Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

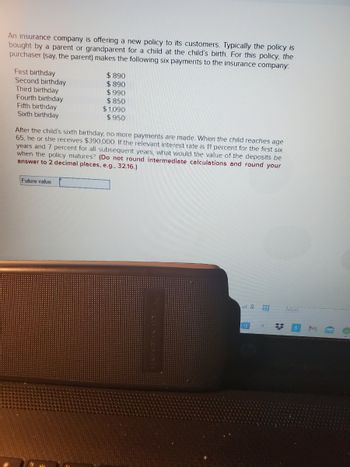

Transcribed Image Text:An insurance company is offering a new policy to its customers. Typically the policy is

bought by a parent or grandparent for a child at the child's birth. For this policy, the

purchaser (say, the parent) makes the following six payments to the insurance company:

First birthday

Second birthday

Third birthday

Fourth birthday

Fifth birthday

Sixth birthday

$890

$890

$990

$850

$1,090

$950

After the child's sixth birthday, no more payments are made. When the child reaches age

65, he or she receives $390,000. If the relevant interest rate is 11 percent for the first six

years and 7 percent for all subsequent years, what would the value of the deposits be

when the policy matures? (Do not round intermediate calculations and round your

answer to 2 decimal places, e.g., 32.16.)

Future value

of 8

TH

*

NEXT

C

Transcribed Image Text:es

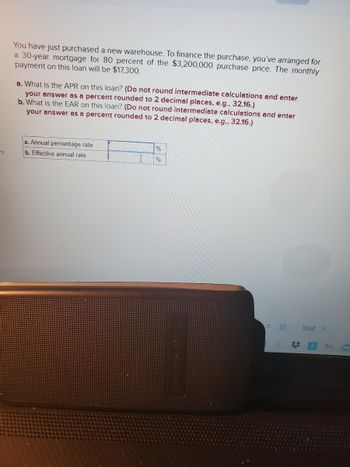

You have just purchased a new warehouse. To finance the purchase, you've arranged for

a 30-year mortgage for 80 percent of the $3,200,000 purchase price. The monthly

payment on this loan will be $17,300.

a. What is the APR on this loan? (Do not round intermediate calculations and enter

your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

b. What is the EAR on this loan? (Do not round intermediate calculations and enter

your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

a. Annual percentage rate

b. Effective annual rate

%

%

8

#

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Similar questions

- A career counselor decides to make monthly payments of $150 on credit card debt of $3,496.46 and discontinue using that credit card. Assuming the monthly interest rate is 1.85%, it will take the counselor approximately 31 months to repay the debt. How many fewer months would it take to repay the debt if the counselor makes monthly payments of $200? (Round your answer to the nearest month.)arrow_forwardYour local bank is offering a new type of retirement savings account. An initial deposit is made to the account when it is opened. This money and any accumulated interest must be left in the account for 28 years. No additional deposits can be made. On the day the account is opened and on each annual anniversary of the initial deposit, the account balance is reviewed and the following terms apply: 1. If the account balance is less than or equal to $20,000, interest for the next annual period is 7 %/year compounded annually. 2. If the account balance is greater than $20,000 but less than or equal to $40,000, interest for the next annual period is 10%/year compounded quarterly. 3. If the account balance is greater than $40,000, interest for the next annual period is 12%/year compounded monthly. You decide to open an account under these terms today with $9,400. How much money will you withdraw when the account is closed 28 years from today? $arrow_forwardYou are the wage earner in a "typical family," with $60,000 gross annual income. Use the easy method to determine how much life insurance you should carry. O 60,000 O 120,000 294,000 420,000arrow_forward

- An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The purchaser (say, the parent) makes the following six payments to the insurance company: First birthday: Second birthday: Third birthday: Fourth birthday: Fifth birthday: Sixth birthday: $ 860 $ 860 $ 960 Future value $850 $ 1,060 $950 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $360,000. The relevant interest rate is 10 percent for the first six years and 7 percent for all subsequent years. Find the future value of the payments at the child's 65th birthday. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardA man will deposit P1,000.00 with a savings and loan association at the beginning of each 3 months for 9 years. If the association pays interest at the rate of 10% quarterly, find the sum to his credit just after the last deposit. a. P58,633.95 O b. P58,733.95 O c. P58,373.95 O d. P58,763.95arrow_forwardAn insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The details of the policy are as follows: The purchaser (say, the parent) makes the following six payments to the insurance company. First birthday: Second birthday: Third birthday: Fourth birthday: $ 760 $760 $ 860 $ 860 $ 960 $ 960 Fifth birthday: Sixth birthday: After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $360,000 if the relevant interest rate is 12 percent for the first six years and 7 percent for all subsequent years, what is the value of the policy at the child's 65th birthday? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Child's 55th birthdayarrow_forward

- Ahlam invests a certain fund worth OMR 6,000 in Bank Muscat for 3 years. At the end of this period, she obtains an amount of OMR 7,500. What is the interest amount offered by the bank to Ahlam? a. OMR 1,500 b. OMR 2,000 c. OMR 13,500 d. OMR 500arrow_forwardLarry purchased an annuity from an insurance company that promises to pay him $6,500 per month for the rest of his life. Larry paid $626,340 for the annuity. Larry is in good health and is 72 years old. Larry received the first annuity payment of $6,500 this month. Use the expected number of payments in Exhibit 5-1 for this problem. Problem 5-59 Part-a (Algo) a. How much of the first payment should Larry include in gross income?arrow_forwardA company charges a net single premium of S6,000 for a life insurance policy with face amount $25,000. The force of interest for this policy is 4 Find the probability that the company makes a profit if Benefit paid at the moment of death and the survival function is So(t) = 1- for 0arrow_forward

- Using Table 19-1 and Table 19-2, calculate the annual, semiannual, quarterly, and monthly premiums (in $) for the life insurance policy. Round your answers to the nearest cent. Age 18 19 20 21 22 Face Value of Policy 23 24 25 26 27 28 29 30 TABLE 19-1 Annual Life Insurance Premiums (per $1,000 of Face Value) 35 40 $45,000 45 50 55 60 5-Year Term Male $2.32 2.38 243 2.49 2.55 2.62 32.69 2.77 2.84 2.90 2.98 3.07 3.14 Sex and Age of Insured 3.43 4.23 6.12 9.72 16.25 24.10 Term Insurance Female $ 1.90 1.96 2.07 2.15 2.22 2.30 2.37 2.45 2.51 2.58 male-50 2.64 2.70 2.78 2.92 3.90 5.18 8.73 12.82 19.43 10-Year Term 4.57 4.64 4.70 4.79 4.85 Male Female $4.33 $4.01 4.42 4.12 4.49 4.20 4.92 5.11 5.18 5.23 5.30 Type of Policy 6.42 7.14 8.81 14.19 22.03 37.70 20-payment life 4.29 4.36 4.42 4.47 4.51 4.60 4.69 4.77 4.84 4.93 5.35 6.24 7.40 9.11 13.17 24.82 Whole Life Male Female $11.17 $13.22 13.60 11.68 14.12 12.09 14.53 14.97 15.39 15.90 16.38 16.91 17.27 17.76 18.12 18.54 24.19 27.21 33.02 37.94…arrow_forwardAn insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The details of the policy are as follows: The purchaser (say, the parent) makes the following six payments to the insurance company: First birthday: Second birthday: Third birthday: Fourth birthday: Fifth birthday: Sixth birthday: After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $380,000. If the relevant interest rate is 11 percent for the first six years and 7 percent for all subsequent years, what is the value of the policy at the child's 65th birthday? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Child's 65th birthday $ 830 $ 830 $930 $930 $ 1,030 $ 1,030arrow_forwardGodoarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education