Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

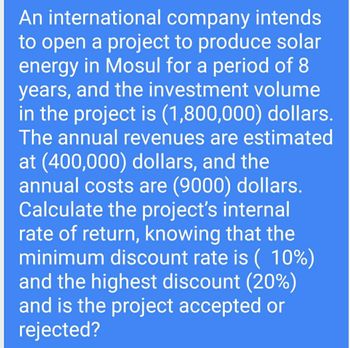

Transcribed Image Text:An international company intends

to open a project to produce solar

energy in Mosul for a period of 8

years, and the investment volume

in the project is (1,800,000) dollars.

The annual revenues are estimated

at (400,000) dollars, and the

annual costs are (9000) dollars.

Calculate the project's internal

rate of return, knowing that the

minimum discount rate is (10%)

and the highest discount (20%)

and is the project accepted or

rejected?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Maud'Dib Intergalactic has a new project available on Arrakis. The cost of the project is $36,000 and it will provide cash flows of $19,800, $25, 300, and $24, 200 over each of the next three years, respectively. Any cash earned in Arrakis is "blocked" and must be reinvested in the country for one year at an interest of 3.5 percent. The project has a required return of 8.5 percent. What is the project's NPV? Multiple Choice $19, 982.00 $22, 686.44 $31, 694.85 $28,575.27 $34, 576.20arrow_forwardThe management team is considering two hotel projects. Project A will be in Jamaica with an initial investment of $985,000 and Project B will be in Canada with an initial investment of $850,000. Years Project A Project B 1 $350,000.00 $457,000.00 2 $575,000.00 $500,000.00 3 ($53,000.00) ($100,000.00) 4 $880,000.00 $780,000.00 The cost of capital for Project A is 15% and the cost of capital for project B is 13%. Calculate the Discounted Payback Period for Project B Question 17 Answer a. 5.4 Years b. 3.6 years c. 4.5 Years d. 3.3 yearsarrow_forwardAn investor is considering two investment projects. Project A requires an initial payment of £19,000. In return, the investor will receive a payment of £27,100 after one year. Project B requires an initial payment of £10,800. In return, the investor will receive a payment of £1,490 at the end of every month for one year. Calculate the cross-over rate of the projects 数字 Enter a percentage correct to 1 decimal place. %arrow_forward

- Kara, Incorporated, imposes a payback cutoff of three years for its international investment projects. Year Cash Flow (A) Cash Flow (B) 01234 -$40,000 14,000 18,000 17,000 11,000 -$ 55,000 11,000 13,000 16,000 255,000 What is the payback period for both projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Project A Project B years years Which project should the company accept? O Project A Project Barrow_forwardlTG ltd is considering investing $2,000,000 in a project to develop a new form of robotics. New Co, a global manufacturing company, has already expressed an interest in purchasing an exclusive five-year licence for the technology when it becomes available in three years' time.New Co has proposed five annual payments of $675,000 per annum in advance during each of the years that the licence is operational.lTG uses 9% as its cost of capital.Required:Calculate the Net Present Value (NPV) of this project? (Use the discount factor from your PV table in your course book). (show all you calculations)arrow_forwardAn MNC is considering establishing a two- year project in New Zealand with a USD$50 million initial investment. The required rate of return on this project is 11%. The project is expected to generate cash flows of NZ$15 million in Year 1 and NZ$35 million in Year 2, excluding the salvage value. Assume a stable exchange rate of USD$.70 per NZ$1 over the next two years. All cash flows are remitted to the parent. What is the break-even salvage value? about NZ$47 million about NZ$21 million about NZ$14 million about NZ$60 million about NZ$36 millionarrow_forward

- Mansukhbhaiarrow_forwardSouthern Pole is developing a special vehicle for Antarctic exploration. The development requires investments of $100,000 today, $200,000 in 1 year from today and $300,000 in 2 years from today. Net returns for the project are expected to be $96,000 at the end of year over the next 15 years. If the company requires a rate of return of 12% compounded annually-find the NPV of the project. (Chapter 16.2)arrow_forwardThe UniMAP Holdings Group is considering investing RM10.0 million in a new shopping complex in Kangar, Perlis. The group has estimated that the shopping complex once built, will contribute RM1,250,000 per year for 10 years. The board of trustees of the group require that any new investment to be undertaken by the group should generate a required rate of return (MARR) of at least 12% per year of its investment. Assuming that at the end of 10 years period the shopping complex will retain about 60% of its initial investment as a salvage value. What should be the decision of the group on this proposed asset investment?arrow_forward

- U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Project Bono Project Edge Project Clayton Capital investment $176,000 $192,500 $212,000 Annual net income: Year 1 15,400 19,800 29,700 15,400 18,700 25,300 15,400 17,600 23,100 4 15,400 13,200 14,300 15,400 9,900 13,200 Total $77,000 $79,200 $105,600 Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Click here to view PV table. (a) Compute the cash payback period for each project. (Round answers to 2 decimal places, e.g. 10.50.) years Project Bono years Project Edge years Project Claytonarrow_forwardThe Bank of China is considering an application from the Government of the Republic of Zambia for a large dam project. Some costs and benefits of the project (in Kwacha values) are as follows: Construction costs: K500 million per year for three years Operating costs: K50 million per year Hydropower to be generated: 3 billion kilowatt hours per year Price of electricity: K0.05 per kilowatt hour Irrigation water available from dam: 5 billion liters per year Price of irrigation water: K0.02 per liter Agricultural product lost from flooded lands: K45 million per year Forest products lost from flooded lands: K20 million per year Assume that the project incurs no ecological and other costs besides the ones stated above. Do a formal cost-benefit analysis encompassing all of the quantifiable factors listed above. Assume that the lifespan of the dam is 10 years and that construction begins in Year 0. All other impacts start once the dam is completed and continue for 10 years. Use 5%…arrow_forwardKara, Incorporated, imposes a payback cutoff of three years for its international investment projects. Assume the company has the following two projects available. Year Cash Flow (A) -$ 59,000 Cash Flow (B) 01234 24,000 31,400 26,000 12,000 -$ 104,000 26,000 31,000 28,000 236,000 a. What is the payback period for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b. Which, if either, of the projects should the company accept? a. Project A years Project B years b. Project acceptance Accept Project A and reject Project Barrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education