Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

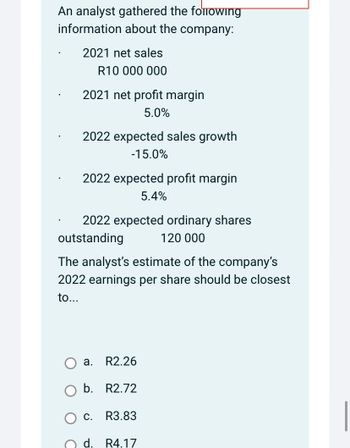

Transcribed Image Text:An analyst gathered the following

information about the company:

2021 net sales

R10 000 000

2021 net profit margin

5.0%

2022 expected sales growth

-15.0%

2022 expected profit margin

5.4%

2022 expected ordinary shares

outstanding

120 000

The analyst's estimate of the company's

2022 earnings per share should be closest

to...

a. R2.26

b. R2.72

C. R3.83

d. R4.17

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Given the information below for HooYah! Corporation, compute the expected share price at the end of 2020 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2020. Year 2014 2015 2016 2017 2018 2019 Price $ 15.00 $ 51.50 $ 123.00 $ 200.00 $ 90.00 $ 20.50 EPS −7.00 −6.29 −2.10 −.45 .03 .06 CFPS −16.00 −13.50 −3.10 −.15 .38 .08 SPS 12.00 20.50 21.60 25.10 28.60 28.95 using PE ratio Using P / CF ratio Using the P /S ratioarrow_forwardPlease help me with all answers and show all calculation thankuarrow_forwardBetter Burgers reported the following numbers (in millions) for the years ending February 2021 and 2022. Net income Dividends Total assets Total equity Internal growth rate Sustainable growth rate 2021 Internal growth rate Sustainable growth rate $ 13,620 6,251 What are the internal and sustainable growth rates? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. 2022 $ 1,457 209 Internal growth rate Sustainable growth rate % % What are the internal and sustainable growth rates using ROE × b and ROA × b and the end of period equity (assets)? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. 14,868 7,499 % % What are the growth rates if you use the beginning of period equity in this equation? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. % %arrow_forward

- Assume General Motors announced a quarterly profit of $119 million for 4th quarter 2022. Below is a portion of its balance sheet. Conduct a horizontal analysis of the following line items. Note: Negative answers should be indicated by a minus sign. Round the "percent" answers to the nearest hundredth percent. Cash and cash equivalents Marketable securities Inventories Goodwill Total liabilities and equity 2022 (dollars in millions) $ $ 2021 (dollars in millions) 15,980 9,222 13,642 0 103,249 $ $ 15,499 16,148 14,324 1,278 144,603 Difference % Changearrow_forwardGiven the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year Price EPS CFPS SPS 2016 $ 87.90 4.64 8.17 69.00 Using PE ratio Using P/CF ratio Using P/S ratio 2017 2018 $93.80 $ 92.50 5.35 6.15 8.96 9.25 74.00 73.40 Share Price 2019 $90.00 6.85 11.02 76.90 2020 2021 $111.50 $ 126.90 7.90 12.34 88.10 8.90 13.46 96.10arrow_forwardA company has the following items for the fiscal year 2020: Revenue =10 million EBIT = 5 million Net income = 2 million Total Equity = 20 million Total Assets = 40 million Calculate the company’s ROA and ROEarrow_forward

- The following amounts were taken from the financial statements of Bramble Company: 2020 2019 Total assets $840000 $1020000 Net sales 770000 640000 Gross profit 353000 350000 Net income 200000 111000 Weighted average number of common shares outstanding 40000 88000 Market price of common stock $145.00 $36.00 The price-earnings ratio for 2020 is 5.00 times. 7.53 times. 31.00 times. 29.00 times.arrow_forwardes Given the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year Price 2016 $ 97.60 2017 $ 103.50 2018 $ 102.20 2019 $ 99.70 2020 $ 121.20 2021 $ 136.60 EPS CFPS 2.80 8.22 3.51 4.31 5.01 7.95 8.95 9.00 9.28 11.07 12.37 13.48 SPS 52.60 57.60 57.00 60.50 71.70 79.70 Using PE ratio Using P/CF ratio Using P/S ratio Share Pricearrow_forwardAbbreviated financial statements for Archimedes Levers are shown in the table below. Assume sales and expenses increase by 13% in 2022 and all assets and liabilities increase correspondingly. Income Statement Sales Costs, including interest Net income $ 6,800 4,900 $ 1,900 2021 Balance Sheet, Year-End 2020 Net assets $ 5,916 $ 5,500 Total $ 5,916 $ 5,500 Debt Equity Total 2021 $ 2,516 3,400 $ 5,916 2020 $ 2,433 3,067 $ 5,500 a. If the payout ratio is set at 60% and no external debt or equity is to be issued, what is the maximum possible growth rate for Archimedes? b. If the payout ratio is set at 60% and the firm maintains a fixed debt ratio but issues no equity, what is the maximum possible growth rate for Archimedes? Note: For all requirements, do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. a. Maximum possible growth rate b. Maximum possible growth rate % %arrow_forward

- Please no hand writing solutionarrow_forwardQ1) You are required to calculate the Relative Percentage Change in the company for the blanks below and the Net Profit for the other blanks. Show all working out below including the formula used for each year and include the completed table here. Year 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Net Profit ($ 000’) <blank> 50 200 150 225 250 <blank> 200 250 260 Relative Percentage Change N/A -50% 300% <blank> 50% 11% -30% 14% 25% <blank> Table 1: Net Profit ($) per financial year Q1 a) Using Excel, create a column chart of the Net Profit calculated in part (a) for the years 2010-2019. label the axis and provide an appropriate title. Q1 b) Using Excel, create a Sparkline of the Relative Percentage Change calculated in part (a) for the years 2011-2019. use the Sparkline options to mark if there are any negative values and include a horizontal axis to easily visualise…arrow_forwardFor XYZ Corporation, the book value per share at the end of 2021 Is 31.46, ROI is .1, and earnings per share for 2022 (at the end of the year) are 4.57. What is the value of residual earnings per share for 2022? O2.38 1.42 O 3.57 O 1.13arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education