A First Course in Probability (10th Edition)

10th Edition

ISBN: 9780134753119

Author: Sheldon Ross

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Question

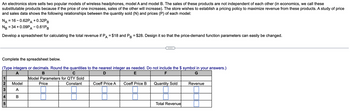

Transcribed Image Text:An electronics store sells two popular models of wireless headphones, model A and model B. The sales of these products are not independent of each other (in economics, we call these

substitutable products because if the price of one increases, sales of the other will increase). The store wishes to establish a pricing policy to maximize revenue from these products. A study of price

and sales data shows the following relationships between the quantity sold (N) and prices (P) of each model:

NA = 16-0.62PA + 0.32PB

NB

= 34 +0.09PA -0.61PB

Develop a spreadsheet for calculating the total revenue if PA = $18 and PB = $28. Design it so that the price-demand function parameters can easily be changed.

Complete the spreadsheet below.

(Type integers or decimals. Round the quantities to the nearest integer as needed. Do not include the $ symbol in your answers.)

A

B

D

E

F

G

1

23

Model

Price

Model Parameters for QTY Sold

Constant

Coeff Price A

Coeff Price B

Quantity Sold

Revenue

A

4

B

5

Total Revenue

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Projected Consumer Goods Exports 600 Hong Kong Dollar (million) 500 400 300 200 100 0+ Y 300 60 330 + 70 Y + 1 350 80 Y+2 Year 420 80 Y+3 450 90 Y+4 Exchange Rates for Year Y $4.50 Hong Kong Dollar (HKD) $1 Singapore Dollar (SGD) $1.60 Singapore Dollar (SGD) $1 US Dollar (USD) Hong Kong Singapore According to this projection, what would be the value (in HKD) of Hong Kong's exports in Y+4? $500 million $501 million $502 million $503 million $504 millionarrow_forwardCan you help me answer this question?arrow_forward6. Yet another company has studied the market and found that demand for their items indicate that if they set a price of $50 each, they would expect to sell 1000 units. However, if they set their price to $45 each, the could sell 1200 units. Their wholesaler as indicated they would supply 1000 units at a price of $40 each, but for every $10 increase in price, they would supply 400 more units. a. Find the linear demand function. b. Find the linear supply function c. Find the market equilibrium (equilibrium price and quantity) d. If the company produces 500units, is there going to be a shortage or a surplus? Why?arrow_forward

- Nonearrow_forwardSolve the problem. Suppose an economy consists of three sectors: Energy (E), Manufacturing (M), and Agriculture (A). Sector E sells 70% of its output to M and 30% to A. Sector M sells 30% of its output to E, 50% to A, and retains the rest. Sector A sells 15% of its output to E, 30% to M, and retains the rest. Denote the prices (dollar values) of the total annual outputs of the Energy, Manufacturing, and Agriculture sectors by Pe. Pm, and Pa respectively. If possible, find equilibrium prices that make each sector's income match its expenditures. Find the general solution as a vector, with pa free. 0.356 Pal Pm-0.686 Pa Pe Pa Pe Pm Pa Pe Pm - Pa Pe Pm Pa Pa [0.465 Pa = 0.593 Pa Pa [0.308 Pa 0.716 Pa Pa 0.607 Pa 0.481 Pa Paarrow_forwardCan you help with parts g, h, and i please? The Admission director for a college far from mart and town believes that an inverse relationship exists between a private college's average discount rate(determined by the average amount of scholarships students receive) and the annual yield (the percentage of admitted students who actually attend). The Director's independent variable is a private college's discount rate measured as a percentage, and the dependent variable is the college's annual yield measured as a percentage. The following results were obtained for a sample of 30 private colleges: x- Discount rate(percentage) - range: 35 to 72 percent y- Annual Yield(percentage) - range: 12 o 81 percent Σxi = 1612 Σyi = 898Σxiyi = 44,377Σxi2 = 89,790Σyi2 = 35,704 a. Calculate the sample regression line's slope estimate. Interpret the sample regression line's slope estimate.b. Calculate the sample regression line's intercept estimate. Interpret the sample regression line's intercept…arrow_forward

- interpret Company A and Company B's results below in terms of the factors that impact Cost Volume Profit Analysis (CVP). Why does Company B have the greater degree of operating leverage? As a manager, why is operating leverage an important concept? Company A Company B Sales (10,000 units times $26) $260,000 Sales (10,000 units times $32) $320,000 Less Variable expenses (10,000 units $16) 160,000 Less Variable expenses (10,000 units times $20) 200,000 Contribution margin (a) 100,000 Contribution margin (a) 120,000 Less Fixed expenses 80,000 Less Fixed expenses 100,000 Net operating income (b) 20,000 Net operating income (b) 20,000 Degree of operating leverage (a divided by b) 5.0 Degree of operating leverage (a divided by b) 6.0arrow_forwardanswer D & E ONLYarrow_forward1. The yearly data have been published showing the number of releases for each of the commercial movie studios and the gross receipts for those studios thus far. No. of releases (x) 361 270 306 22 35 10 8 12 21 Gross receipts (y) (million $)| 3844 1962 1371 1064 334 241 188 154 125 (a) Based on these data, can it be concluded that there is a linear relationship between the number of releases and the gross receipts? (b) Find y' when x = 200 new releases (c) Find the 95% prediction interval when x = 200 new releases 2. An economics student wishes to see if there is a relationship between the amount of state debt per capita and the amount of tax per capita at the state level. Per capita debt (x) 1924 907 1445 1608 661 Per capita tax (y) 1685 1838 1734 1842 1317 (a) Based on the data, can they conclude that per capita state debt and per capita state taxes are related? Both amounts are in dollars and represent five randomly selected states. (b) Find y' when x = $1500 in per capita debt (c)…arrow_forward

- Fuel efficiency, measured in miles per gallon, is a feature often considered by shoppers looking for a new car. The scatterplot shows the vehicle weight of 15 car models in pounds, plotted against their highway fuel efficiency. Which of the labeled points on the graph would be considered a high leverage point? point A point B point C point Darrow_forwardExercise 2. Marginal and Conditional Relationships can be Very Different. For 100 mild cases of eczema, a new treatment had a higher cure rate than the old treatment (33.3% of 90 vs. 20% of 10). For 100 severe cases of eczema, again the new treatment had a higher cure rate than the old treatment (60% of 20 vs. 50% of 80). Over all 200 eczema cases, however, the old treatment had a higher cure rate than the new treatment- i.e. Simpson's Paradox strikes again. (a) Compute the overall cure rates for the new and old treatments. (b) Which treatment, old or new, would you choose and why?arrow_forwardAn entrepreneur who owns and operates two businesses (A and B) would like to analyze their profitability. They would like your help in the analysis. They give you the annual net profit (in thousands of $) for each business from 2008-2020. Table 1: Annual Net Profits for Businesses A and B Business Year Profit Business Year Profit 2008 -50 2008 -10 2009 57 2009 30 2010 71 2010 27 2011 64 2011 22 2012 60 2012 21 2013 50 2013 20 A 2014 41 2014 24 2015 59 2015 24 2016 71 2016 32 2017 71 2017 36 2018 74 2018 37 019 81 20 40 2020 97 2020 49 a. Suppose you want to graph the distribution of profits. Explain why using only one stem- plot might not be optimal for the analysis. b. Describe the correct stemplot to use. Generate this stemplot. Explain your steps. What can you say about the distribution from this stemplot? c. When are stemplots useful? And why is that? d. Suppose that instead of having 26 observations you have 200 observations. What graph should you generate? e. What other type of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)

Probability

ISBN:9780134753119

Author:Sheldon Ross

Publisher:PEARSON