Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

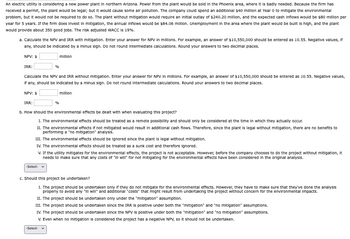

Transcribed Image Text:An electric utility is considering a new power plant in northern Arizona. Power from the plant would be sold in the Phoenix area, where it is badly needed. Because the firm has

received a permit, the plant would be legal; but it would cause some air pollution. The company could spend an additional $40 million at Year 0 to mitigate the environmental

problem, but it would not be required to do so. The plant without mitigation would require an initial outlay of $240.20 million, and the expected cash inflows would be $80 million per

year for 5 years. If the firm does Invest in mitigation, the annual inflows would be $84.06 million. Unemployment in the area where the plant would be built is high, and the plant

would provide about 350 good jobs. The risk adjusted WACC is 19%.

a. Calculate the NPV and IRR with mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if

any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to two decimal places.

NPV: $

IRR:

%

million

Calculate the NPV and IRR without mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values,

If any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to two decimal places.

NPV: $

IRR:

%

million

b. How should the environmental effects be dealt with when evaluating this project?

1. The environmental effects should be treated as a remote possibility and should only be considered at the time in which they actually occur.

II. The environmental effects if not mitigated would result in additional cash flows. Therefore, since the plant is legal without mitigation, there are no benefits to

performing a "no mitigation" analysis.

III. The environmental effects should be ignored since the plant is legal without mitigation.

IV. The environmental effects should be treated as a sunk cost and therefore ignored.

V. If the utility mitigates for the environmental effects, the project is not acceptable. However, before the company chooses to do the project without mitigation, it

needs to make sure that any costs of "Ill will" for not mitigating for the environmental effects have been considered in the original analysis.

-Select- ▼

c. Should this project be undertaken?

1. The project should be undertaken only if they do not mitigate for the environmental effects. However, they have to make sure that they've done the analysis

properly to avoid any "ill will" and additional "costs" that might result from undertaking the project without concern for the environmental impacts.

II. The project should be undertaken only under the "mitigation" assumption.

III. The project should be undertaken since the IRR is positive under both the "mitigation" and "no mitigation" assumptions.

IV. The project should be undertaken since the NPV is positive under both the "mitigation" and "no mitigation" assumptions.

V. Even when no mitigation is considered the project has a negative NPV, so it should not be undertaken.

-Select- ✔

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A mining company is considering a new project. Because the mine has received a permit, the project would be legal; but it would cause significant harm to a nearby river. The firm could spend an additional $10 million at Year o to mitigate the environmental problem, but it would not be required to do so. Developing the mine (without mitigation) would require an initial outlay of $60 million, and the expected cash inflows would be $20 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $21 million. The risk-adjusted WACC is 12%. a. Calculate the NPV and IRR with mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answers to two decimal places. NPV: $ million IRR: Calculate the NPV and IRR without mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round…arrow_forwardRefer to Picture, Please answer Part A and Barrow_forwardThe Aubey Coffee Company is evaluating the within-plant distribution system for its new roasting, grinding, and packing plant. The two alternatives are (1) a conveyor system with a high initial cost but low annual operating costs and (2) several forklift trucks, which cost less but have considerably higher operating costs. The decision to construct the plant has already been made, and the choice here will have no effect on the overall revenues of the project. The cost of capital for the plant is 12%, and the projects' expected net costs are listed in the following table: a. What is the IRR of each alternative? The IRR of alternative 1 is -Select- Year 0 1 2 3 4 5 -Select- Expected Net Cost Forklift -$200,000 -160,000 -160,000 -160,000 -160,000 -160,000 Conveyor -$500,000 -120,000 -120,000 -120,000 -120,000 -20,000 The IRR of alternative 2 is-Select- b. What is the present value of costs of each alternative? Do not round Intermediate calculations. Round your answers to the nearest…arrow_forward

- A firm that manufactures paper is considering a project to set up a logging operation. Wood pulp generated by the project - normally an unwanted by-product of a logging operation - is an input to the paper manufacturing process. This will save the company $340,000 in wood pulp purchases, but it will cost $50,000 more to transport the wood pulp to the paper factory than it would cost to dump it as waste. How would you describe this situation in terms of the NPV analysis for the logging operation? Question 2Answer a. There is a positive externality equal to $290,000 which should be included in the NPV analysis. b. There is a positive externality equal to $340,000 which should be included in the NPV analysis. c. There is a negative externality equal to $290,000 which should be included in the NPV analysis. d. There is a negative externality equal to $340,000 which should be included in the NPV analysis.arrow_forwardThe city of Columbia is considering extending the runways of its municipal airport so that commercial jets can use the facility. The land necessary for the runway extension is currently a farmland that can be purchased for $350,000. Construction costs for the runway extension are projected to be $600,000, and the additional annual maintenance costs for the extension are estimated to be $22,500. If the runways are extended, a small terminal will be constructed at a cost of $250,000. The annual operating and maintenance costs for the terminal are estimated at $75,000. Finally, the projected increase in flights will require the addition of two air traffic controllers at an annual cost of $100,000. Annual benefits of the runway extension have been estimated as follows (shown): Apply the B–C ratio method with a study period of 20 years and a MARR of 10% per year to determine whether the runways at Columbia Municipal Airport should be extended.arrow_forwardUse the following information for the next four questions: The Anti-Zombie Corporation is considering expanding one of its production facilities to research a new type of virus, which will hopefully not cause a future zombie outbreak. The project would require a $24,000,000 capital investment and will be depreciated (straight-line to zero) over its 3 year life. They know that they will be able to salvage $6,000,000 for the equipment at that time. Incremental sales are expected to be $16,000,000 annually for the 3 year period with costs (excluding depreciation) of 40% of sales. The company would also have to commit initial working capital to the project of $2,000,000. The company has a 30% tax rate, and requires a 15% rate of return for projects of this risk level.arrow_forward

- The investor-developer would not be comfortable with a 7.8 percent return on cost because the margin for error is too risky. If construction costs are higher or rents are lower than anticipated, the project may not be feasible. The asking price of the project is $12,700,000 and the construction cost per unit is $82,200. The current rent to justify the land acqusition is $2.2 per square foot. The weighted average is 900 square feet per unit. Average vacancy and Operating expenses are 5% and 35% of Gross Revenue respectively. Use the following data to rework the calculations in Concept Box 16.2 in order to assess the feasibility of the project: Required: a. Based on the fact that the project appears to have 9,360 square feet of surface area in excess of zoning requirements, the developer could make an argument to the planning department for an additional 10 units, 250 units in total, or 25 units per acre. What is the percentage return on total cost under the revised proposal? Is the…arrow_forwardPlease see image for question.arrow_forwardAn electric utility is considering a new power plant in northern Arizona. Power from the plant would be sold in the Phoenix area, where it is badly needed. Because the firm has received a permit, the plant would be legal; but it would cause some alr pollution. The company could spend an additional $40 million at Year 0 to mitigate the environmental problem, but it would not be required to do so. The plant without mitigation would require an initial outlay of $210.55 million, and the expected cash Inflows would be $70 million per year for 5 years. If the firm does Invest in mitigation, the annual inflows would be $75.20 million. Unemployment in the area where the plant would be built is high, and the plant would provide about 350 good jobs. The risk adjusted WACC is 19%. a. Calculate the NPV and IRR with mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education