CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Solve these financial accounting question do fast and step by step calculation

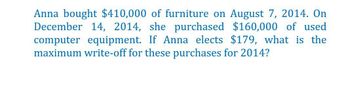

Transcribed Image Text:Anna bought $410,000 of furniture on August 7, 2014. On

December 14, 2014, she purchased $160,000 of used

computer equipment. If Anna elects $179, what is the

maximum write-off for these purchases for 2014?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Shiloh is a sales representative for American Silk Mills who has a company car to visit customer sites. Shiloh drove 26,300 miles during 2022, of which 15 percent was reported as personal miles. Required: Using the cents-per-mile rule, what is the valuation of this benefit for 2022? Note: Round your final answer to 2 decimal places. Valuation of the benefitarrow_forwardAmanda must decide to buy or lease a car that she has selected. She has negoiated a purchase price of $35,000 and can borrow money from her credit union by putting $3,000 down and paying $751.68 per month for 48 months at 6% APR. Alternatively, she could lease the car for 48 months at $495 per month by paying $3,000 capitalized cost reduction and a $350 dispostition fee on the car whic is project to have a residual value of $12,100 at the end of the lease. 1. What is the buying dollar cost? 2. What is the leasing dollar cost?arrow_forwardAmanda Forsythe of Springfield, Missouri, must decide whether to buy or lease a car she has selected. She has negotiated a purchase price (gross capitalized cost) of $30,000 and could borrow the money to buy from her credit union by putting $2,500 down and paying $645.84 per month for 48 months at 6 percent APR. Alternatively, she could lease the car for 48 months at $370 per month by paying a $2,500 capitalized cost reduction and a $350 disposition fee on the car, which is projected to have a residual value of $12,200 at the end of the lease. Round your answers to the nearest cent. Finance charges (borrowing the car): $ The dollar cost of leasing: $arrow_forward

- Amanda Forsythe of Springfield, Missouri, must decide whether to buy or lease a car she has selected. She has negotiated a purchase price (gross capitalized cost) of $38,000 and could borrow the money to buy from her credit union by putting $3,300 down and paying $814.93 per month for 48 months at 6 percent APR. Alternatively, she could lease the car for 48 months at $535 per month by paying a $3,300 capitalized cost reduction and a $350 disposition fee on the car, which is projected to have a residual value of $11,800 at the end of the lease. Use the Run the Numbers worksheet to advise Amanda about whether she should finance or lease the car. Round your answers to the nearest cent.arrow_forwardDuring 2020, Jeff has the following startup costs for his new lawn-care business: · Employee Training & Orientation Costs: $5,000 · Legal and Accounting fees: $8,000 · Market Research and Surveys: $4,000 Jeff’s business begins operations on January 1, 2021. Determine the amount that Jeff should deduct and when. Group of answer choices $5,000 in the 2020 tax year. $5,800 in the 2020 tax year. $5,800 in the 2021 tax year. $17,000 in the 2021 tax year.arrow_forwardJennifer installed a new enery-efficient tankless water heater in 2021 at a cost of $5,000. She replaced a similar unit in 2006 and claimed a nonbusiness energy property credit of $400 at that time. What is the amount of her nonbusiess energy property credit for 2021?arrow_forward

- Lily graduated from UCSD in 2015. Right now she has an excellent job with a take-home income (after taxes) of $5,000 a month. The following is her financial situation: 1. She is single and shares an apartment with a roommate. Her monthly expenses in December 2020 were: Rent: Utilities (including cell phone): Food (including eating out) Car payment Gas Student loan payment Credit card payment Personal loan payment Clothing and personal items TOTAL Net loss of $450.00 As of December 31, 2020, what was Lily's net income for the month of December 2020? Express it in terms of a net gain or a net loss for the month. Net gain of $450.00 $1,400 600 600 No gain or loss No answer text provided. 500 200 1,100 500 300 250 $5,450arrow_forwardIn australia context during the 2020 hattie bought 10 vintage chairs for $11000 each wgich she restored and sold for $16500 each in her antique furniture shop. she also bought 5 vintage tables for 24553 each which she sold for $35200. calulate how much GST hattie will remit for 2020 financial year?arrow_forwardKim works for a clothing manufacturer as a dress designer. During 2020, she travels to New York City to attend five days of fashion shows and then spends three days sightseeing. Her expenses are as follows: Airfare $1,500 Lodging (8 nights) 1,920 Meals (8 days) 1,440 Airport transportation 120 Assume lodging/meals are the same amount for the business and personal portion of the trip ($240 per day for lodging and $180 per day for meals). If an amount is zero, enter "0". a. Determine Kim's business expenses, presuming no reimbursement. Airfare Lodging X Мeals Transportation X Total What amount may she deduct on her tax return? X Feedback b. Would the tax treatment of Kim's deduction differ if she was an independent contractor? The deductible expenses on her tax return would be $ X and the expenses would be classified as a deduction for AGI Varrow_forward

- Jessica spent $5,000 on a new energy-efficient tankless water heater in 2021. She claimed a $400 nonbusiness energy property credit when she replaced an identical unit in 2006. What is the amount of her 2021 non-business energy property borrowing?arrow_forwardIn May 2020, Regina graduated from the Air force Academy with a degree in aeronautical engineering and was assigned to Homestead, Florida. as a permanent duty station. In her move to Homestead, Regina incurred the following costs: $525 in gasoline. $295 for renting a truck from UPAYME rentals. $130 for a tow trailer for her car. $115 in food. $40 in double espressos from Starbucks. $390 for motel lodging on the way to Homestead. $510 for a previous plane trip to Homestead to look for an apartment $235 in temporary storage costs for her collection of crystal figurines Required: If the government reimburses her $900, how much, if any, may Regina take as a moving expense deduction on her 2020 tax return? Moving expense doductionarrow_forwardOn October 1, 2023, Blossom sold one of its super deluxe combination gas/charcoal barbecues to a local builder. The builder plans to install it in one of its "Parade of Homes" houses. Blossom accepted a three-year, zero-interest-bearing note with a face amount of $3,940. The barbecue has an inventory cost of $1,998. An interest rate of 10% is an appropriate market rate of interest for this customer. Prepare the journal entries on October 1, 2023, and December 31, 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to O decimal places, e.g. 5,275.) te 2023 2023 31, 2023 Account Titles and Explanation Notes Receivable…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you