FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

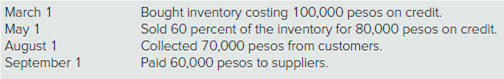

Voltac Corporation (a U.S. company located in Charlotte, North Carolina) has the following import/ export transactions denominated in Mexican pesos in 2017:

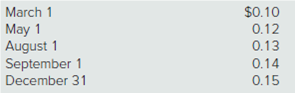

Currency exchange rates for 1 peso for 2017 are as follows:

For each of the following accounts, how much will Voltac report on its 2017 financial statements?

a. Inventory.

b. Cost of Goods Sold.

c. Sales.

d. Accounts Receivable.

e. Accounts Payable.

f. Cash.

Transcribed Image Text:March 1

May 1

August 1

Bought inventory costing 100,000 pesos on credit.

Sold 60 percent of the inventory for 80,000 pesos on credit.

Collected 70,000 pesos from customers.

Paid 60,000 pesos to suppliers.

September 1

Transcribed Image Text:March 1

May 1

August 1

$0.10

0.12

0.13

0.14

December 31

0.15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A bank in Mississauga has a buying rate of ¥1 = C$0.01275. If the exchange rate is ¥1 = C$0.01315, calculate the rate of commission that the bank charges to buy currencies. Round to two decimal placesarrow_forwardASSUME THAT THE U.S. DOLLAR IS THE FUNCTIONAL CURRENCY. Ruthie Inc. had a debit adjustment of $7900 for the year ended December 31, 2019, from restating its foreign subsidiary's accounts from their local currency units into U.S. dollars. Additionally, Ruthie had a receivable from a foreign customer. It is denominated in the customer's local currency. On December 31, 2018, this receivable for 300,000 local currency units (LCU) was correctly included in Ruthie's balance sheet at $124200. When the receivable was collected on February 15, 2019, the U.S. dollar-equivalent was $122200. In Ruthie's 2019 consolidated statement of income, how much should be reported as foreign exchange gain/(loss) in computing net income? BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. IF THE NUMBER IS NEGATIVE, TYPE -1000 INSTEAD OF ($1,000) Your Answer:arrow_forwardA bank in London, Ontario has a buying rate of CHF 1 = C$1.3547. If the exchange rate is CHF 1 = C$1.3841, calculate the rate of commission that the bank charges.arrow_forward

- Brief, Inc., had a receivable from a foreign customer that is payable in the customer's local currency. On December 31, 2020, Brief correctly included this receivable for 377,500 local currency units (LCU) in its balance sheet at $290,000. When Brief collected the receivable on February 15, 2021, the U.S. dollar equivalent was $301,200. In Brief's 2021 consolidated income statement, how much should it report as a foreign exchange gain? Multiple Choice $16,200 $27,400 $0 $11,200arrow_forward4arrow_forwardWinston Corp., a U.S. company, had the following foreign currency transactions during 2021: ( 1.) Purchased merchandise from a foreign supplier on July 16, 2021 for the U.S. dollar equivalent of $47,000 and paid the invoice on August 3, 2021 at the U.S. dollar equivalent of $54,000. (2.) On October 15, 2021 borrowed the U.S. dollar equivalent of $315,000 evidenced by a non-interest-bearing note payable in euros on October 15, 2022. The U.S. dollar equivalent of the note amount was $295,000 on December 31, 2021, and $299,000 on October 15, 2022. What amount should be included as a foreign exchange gain or loss from the two transactions for 2022?arrow_forward

- ASSUME THAT THE LOCAL CURRENCY UNIT IS THE FUNCTIONAL CURRENCY. Cade Inc. had a debit adjustment of $6400 for the year ended December 31, 2019, from restating its foreign subsidiary's accounts from their local currency units into U.S. dollars. Additionally, Cade had a receivable from a foreign customer. It is denominated in the customer's local currency. On December 31, 2018, this receivable for 300,000 local currency units (LCU) was correctly included in Cade's balance sheet at $121000. When the receivable was collected on February 15, 2019, the U.S. dollar-equivalent was $123800. In Cade's 2019 consolidated statement of income, how much should be reported as foreign exchange gain/(loss) in computing net income? BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. IF THE NUMBER IS NEGATIVE, TYPE -1000 INSTEAD OF ($1,000) Your Answer:arrow_forwardOn December 15, 2017, Lisbeth Inc. (a U.S. company) purchases merchandise inventory from a foreign supplier for 50,000 schillings. Lisbeth agrees to pay in 45 days after it sells the merchandise. Lisbeth makes sales rather quickly and pays the entire obligation on January 25, 2018. Currency exchange rates for 1 schilling are as follows:Prepare all journal entries for Lisbeth Company in connection with this purchase and payment.arrow_forwardA U.S. company's foreign subsidiary had the following amounts in stickles (5), the functional currency, in 2018: Cost of goods sold $12,000, e00 Ending inventory Beginning inventory 600,000 240,000 The average exchange rate during 2018 was 81 = $.96. The beginning inventory was acquired when the exchange rate was §1 = $1.20. The ending inventory was acquired when the exchange rate was §1 = $.90. The exchange rate at December 31, 2018 was §1= $.84. Assuming that the foreign nation for the subsidiary had a highly inflationary economy, at what amount should that foreign subsidiary's purchases have been reflected in the 2018 U.S. dollar income statement? Multiple Cholce $11,865,600. $11.577,600. $11.520.000. $11,613,600. $11,523,600.arrow_forward

- As at 1st January, 2017, the spot exchange rate between the U.S. dollar and Japanese Yen was trading at $1.00 equivalent to ¥100. The local bank offered the Company to exchange $1.00 for ¥102 on 31st December, 2017. The Interest rates on one year government bonds were 6% in U.S. and 10% in Japan. The company can borrow and lend at the risk-free rate on government bonds. As an Investment Advisor you have been approached for advice by the CEO on the most profitable option that he should take:Under option 1, he is contemplating borrowing in dollars on 1st January, exchange for Yen, enter into a forward contract to exchange Yen for dollars in one year, and invest the Yen for one year.The second option entails borrowing in Yen on January 1, exchange for dollars, enter into a forward contract to exchange dollars for Yen in one year, and invest the dollars for one year.Required:With the help of detailed explanations and steps, advise the CEO on the most profitable option that the company must…arrow_forwardAccounting records of Company C are expressed in EUR. On 30 April 20XX, it sells goods to a foreign company that requests the amount of the sale to be expressed in USD. No VAT to be charged. When the invoice is sent to the client for an amount of USD 1.000, the exchange rate EUR / USD is 1. On 31 May 20XX, the client paid the invoice in USD on the EUR bank account so that the amount in USD is immediately converted into EUR at the current exchange rate. The current exchange rate is 1EUR = 1,10 USD. Prepare the accounting journal entries for the sale and the repayment.arrow_forwardThe following balance sheet accounts of a foreign subsidiary at December 31, 2011, have been translated into U.S. dollars as follows: Translated at Current Rates Historical Rates Accounts receivable, current $ 600,000 $ 660,000 Accounts receivable, long-term 300,000 324,000 Inventories carried at market 180,000 198,000 Goodwill 190,000 220,000 $1,270,000 $1.402,000 What total should be included in the translated balance sheet at December 31, 2011, for the above items? Assume the U.S. dotlar is the functional currency $1,300,000 $1.288.000 10:56 EN lenovoarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education