ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

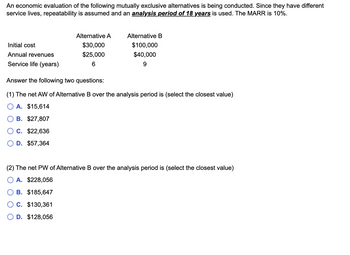

Transcribed Image Text:An economic evaluation of the following mutually exclusive alternatives is being conducted. Since they have different

service lives, repeatability is assumed and an analysis period of 18 years is used. The MARR is 10%.

Initial cost

Annual revenues

Service life (years)

Alternative A

$30,000

$25,000

6

Alternative B

$100,000

$40,000

9

Answer the following two questions:

(1) The net AW of Alternative B over the analysis period is (select the closest value)

A. $15,614

B. $27,807

C. $22,636

D. $57,364

(2) The net PW of Alternative B over the analysis period is (select the closest value)

A. $228,056

B. $185,647

C. $130,361

D. $128,056

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The following currency rate: C$1.2948/$ is .. A direct quote from the perspective of the U.S. An indirect quote from the perspective of Canada A direct quote from the perspective of Canada An indirect quote from the perspective of the U.S. Both c and d are correctarrow_forwardCompare the alternatives below on the basis of their capitalized costs. Assume the MARR is 10% per year, compounded annually Project A Project B Project C First cost ($200,000) ($275,000) ($800,000) Annual income $60,000 $70,000 $80,000 Salvage value $40,000 $60,000 $500,000 Life, years 4 7 infinityarrow_forwardGive typing answer with explanation and conclusionarrow_forward

- ! Required information An electric switch manufacturing company is trying to decide between three different assembly methods. Method A has an estimated first cost of $40,000, an annual operating cost (AOC) of $12,000, and a service life of 2 years. Method B will cost $70,000 to buy and will have an AOC of $6,000 over its 4-year service life. Method C costs $125,000 initially with an AOC of $3,500 over its 8-year life. Methods A and B will have no salvage value, but Method C will have equipment worth 7% of its first cost. Perform a present worth analysis to select the method at /= 12% per year. The present worth of method A is $ The present worth of method B is $ The present worth of method C is $ ✓is selected. Method Carrow_forwardMost likely estimates for a project are as follows. MARR Useful life Initial investment Receipts - Expenses (R-E) 10% per year 9 years $5,000 $1,200/year Click the icon to view the relationship between the PW and the percent change in parameter. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year. (b) To which variable is the PW most sensitive to? OA. Receipts - Expenses OB. Usefule life OC. Initial Investment (a) Determine whether the statement "An initial investment of $6,000 keeps the investment economical." is true or false. O False O Truearrow_forwardThree mutually exclusive electric-vehicle battery systems are being investigated by a large automobile manufacturer. Pertinent data are given below: Solve, a. Use the PW method to select the best battery system. The MARR is 15% per year, and the system chosen must provide service for 10 years. Assume repeatability. b. Confirm your recommendation in Part (a) using the IRR method.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education