeding stock horses on her 25 - acre property for the past

20 years. Now retiring from the business, Anna has decided to sub-divide and sell off her land

in small parcels. She has been advised by her neighbours who have done the same thing that

she will achieve a much better price for the farm by doing this. Anna engaged a surveyor and

applied to the local council for the relevant development applications. Deciding to retain a

block of 50 acres on which her house was situated and so that she could still keep a few

horses. She then sub-divided the remaining land into forty blocks of five acres. All up the sub

- division work cost Anna $200,000 which included removal of trees, land levelling and road

clearing. In March 2023, Anna was $2,200, 000 by a property developer for ten of the blocks.

She accepted the offer and settlement took place in April 2023. The developer then went on

to connect utilities and offer house and land packages for sale. Ten of the blocks remained

unsold as at 30 June 2023. With reference to relevant legal authority, advise Anna of the

taxation consequences of the sale of the blocks. Anna is registered for GST since July 2014.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jagdeep sold his Indian restaurant “Maya no Dhaba” to Jasleen for the amount of $450,000. On top of that, Jasleen paid another $50,000 for Jagdeep to agreed that he won’t open a new Indian restaurant in the radius of 10 Kms for the next five years.Discuss whether the $50,000 payment is considered as Ordinary Income?arrow_forwardGlen Campbell owns a small office building adjacent to an airport. He acquired the property 10 years ago at a total cost of $608,000—that is, $70,000 for the land and $538,000 for the building. He has just received an offer from a realty company that wants to purchase the property; however, the property has been a good source of income over the years, and so Campbell is unsure whether he should keep it or sell it. His alternatives are as follows: a. Keep the property. Campbell's accountant has kept careful records of the income realized from the property over the past 10 years. These records indicate the following annual revenues and expenses: Campbell makes a $13,450 mortgage payment each year on the property. The mortgage will be paid off in eight more years. He has been depreciating the building by the straight-line method, assuming a salvage value of $80,700 for the building, which he still thinks is an appropriate figure. He feels sure that the building can be rented for another…arrow_forwardAngus and his sister Oona operate a small charter flight service that takes tourists on sightseeing tours over the beautiful Margaree River on Cape Breton Island. At the end of 2009, they had one four-seater plane in the aircraft asset class with a UCC of $30 000. In 2010, they purchased a second plane for $50 000. Business was going well in 2011, so they sold the old plane they had in 2009 for $15 000 and bought a newer version for $64 000. What was the UCC balance in the aircraft asset class at the end of 2012? The CCA rate for aircraft is 25 percent.arrow_forward

- The Blowing Rock Partnership purchased land for $1,200,000 with plans to build a spa on the site. The partnership tore down several buildings on the property for $20,000. Salvaged materials with a cost of $6,000 will be repurposed in the spa. Trees were removed for $5,000 and drainage was added for $30,000. The area was fenced for $41,000. A preliminary consultation with an architect cost $2,500 and legal fees of $3,200 were paid in connection with changing the zoning of the property. What accounts will be debited for these costs? O Land, $1,249,000; Land Improvements, $41,000; Building, $5,700 O Land, $1,235,000; Land Improvements, $55,000; Architect Expense, $2,500,000; Legal Expense, $3,200 Land, $1,255,000; Land Improvements, $41,000; Building, $11,700 O Land, $1,249,000; Land Improvements, $41,000; Building, $2,500; Legal Expense, $3,200arrow_forwardPamela recently moved to Celebration, Florida, an unincorporated master-planned community in Osceola County that connects directly to the Walt Disney World parks. To support the planned community's environmentally friendly transit system and to save on transportation costs, she wants to buy a new Neighborhood Electric Vehicle (NEV). She is looking into three models of the NEVs and has been provided with the information below. Compare the alternatives shown and determine which model should be purchased if Pamela's personal MARR is 8% per year. Initial costs Dynasty Might-E Zenn $13,000 $13,550 $14,000 Annual expenses $4,781 $5,281 $6,081 Annual savings $6,781 $7,581 $7,581 Salvage value $1,300 $1,600 $2,000 Life (years) 10 10 10 10 IRR 9.64% 11.93% 3.36%arrow_forward-Betty is an unmarried attorney. During the year a hurricane completely destroys her home, which had a basis of $60,000. The value of her home before the tornado is $100,000 and the value afterwards is $35,000. Betty's home is located in a federally declared natural disaster area. Her AGI is $50,000. What is the amount that Betty can deduct after limitations? Group of answer choices $29,900. $54,900. $59,900. $65,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education