FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

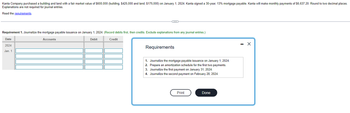

Transcribed Image Text:### Kanta Company Mortgage Transaction Analysis

**Scenario Overview:**

Kanta Company acquired a building and land with a combined fair market value of $600,000 as of January 1, 2024. The breakdown includes $425,000 for the building and $175,000 for the land. Kanta has taken a 30-year mortgage at an interest rate of 13% and will make monthly payments of $6,637.20. All values should be rounded to two decimal places. No explanations are needed for journal entries.

**Journal Entry Requirement:**

1. **Task:** Journalize the mortgage payable issuance on January 1, 2024.

2. **Instructions:** Record debits first, then credits, and exclude any explanations.

#### Journal Entry Table

| Date | Accounts | Debit | Credit |

|----------|----------|-------|--------|

| 2024 | | | |

| Jan. 1 | | | |

**Detailed Requirements:**

1. **Journalize the mortgage payable issuance** on January 1, 2024.

2. **Prepare an amortization schedule** for the first two payments.

3. **Journalize the first payment** on January 31, 2024.

4. **Journalize the second payment** on February 28, 2024.

**Instructions Interface:**

The requirements and tasks are displayed within an interface box titled "Requirements." This box provides options to either "Print" or mark the task as "Done."

This educational task aims to help learners understand how to record mortgage transactions, handle amortization schedules, and prepare journal entries systematically.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Find the new balances and adjusted balanced in the table below Check Service Statement Register Charge Balance Balance 1 $275.14 2 378.95 3 1,591.40 4 1,202.91 5 1,861.20 $4.81 4.35 6.20 0.00 0.00 New Balance $549.95 231.36 1,027.33 2,174.00 2,361.40 Outstanding Checks, Payments/Debits $529.63 190.00 0.00 1,046.20 812.14 Outstanding Deposits $250.01 333.24 557.87 75.11 311.94 5b) What do you notice about all of the new balances and adjusted balances in the above table? Adjusted Balancearrow_forwardWhat was the 10/31 balance in Accounts Receivable?arrow_forwardvable Prepare Jun's journal entry assuming the note is honored by the customer on October 31 of that same year. (Do not round intermediate calculations. Round your answers to nearest whole dollar value. Use 360 days a year.) View transaction list Journal entry worksheet 1 Record cash received on note plus interest.arrow_forward

- Hi, How do I organize these transactions ? Thanksarrow_forwardThe bank statement for Unique Fashion had an ending cash balance of $2,200 on April 30, 2022. On this date the cash balance in their general ledger was $3,678. After comparing the bank statement with the company records, the following information was determined. The bank returned an NSF cheque in the amount of $350 that Unique Fashion deposited on April 20. The NSF service fee was $9. A direct deposit received from a customer on April 29 in payment of their accounts totaling $3,780. This has not yet been recorded by the company. On April 29, the bank deposited $16 for interest earned. The bank withdrew $35 for bank service charges. Deposits in transit on April 30 totalled $4,880. Required Reconcile the ledger and bank statement and create the required journal entries. Do not enter dollar signs or commas in the input boxes. Do not use negative signs. Select the proper order for the headings of the Bank Reconciliation. Cash balance per bank statement Add Outstanding deposit Adjusted bank…arrow_forwardData Recovery Services (DRS) specializes in data recovery from crashed hard drives. The price charged varies based on the extent of damage and the amount of data being recovered. DRS offers a 10% discount to students and faculty at educational institutions. Consider the following transactions during the month of June. June 10 June 12 June 13 Rashid's hard drive crashes and he sends it to DRS. After initial evaluation, DRS e-mails Rashid to let him know that full data recovery will cost $2,700. Rashid informs DRS that he would like them to recover the data and that he is a student at UCLA, qualifying him for a 10% educational discount and reducing the cost by $270 ( = $2,700 × 10%). DRS performs the work and claims to be successful in recovering all data. DRS asks Rashid to pay within 30 days of today's date, offering a 2% discount for payment within 10 days. When Rashid receives the hard drive, he notices that DRS did not successfully recover all data. Approximately 30% of the data has…arrow_forward

- The accompanying table, Data table Date Deposit (Withdrawal) Date Deposit (Withdrawal) 1/1/20 $8,000 1/1/22 $3,272 1/1/21 $(6,540) 1/1/23 $5,255 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) , shows a series of transactions in a savings account. The account pays 5% simple interest, and the account owner withdraws interest as soon as it is paid. Calculate the following: a. The account balance at the end of each year. (Assume that the account balance at December 31, 2019, is zero.) b. The interest earned each year. c. The true rate of interest that the investor earns in this account. Question content area bottom Part 1 a. The account balance at the end of 2020 is $8,0008,000. (Round to the nearest dollar.) Part 2 The account balance at the end of 2021 is $1,9531,953. (Round to the nearest dollar.)arrow_forwardSandhill Company issued $2,400,000 of 10%, 10-year bonds on January 1, 2017, at 103. Interest is payable semiannually on July 1 and January 1. Sandhill Company uses the effective-interest method of amortization for bond premium or discount. Assume an effective yield of 9.5281%. Prepare the journal entries to record the following. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (a) The issuance of the bonds. (b) The payment of interest and related amortization on July 1, 2017. (c) The accrual of interest and the related amortization on December 31, 2017.arrow_forwardEntries for Issuing Bonds and Amortizing Discount by Straight-Line Method On the first day of its fiscal year, Chin Company issued $26,500,000 of five-year, 12% bonds to finance its operations of producing and selling home improvement products. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 13%, resulting in Chin receiving cash of $25,547,585. a. Journalize the entries to record the following: 1. Issuance of the bonds. 2. First semiannual interest payment. The bond discount is combined with the semiannual interest payment. (Round your answer to the nearest dollar.) 3. Second semiannual interest payment. The bond discount is combined with the semiannual interest payment. (Round your answer to the nearest dollar.) If an amount box does not require an entry, leave it blank. 1. 2. 3. 300 000 000 000 000 b. Determine the amount of the bond interest expense for the first year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education