Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Estimate Pharma’s sustainable sales growth rate based on its 2019 financial statements. [Hint: You need to estimate the beginning of period stockholders’ equity based on the information provided.] What financial policy change might Pharma Biotech make to improve its sustainable growth rate? Show your calculations.

Transcribed Image Text:Pharma Biotech Corporation

The Pharma Biotech Corporation spent several years working on developing a DHA product that can be used to provide

a fatty-acid supplement to a variety of food products. DHA stands for docosahexaenoic acid, an omega-3 fatty acid

found naturally in cold-water fish. The benefits of fatty fish oil have been cited in studies of the brain, the eyes, and the

immune system. Unfortunately, it is difficult to consume enough fish to get the benefits of DHA, and most individuals

might be concerned about the taste consequences associated with adding fatty fish oil to eggs, ice cream, or chocolate

candy. To counter these constraints, Pharma Biotech and several competitors have been able to grow algae and other

plants that are rich in DHA. The resulting chemical compounds then are used to enhance a variety of food products.

Pharma Biotech's initial DHA product was designed as an additive to dairy products and yogurt. For example, the

venture's DHA product was added to cottage cheese and fruit-flavored yogurts to enhance the health benefits of those

products. After the long product development period, Pharma Biotech began operations in 2018. Income statement and

balance sheet results for 2019, the first full year of operations, have been prepared.

Pharma Biotech, however, is concerned about forecasting its financial statements for next year because it is uncer-

tain about the amount of additional financing for assets that will be needed as Pharma Biotech Corporation the venture

ramps up sales. Pharma Biotech expects to introduce a DHA product that can be added to chocolate candies. Not

only will consumers get the satisfaction of the taste of the chocolate candies, but they will also benefit from the DHA

enhancement. Because this is anticipated to be a blockbuster new product, sales are anticipated to increase 50 percent

next year (2020), even though the new product will come online in midyear. An additional 80 percent increase in sales is

expected the following year (2021).

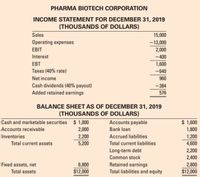

Transcribed Image Text:PHARMA BIOTECH CORPORATION

INCOME STATEMENT FOR DECEMBER 31, 2019

(THOUSANDS OF DOLLARS)

Sales

15,000

Operating expenses

- 13,000

ЕBIT

2,000

Interest

- 400

EBT

1,600

Taxes (40% rate)

-640

Net income

960

Cash dividends (40% payout)

Added retained earnings

-384

576

BALANCE SHEET AS OF DECEMBER 31, 2019

(THOUSANDS OF DOLLARS)

Cash and marketable securities $ 1,000

Accounts payable

$ 1,600

Accounts receivable

2,000

Bank loan

1,800

Inventories

2,200

Accrued liabilities

1,200

Total current assets

5,200

Total current liabilities

4,600

Long-term debt

2,200

Common stock

2,400

Fixed assets, net

6,800

Retained earnings

2,800

Total assets

$12,000

Total liabilities and equity

$12,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Beagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look glamorous. Below you will find selected information necessary to compute some valuation estimates for the firm. Assume the values provided are from year-end 2021. Also assume that the firm's equity beta is 1.30, the risk-free rate is 2.55 percent, and the market risk premium is 7.0 percent. Dividends per share. Return on equity Book value per share 2021 value per share. Average price multiple Forecasted growth rate $ 2.22 9.50% $18.40 Share price Earnings $ 5.00 13.10 13.57% Cash Flow $ 6.50 9.51 11.32% Sales $25.65 2.45 7.17% The sustainable growth rate is 5.282 percent, and the required return is 11.65 percent. Use the clean surplus relationship to calculate the share price for Beagle Beauties with the residual income model. Note: Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forwardThe following table contains yearly rate of returns on Pepsi and Sprite from 2020 to 2023: 2021 2022 2023 12 14 16 10 9 7 Year Rate of return on Pepsi (%) Rate of return on Sprite (%) 2020 10 10 1. Compute RRC for each stock; 2. Would you invest in Pepsi or Sprite? Why or why not; 3. Compute the covariance between the return on Pepsi and the return on Sprite; 3. In order to mitigate risk (given your result in 1.3), would you consider investing in a portfolio consisting of Pepsi and Sprite? Why or why not?arrow_forwardPlease help me for this question to find cash flow and net present valuearrow_forward

- All answers are correct except: At what amount will Fuzzy Monkey report its investment in the December 31, 2024 balance sheet?arrow_forwardGiven the information below for HooYah! Corporation, compute the expected share price at the end of 2020 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2020. (Do not round intermediate calculations. Round your answers to 2 decimal places. Exclude negative annual PE and P/CFPS ratios from the average PE and average P/CFPS ratio calculations. When computing annual growth rates, use a positive sign on the annual rate of change if the per share value increased in value and use a negative sign on the annual rate of change if the per share value deceased in value.) Year Price EPS CFPS SPS 2014 $11.00 -7.00 -12.00 8,00 Using PE ratio Using P/CF ratio Using P/S ratio 2015 2016 $47.50 $119.00 -6.29 -9,50 16.50 -1.70 -2.70 19.60 Share Price 2017 $196.00 -.50 10 23.10 2018 $86.00 .07 18 26.60 2019 $16.50 0.06 00 24.95arrow_forwardGive typing answer with explanation and conclusion 1. If the value of sustainable investing is $171.1 and the discount rate is 8% while the value of non-sustainable investing is $15.7 and the company has a 28.7% probability of being sustainable. What is the expected value today of the company given a 18 year horizon? (Answer to 2 decimal places in $).arrow_forward

- Beagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look glamorous. Below you will find selected information necessary to compute some valuation estimates for the firm. Assume the values provided are from year-end 2021. Also assume that the firm's equity beta is 1.40, the risk-free rate is 2.35 percent, and the market risk premium is 6.0 percent. Dividends per share Return on equity Book value per share 2021 value per share Average price multiple Forecasted growth rate $2.34 8.50% $ 19.30 Share price Earnings Cash Flow $5.00 13.10 13.63% $6.30 9.57 11.26% Sales $ 25.65 2.51 7.24% The sustainable growth rate is 4.522 percent, and the required return is 10.75 percent. Use the clean surplus relationship to calculate the share price for Beagle Beauties with the residual income model. Note: Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forwarddid actual returns for the common stocks of large firms continue to generate similar returns during 2022? Please Answer Fast.arrow_forwardIf Company A has a PE ratio of 20 and Company B has a PE ratio of 80, investors expect Company A to grow more in the future than Company B. True Falsearrow_forward

- Beagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look glamorous. Below you will find selected information necessary to compute some valuation estimates for the firm. Assume the values provided are from year - end 2021. Also assume that the firm's equity beta is 1.40, the risk - free rate is 2.60 percent, and the market risk premium is 8.0 percent. Dividends per share $ 2.44 Return on equity 10.50% Book value per share $ 20.05 Earnings Cash Flow Sales 2021 value per share $ 5.00 $ 6.40 $ 25.65 Average price multiple 13.10 9.62 2.56 Forecasted growth rate 13.68% 11.21% 7.39% Using the PE, P/CF, and P/S ratios, estimate the 2022 share price for Beagle Beauties. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. DO NOT USE EXCEL please leave a key for the formula thank youarrow_forwardHow to calculate annual sustainable growth rate for the years 2009 through 2013.arrow_forwardConsidering the globalization of financial markets and how different our world is now compared to even 25 years ago. How useful can historical returns going back 50 or 80 years be to the investor as a predictor of future returns?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education