Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Need help with this general accounting question

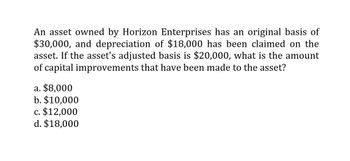

Transcribed Image Text:An asset owned by Horizon Enterprises has an original basis of

$30,000, and depreciation of $18,000 has been claimed on the

asset. If the asset's adjusted basis is $20,000, what is the amount

of capital improvements that have been made to the asset?

a. $8,000

b. $10,000

c. $12,000

d. $18,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Estimate the average total estimated useful life of depreciable property, plant, and equipment. Starbucks reports 580.6 million of depreciation and amortization in the statement of cash flows, of which 4.5 million relates to amortization of limited-life intangible assets. Does the estimate reconcile with stated accounting policy on useful lives for property, plant, and equipment? Explain.arrow_forwardImprovement that have been made to the asset?arrow_forwardCalculate and allocate basis for the following problems. 1. A property is acquired for a purchase price of $230,000 cash plus acquisition costs of $20,000. The tax assessment for this property is as follows: Assessed Value Land Improvements Total assessments $40,000 160,000 $200,000 a. What is the acquisition basis for this property? b. What is the allocation for land? c. What is the allocation for improvements?arrow_forward

- A company purchased an asset for $3,700.000 that will be used in a 3-year project. The asset is in the 3-year MACRS class. The depreciation percentage each year is 33.33 percent. 44.45 percent, and 14.81 percent, respectively What is the book value of the equipment at the end of the project? Multiple Choice $3.425.830 $274,170 $2.466,790arrow_forwardA fixed asset with a cost of $33,769.00 and accumulated depreciation of $30,392.10 is sold for $5,740.73. What is the amount of the gain or loss on disposal of the fixed asset? Select the correct answer. $2,363.83 gain $2,363.83 loss $3,376.90 loss $3,376.90 gainarrow_forwardA fixed asset with a cost of $32,167.00 and accumulated depreciation of $28,950.30 is sold for $5,468.39. What is the amount of the gain or loss on disposal of the fixed asset? Select the correct answer. A. $2,251.69 loss B. $2,251.69 gain C. $3,216.70 gain D. $3,216.70 lossarrow_forward

- Need help with this question solution general accountingarrow_forward18arrow_forwardA. CALCULATE the amount, if any, of recapture of depreciation, ordinary loss or capital gain on the disposal of an asset that was sold at the end of year 1 for $ 18,000. The machine was originally purchased at a cost of $ 20,000 and was depreciated using the MACRS method for a 5 year property class. B. INDICATE if there was recapture of depreciation (D), ordinary loss (P) or capital gain (G) in the disposal of this asset. [fill these blanks] * Amount = $. ___- * Type of disposition:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,