FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

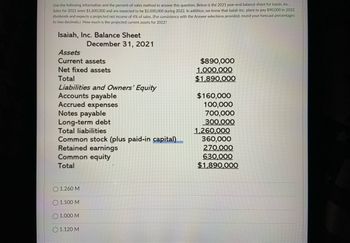

Transcribed Image Text:Use the following information and the percent-of-sales method to answer this question. Below is the 2021 year-end balance sheet for Isaiah, Inc.

Sales for 2021 were $1,600,000 and are expected to be $2,000,000 during 2022. In addition, we know that Isaiah Inc. plans to pay $90,000 in 2022

dividends and expects a projected net income of 4% of sales. (For consistency with the Answer selections provided, round your forecast percentages

to two decimals.) How much is the projected current assets for 2022?

Isaiah, Inc. Balance Sheet

Assets

Current assets

Net fixed assets

Total

Liabilities and Owners' Equity

Accounts payable

Accrued expenses

Notes payable

Long-term debt

Total liabilities

Common stock (plus paid-in capital)

Retained earnings

Common equity

Total

O 1.260 M

December 31, 2021

1.500 M

O 1.000 M

1.120 M

$890,000

1,000,000

$1,890,000

$160,000

100,000

700,000

300,000

1,260,000

360,000

270,000

630,000

$1,890,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Search online for Tesla’s Annual Report for fiscal year 2020 that ended on December 31, 2020. Answer the following questions using the report. What’s Tesla’s current ratio in 2019 and 2020? What does this ratio suggest? What’s Tesla’s net profit margin and gross profit percentage in 2019 and 2020? What’s your interpretation of the trend? What’s Tesla’s return on assets(ROA) and total asset turnover ratio in 2020?arrow_forwardOperating data for Joshua Corporation are presented below. 2020 2019 Sales revenue $ 755,000 $ 604,000 Cost of goods sold 464,325 386,560 Selling expenses 118,535 75,500 Administrative expenses 58,135 54,360 Income tax expense 37,750 24,764 Net income 76,255 62,816 Prepare a schedule showing a vertical analysis for 2020 and 2019. (Round answers to 1 decimal place, e.g. 48.5%.)arrow_forwardThe income statements for Federer Sports Apparel for 2022 and 2021 are presented below. Required: Prepare a horizontal analysis for 2022 using 2021 as the base year. (Decreases should be indicated with a minus sign. Round your percentage answers to 1 decimal place.) FEDERER SPORTS APPAREL Income Statement For the Years Ended December 31 Year Increase (Decrease) 2022 2021 Amount Net sales 19,100,000 S 15,800,000 Cost of goods sold 13,064,400 7,189,000 Gross profit 6,035,600 8,611,000 1,680,800 1,264,000 Operating expenses Depreciation expense 1,069,600 1,069,600 Inventory write-down 267,400 Loss (litigation) 1,585,300 347,600 Income before tax 1,432,500 5,929,800 Income tax expense 515,700 2,085,600 Net income $4 916,800 S 3,844,200arrow_forward

- Hammond Motors had sales of $35 million in 2020 with a cost of goods sold of $20 million. A simplified balance sheet for Hammond appears below attached: 23) Hammond's net working capital in 2020 is closest to: A) $2.3 million B) $3.8 million C) $6.5 million D) $10.5 million Justify your answerarrow_forwardCafua Corporation makes cell phone covers and has the following comparative income statement for the years ended December 31, 2025 and 2024: (Cick the icon to view the comparative income statement.) Read the requirement. Begin by completing a horizontal analysis of Cafua Corporation's income statement. (Use a minus sign or parentheses to show an amount and/or percentage decrease. Round all percentages to the nearest tenth percent, X.X. For example, enter 10.2% as 10.2. Complete all input boxes. If the base amount is $0, enter a "0" in the percentage column.) Revenues: Net Sales Revenue Other Revenues Total Revenues Expenses: Cost of Goods Sold Engineering, Selling, and Administrative Expenses Interest Expense Income Tax Expense Other Expenses Total Expenses Cafua Corporation Income Statement Years Ended December 31, 2025 and 2024 Net Income 2025 $ $ 1,100,000 $ 1,000,000 9,000 1,100,000 1,009,000 781,000 205,700 26,400 27,500 8,800 2024 1,049,400 50,600 $ 673,000 193,000 15,000 14,000…arrow_forwardGodhi's 2024 financial statements reported the following items with 2023 figures given for comparison: (Click the icon to view the reported items.) Net income for 2024 was $4,230, and interest expense was $260. Compute Godhi's rate of return on total assets for 2024. (Round to the nearest percent.) Select the formula, then enter the amounts to compute the rate of return on total assets for 2024. (Round to the nearest percent.) Rate of return on total assets % C Data table Total Assets Godhi, Inc. Balance Sheet As of December 31, 2024 and 2023 2024 Total Liabilities Total Stockholders' Equity (all common) Total Liabilities and Stockholders' Equity Print S S Done 38,740 $ 17,200 21,540 38,740 S 2023 33,820 16,220 17,600 33,820arrow_forward

- Please help me with all answers and show all calculation thankuarrow_forwardAssume this is a partial list of financial highlights from a Best Buy annual report: 2019 2020 (dollars in millions). $ 37,580 $ 33,075 1,283 891 2,231 1,318. Net sales Earnings before taxes Net earnings Complete a horizontal and vertical analysis from the above information. (Enter your answers in millions. Round the "percent" answers to the nearest hundredth percent.) Net sales Earnings before taxes Net earnings 2020 Horizontal analysis 2019 Increase Percent Vertical analysis 2020 % % % 2019 + % % %arrow_forwardBegin by calculating the gross profit for each year, then prepare a horizontal analysis of revenues and gross profitlong dash—both in dollar amounts and in percentageslong dash—for 20192019 and 20182018. (Enter amounts in millions as provided to you in the problem statement. Round the percentages to one decimal place, X.X%. Use a minus sign or parentheses to indicate a decrease.) McDonald Corp. Income Statement - (Partial) Years Ended December 31, 2019 and 2018 (Amounts in millions) 2019 2018 2017 Revenues $9,575 $9,300 $8,975 Cost of Goods Sold 6,250 6,000 5,890 Gross Profitarrow_forward

- In January 2019, United Airlines (UAL) had a market capitalization of $22.90 billion, debt of $13.40 billion, and cash of $4.00 billion. United Airlines had revenues of $41.30 billion. Southwest Airlines (LUV) had a market capitalization of $27.50 billion, debt of $3.40 billion, cash of $3.70 billion, and revenues of $22.00 billion. a. Compare the market capitalization-to-revenue ratio (also called the price-to-sales ratio) for United Airlines and Southwest Airlines. b. Compare the enterprise value-to-revenue ratio for United Airlines and Southwest Airlines. c. Which of these comparisons is more meaningful? Explain. a. Compare the market capitalization-to-revenue ratio (also called the price-to-sales ratio) for United Airlines and Southwest Airlines. The market capitalization-to-revenue ratio for United Airlines is The market capitalization-to-revenue ratio for United Airlines is enter your response here . (Round to three decimal places.) Part 2 The market…arrow_forwardUse the following selected 2019 balance sheet and income statement information for Homer Glen Supply Co. (in millions) to compute the gross profit percentage to the nearest hundredth of a percent. Net income $104,940 Select one: C O O O A. 44.26% B. 4.42% C. 8.56% D. 28.76% Gross profit on sales $1,050,600 Average total assets $631,050 Sales $2,373,882 Tax rate on operating profit 35%arrow_forwardThe most recent financial statements for Crosby, Incorporated, follow Sales for 2024 are projected to grow by 20 percent. Interest expense will remain constant, the tax rate and the dividend payout rate will also remain constant Costs, other expenses, current assets, and accounts payable incresse spontaneously with sales. Sales Costs Other expenses Earnings before interest and taxes Interest paid Taxable income Taxes (243) Net Income Dividends Addition to retained earnings Current assets Accounts receivable Inventory Total Total assets Fixed assets Net plant and equipent Sales Costs CROSBY, INCORPORATED 2823 Income Statement Other expenses EBIT Interest Taxable income Assets Pro Forme Income statement TAKAS Not income Cument assets Cash Accounts receivable Inventory Total Totalassos EFN Fixed assets Not plant and equipment Assets In 2023, the firm operated at 80 percent of capacity. Construct the pro forms Income statement and balance sheet for the company. Assume that fixed assets are…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education