Concept explainers

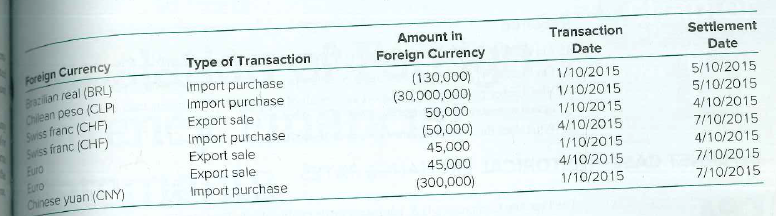

Import/Export Company, a U.S. company, made a number of import purchases and export sales denominated in foreign currency in 2015. Information related to these transactions is summarized in the following table. The company made each purchase or sale on the date in the Transaction Date column and made payment in foreign currency or received payment on the date in the Settlement Date column.

Required

1. Create an electronic spreadsheet with the information from the preceding table. Label columns as follows:

Foreign Currency

Type of Transaction

Amount in Foreign Currency

Transaction Date

Exchange Rate at Transaction Date .

$ Value at Transaction Date

Settlement Date

Exchange Rate at Settlement Date

$ Value st Settlement Date

Foreign Exchange Gain (Loss)

2. Use historical exchange rate information available on the Internet at www.x-rates.com, Historic Lookup, to find the 2015 exchange rates between the U.S. dollar and each foreign currency on the relevant transaction and settlement dates.

3. Complete the electronic spreadsheet to determine the foreign exchange gain (loss) on each transaction. Determine the total net foreign exchange gain (loss) reported in Import/Export Company's 2015 income statement.

4. Explain why a foreign exchange gain arises for some transactions and a foreign exchange loss occurs for other transactions.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

- Required information McCarthy, Inc.'s Brazilian subsidiary borrowed 115,000 euros on January 1, 2017. Exchange rates between the Brazilian real (BRL) and euro (€) and between the U.S. dollar ($) and BRL are as follows: US$ per BRL $ 0.28 $ 0.25 $ 0.20 BRL per €. BŘL 4.20 January 1, 2017 Average, 2017 December 31, 2017 BRL 4.30 BRL 4.60 05 a017arrow_forwardRecording Export Transactions Daisy Brands, a U.S. company, sells items abroad. Daisy prices many of these transactions in the currency of the customer. Following are four such transactions made in the last accounting period, plus the direct exchange rates for each date: Country Amount Currency Spot rate at sale Spot rate at collection Argentina . . . . . . . . . . . . . . . . . . . . . . 250,000 Peso $0.056 $0.049 Canada . . . . . . . . . . . . . . . . . . . . . . . . 400,000 Dollar 0.732 0.713 India . . . . . . . . . . . . . . . . . . . . . . . . . . 300,000 Rupee 0.016 0.018 South Africa . . . . . . . . . . . . . . . . . . . . 100,000 Rand 0.074 0.077 Required Prepare the journal entries made by Daisy Brands to record the above sale and collection transactionsarrow_forwardThe U.S Company, In the month of January 15 sold machinery on account to a retailer Australia. The invoice price was 250,000 US dollars and the exchange rate for the Australia dollar was $0.576. Select one:a. Cash A/c Dr 144,000$Sales A/c Cr 144,000$b. Cash A/c Dr 250,000$Sales A/c Cr 250,000$c. Accounts Receivable 250,000$ Sales 250,000$ d. Accounts receivable A/c Dr 144,000$Sales A/c Cr 144,000$arrow_forward

- Iberico plc, a Spanish firm whose functional currency is EUR, bought goods from a British supplier at a cost of 10,000 GBP paid in cash. The exchange rate on the date of sale was 1 GBP = 1.2 EUR. Which the journal entry shall Iberico plc prepare regarding the purchase? Select one: a. DR Inventories 12,000 EUR, CR Cash 10,000 GBP b. DR Inventories 12,000 EUR, CR Cash 12,000 EUR C. DR Inventories 12,000 GBP, CR Cash 12,000 GBP d. DR Inventories 10,000 GBP, CR Cash 10,000 GBP Clear my choicearrow_forwardThe following balance sheet accounts of a foreign subsidiary at December 31, 2017, have been translated into U.S. dollars as follows: Translated at Current Rates Historical Rates Accounts receivable, current $ 600,000 $ 600,000 Accounts receivable, long-term 300,000 324,000 Inventories carried at market 180,000 198,000 Goodwill 190,000 220,000 $1,270,000 $ 1,402,000 What total should be included in the translated balance sheet at December 31, 2017, for the above items? Assume the U.S. dollar is the functional currency. $1,354,000 $1,270,000 $1,288,000 $1,300,000arrow_forwardBrandlin company of anaheim, california, sells parts to a foreign customer on december 1, 2017, with payment of 24,000 korunas to be received on march 1, 2018. Brandlin enters into a forward contact on december 1, 2017 to sell 24,000 korunas on march 1, 2018. Relevant exchange rates for the korunas on various dates are as follow: date spot rate forward rate december 1, 2017 4.20 4.275 december 31, 2017 4.30 4.400 march 1, 2018 4.45 n/a brandli's incremental borrowing rate is 12 percent. The present value factor for two months at annual interest rate of 12 percent (1 percent per month) is 0.9803. Brandlin must close its books and prepare financial statements at december 31. 1. Assuming that brandlin designates the forward contract as a cash flow hedge of a foreign currency receivable and recognizes any premium or discount…arrow_forward

- Concord Company, a U.S. company, made credit sales to four customers in Asia on September 15, 2018, and received payment on October 15, 2018. Information related to these sales is shown below: Concord Company Sales Transactions September 15, 2018 Customer Location Invoice Price Currency Prima Industries Ltd Mumbai 7,195,000 Indian rupees (INR) Samal Island Group Cebu City 5,417,000 Philippine peso (PHP) Yokama Properties Inc Osaka 11,210,000 Japanese yen (JPY) Kinabalu Trading Ltd Johur Bahru 414,000 Malaysian ringgit (MYR) The Concord Company’s fiscal year ends on September 30. Required: 1. Use historical exchange rate information available on the Internet x-rates, Historical Lookup, to find the exchange rates between the U.S. dollar and each foreign currency for September 15, September 30, and October 15, 2018. 2. Determine the foreign exchange gains and losses that Concord Company would have recognized in net income in the fiscal years ended September 30, 2018 and September 30,…arrow_forwardConstellation Brands, a U.S. company, purchases merchandise from a German supplier on a regular basis. On April 1, 2016, Constellation purchased €10,500 for delivery on June 30, 2016, in anticipation of an expected purchase of merchandise for €10,500 at the end of June. The forward contract was a qualified hedge of a forecasted transaction. Constellation took delivery of the merchandise, settled the forward contract, and paid the German supplier €10,500 on June 30, 2016. The merchandise was subsequently sold in the U.S. on July 12, 2016, for $14,250 in cash. Relevant exchange rates ($/€) are as follows: Spot rate Forward rate for deliveryJune 30, 2016 April 1, 2016 $ 1.32 $1.30 June 30, 2016 1.36 -- Prepare the journal entries made by Constellation Brands on June 30 and July 12 concerning the above events. Assume Constellation Brands is a calendar-year company, and records cost of goods sold at the time of sale. General Journal Date Description Debit Credit…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education