Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

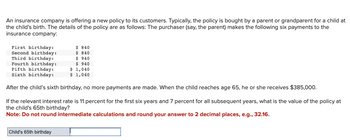

Transcribed Image Text:An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at

the child's birth. The details of the policy are as follows: The purchaser (say, the parent) makes the following six payments to the

insurance company:

First birthday:

Second birthday:

Third birthday:

Fourth birthday:

Fifth birthday:

Sixth birthday:

After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $385,000.

If the relevant interest rate is 11 percent for the first six years and 7 percent for all subsequent years, what is the value of the policy at

the child's 65th birthday?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

Child's 65th birthday

$ 840

$ 840

$ 940

$ 940

$ 1,040

$ 1,040

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The purchaser (say, the parent) makes the following six payments to the insurance company: First birthday: Second birthday: Third birthday: Fourth birthday: Fifth birthday: Sixth birthday: $ 880 $ 880 $980 $850 $ 1,080 $950 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $380,000. The relevant interest rate is 11 percent for the first six years and 7 percent for all subsequent years. Find the future value of the payments at the child's 65th birthday. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Future valuearrow_forwardKia deposited $1,100, at the BEGINNING of each year for 25 years in a credit union account. If the account paid 8% interest, compounded annually, use the appropriate formula to find the future value of her account. A. $73,441.24 B. $80,416.53 C. $86,849.86 D. $87,949.86arrow_forward9. Define out of pocket maximum. a. A flat-rate fee you must pay when receiving any kind of health care service. b. The maximum amount of money your insurance will cover of a certain health care service. c. The maximum amount you will have to pay out of pocket in one year for the benefits your insurance covers. d. The maximum amount of money the insured party will pay toward prescription medications.arrow_forward

- What is the Schedule A deduction for interest expense? Paul paid interest to his lenders as follows: Primary home mortgage $7,200 Home-equity loan 435 (not acquisition debt) Credit cards 498 Car loan 390 Primary home mortgage Home-equity loan Credit cards Car loanarrow_forwardDetermine the amount of the child- and dependent-care credit to which each of the following taxpayers is entitled. If an amount is zero, enter "0". Round intermediate computations and final answer to the nearest dollar. Note: Round your percentage computations up to the next whole number before using in credit dollar amount computations. a. Caryle and Philip are married and have a 4-year-old daughter. Their adjusted gross income is $47,600, and they pay $2,300 in qualified child-care expenses during the year. Caryle earns $17,100, and Philip earns $30,500 in salary. $fill in the blank 1 b. Natalie is a single parent with an 8-year-old son. Her adjusted gross income is $25,000, and she pays $3,190 in qualified child-care expenses. $fill in the blank 2 c. Leanne and Ross are married and have three children, ages 6, 4, and 1. Their adjusted gross income is $77,000, and they pay $6,340 in qualified child-care expenses during the year. Leanne earns $47,600, and Ross earns…arrow_forwardFind the expected net profit of an insurance company on a life-insurance policy whose death benefit is $1,000,000 if the annual premium for the policy is $2000 and the chance of the customer dying within the next year is 0.002. Interpret. (show work)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education