FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

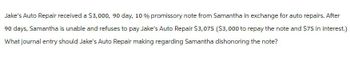

Transcribed Image Text:Jake's Auto Repair received a $3,000, 90 day, 10 % promissory note from Samantha in exchange for auto repairs. After

90 days, Samantha is unable and refuses to pay Jake's Auto Repair $3,075 ($3,000 to repay the note and $75 in interest.)

What journal entry should Jake's Auto Repair making regarding Samantha dishonoring the note?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Caleb's duplex sold at a foreclosure auction for $140,000. At the time of foreclosure, he had not made any payments to the bank for 11 months ($1,200 each). The outstanding balance of his mortgage was $197,000. What is the amount of the deficiency?arrow_forwardMr. Smith did not pay his full credit card balance on June 5th, the due date each month for payment. The unpaid balance was $800. He purchased a new washing machine on credit on June 30 for $1,000. If interest is charged at a rate of 18%, compounded daily, what would be the interest charge on his next credit card bill using the average daily balance method? a) $26.63 b) $21.77 c) $14.79 d) $13.32arrow_forwardFlip opened a credit card account. During the first month he purchased new cloths that totaled $1,505.57 and then put the card in a desk drawer and didn’t use it again. The structure of the minimum monthly payment is the interest charge plus an additional 1.9% of the remaining balance. If Flip only makes the minimum monthly payment, how long will it take for the remaining balance to be half the amount of Flip's original purchases?arrow_forward

- Many bank credit card issuers charge a transaction fee for non-ATM cash advances. Rajiv has a bank credit card. If he takes a non-ATM cash advance, the bank will charge him 2% of the amount of the advance, or a flat fee of $5, whichever is more. Rajiv needs to obtain a non-ATM cash advance of $100. What is his transaction fee? $ This week Rajiv is out of town, and has access to cash advances only by non-ATM methods. For each non-ATM cash advance that he takes, he will be charged 2% of the amount of the advance, or a flat fee of $5, whichever is more. • Rajiv took four cash advances during the week, each for $25. What is the total of his cash advances for that week? $ • What would the transaction fee be, based on percentage, for each cash advance? $ • What would the minimum transaction fee be for each cash advance? $ • Which transaction fee will be charged for each of Rajiv's advances? $ • What will be the total of his transaction fees for the week? $ • If Rajiv had taken just one cash…arrow_forwardTom and Jerry both took out loans for $600.00 on 2011-01-14. Both loans mature on 2011-07-11 and have the same simple interest rate i. But Tom's loan uses the daycount convention ACT/360, and Jerry's loan uses the daycount ACT/365. True or false: Jerry will pay less to settle the loan than Tom. Answer with explanation please.arrow_forwardMike purchased a Personal Auto Policy that included Part D (coverage for damage to your auto). He lost control of his car on an icy road, slid off the road and hit a tree. Ignoring any deductible, what will the insurer pay for the damage to Mike's car? O the lesser of actual cash value or the cost to repair or replace the vehicle O the original purchase price of the vehicle O the replacement cost of the vehicle the greater of actual cash value or the cost to repair or replace the vehicle O nothingarrow_forward

- Edward is attending school and had a financial emergency. He contacted his school's financial aid office and asked about a subsidized student loan, Edward's school facilitates these loans and determined that Edward qualifies for a $270 loan. Edward is able to repay the loan over the next 12 months while he is still in school. How much interest will Edward pay on this loan? O $0 because interest on subsidized loans does not accrue until Edward stops attending school. O $13.50 because the interest rate is 5%. O $6.75 because Edward has been making payments on the loan. None of the answer choices are correct.arrow_forward2. Ms. Fatima sold to Ms. Ruqaiya OMR 60,000 worth of goods on the 15th of April 2022 by accepting a 150 days, 6% interest bearing note. Both Ms. Fatima & Ms. Ruqaiya need your help in understanding how and in what way the notes receivable and the payables should be treated. Provide them with the required help by showing how the transactions would be treated in the books of both parties in the following situations: a) When the notes are accepted. b) On the maturity date, the note is honored. c) Suppose Ms. Fathima prepared final accounts on the 25th of July 2022 d) Following the above situation, the bill is met on maturity. e) The note was dishonored on the maturity date by Ms. Ruqaiya.arrow_forwardRoger Orfield had a skiing accident, and the doctor told him he must not work for the next four weeks. Roger earns $3,000 per month. How long must Roger wait before collecting disability insurance? How much will Roger be able to collect? What is the maximum length of time Roger could collect disability insurance if his doctor tells him he is unable to work? Is his disability check taxable?arrow_forward

- Samantha and Samuel both have student credit cards issued by VISA. Their credit card statements show they are at their credit card limit of $500 this month. Samantha manages her credit well and ensures that her credit card balance is paid off in full each month before the payment deadline while Samuel cannot manage to pay off the minimum amount required each month. Complete the sentence: For Financial Statement reporting purposes, __________________________________________. a) It does not matter where Samantha or Samuel report the$500 as long as it is shown on one of their Financial Statements. b) Both Samantha and Samuel would report their $500 on their Balance Sheet as a current liability. c) Both Samantha and Samuel would report their $500 on their Cash Flow statement as an expense. d) Samantha would report her $500 on her Cash Flow statement as an expense while Samuel would report his credit card debt of $500 on his Balance Sheet as a current liability. e) Samantha would report her…arrow_forwardPlease do not give solution in image format ?arrow_forwardPeter Pan is a self-employed delivery driver. On one delivery trip, Peter Pan received a $100 ticket for being double parked in violation of city traffic laws. In an attempt to avoid the ticket, Peter Pan slipped the parking enforcement officer a $20 bill to "look the other way". Unfortunately, the parking enforcement officer took the $20, but still gave Peter Pan the ticket. How much of the $120 can Peter Pan deduct as a business expense?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education