FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I need help with this homework please follow the instructions it just says numeric which means I have to type the numbers. I don’t want long paragraphs that’s not helpful just simple answers for this homework assignment for each one because I had to resend this and all I got sent was instructions that’s not helpful. Because when I did it the numbers were wrong. Just send me the correct numbers for each one. Please, thank you!

Transcribed Image Text:BUSINESS ACCOUNTING

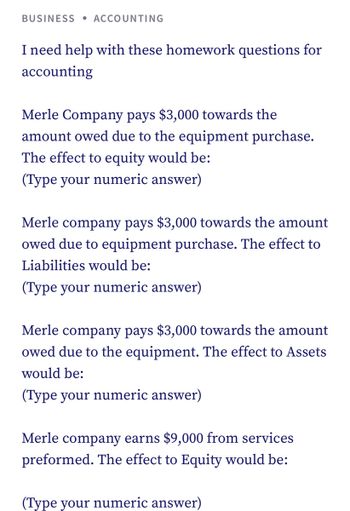

I need help with these homework questions for

accounting

Merle Company pays $3,000 towards the

amount owed due to the equipment purchase.

The effect to equity would be:

(Type your numeric answer)

Merle company pays $3,000 towards the amount

owed due to equipment purchase. The effect to

Liabilities would be:

(Type your numeric answer)

Merle company pays $3,000 towards the amount

owed due to the equipment. The effect to Assets

would be:

(Type your numeric answer)

Merle company earns $9,000 from services

preformed. The effect to Equity would be:

(Type your numeric answer)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Multiple choice: 1. Correction in accounts should NOT be A. Traceable B. Initialed C. Ruled D. Covered completely 2. To find an error, you should do all of the following except A. Double check every entry B. Find the difference between debits and credits C. Erase questionable entries D. Retrace any math computationarrow_forwardPlease answer all parts with detailed calculations and good formatting and make sure the answer is 100% correct, else leave it for the other tutor to answer. Otherwise i will downvote the answer and report it for uprofessionalism for sure. Please don't use AI or Chat GPT also make sure there is no plagiari.sm.arrow_forwardInstructions: 1. Make a double-entry journal about the different ethical principles. Write at least three ethical principles you like the most and your own ethical thoughts/ examples about them. Ethical Principles you like the most Your own ethical thought/descriptions about it. 2. Write your answer- own ethical thought in not less than 100 words per item. answer both question, thanks.arrow_forward

- please answer all the questionss.,.within 30 minutes. make sure the explanation and reasons are explained in very detailed manner. else leave it for other tutor otherwise i will give negative ratings and will also report your answer for unprofessionalism. Make sure the answer is 100% correct and IS NOT COPIED FROM ANYWHERE ELSE YOUR ANSWER WILL DOWNVOTED AND REPORTED STRAIGHTAWAY. USE YOUR OWN LANGUAGE WHILST WRITING. ATTEMPT THE QUESTION ONLY IF YOU ARE 100% CORRECT AND SURE. ELSE LEAVE IT FOR ANOTHER TUTOR. BUT PLEASE DONT PUT WRONG ANSWER ELSE I WILL REPORT. MAKE SURE THE ANSWER IS WELL EXPLAINED AND DETAILED.arrow_forwardPlease answer completely and correctly for all parts with explanation computation formula steps answer in text no copy paste show explanation and computation clearly for numbers provide full working for all steps with explanation answer in text formarrow_forwardWould you please remind me how the debits and credits system works? Why do the assets get debit increased and the liabilities and owner’s equity get debit decreased? I know the parts must balance and clear each other out, but reviewing my notes from a previous class, I’m having a hard time getting a perspective on the principle of the T-balance.arrow_forward

- Go to the Loan Calculator The cells in the range B6:B8 have defined names, but one is incomplete and could be confusing. Cell A2 also has a defined name, which is unnecessary for a cell that will not be used in a formula.Update the defined names in the worksheet as follows: a)Delete the Loan_Calculator defined name. b)For cell B8, edit the defined name to use Loan_Amount as the name. 2. In cell B8, calculate the loan amount by entering a formula without using a function that subtracts the Down_Payment from the Price. 3.Liam also wants to use defined names in other calculations to help him interpret the formulas.a) In the range D4:D8, create defined names based on the values in the range C4:C8.arrow_forwardcan you help me on how to do my assignment?arrow_forwardHELP THESE TWO QUESTIONSarrow_forward

- please answer without copy paste and with all work like explanation , computation, formula with steps need correct and complete answer for better understanding please answer in text no AI no handwritten no image need accurate answer need answer in text no copy from other answer help part b with workingarrow_forwardFurther info is in the attached images For the Excel part of the question give the solutions in the form of the Excel equations. Please and thank you! :) Download the Applying Excel form and enter formulas in all cells that contain question marks. For example, in cell B34 enter the formula "= B9". After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the example in the text. Check your worksheet by changing the beginning work in process inventory to 100 units, the units started into production during the period to 2,500 units, and the units in ending work in process inventory to 200 units, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the cost per equivalent unit for materials should now be $152.50 and the cost per equivalent unit for conversion should be $145.50. Thank you!arrow_forwardHi I asked this question previously and the individual did not explain things clearly. For instance he provided the I'm guessing standard method of finding a missing amount on a certain type of T-Account but then would turn around and solve it using a different method. I am posting the response that were not clear below. If you could tell me what the actual method is and if there exceptions and if so what those are.Answer #1 I needed the BEGINNING balance of a debit account. As you can see the response below the individual provided a formula that included the BB which is UNKOWN because that is WHAT I NEED. At the bottom they change around the equation to come to the answer. So what is the proper way???Part-1. Begining balance of cash account is missing. The cash account is having a debit balance always. The formula for Cash account is as under:Ending balance of Cash Account = Begining Balance of cash account + All debits - All creditsHere,Ending Balance of cash = 9800All debits…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education