FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Transaction

a

b

C

d

e

f

g

h

Assets

i

j

623

6,320

(4,893)

(5,300)

123,949

53,917

(118,241)

(10,069)

38,200

Balance Sheet

Liabilities

1,427

(5,000)

25,249

(118,241)

(10,069)

Stockholders'

Equity

16,231

623

(300)

177,866

(25,249)

(11,934)

Income Statement

Revenues Expenses

177,866

(38,200)

16,231

(111,934)

k

(830)

(830)

*Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted.

300

25,249

10,069

111,934

Net

Income

(300)

177,866

(25,249)

(10,069)

(111,934)

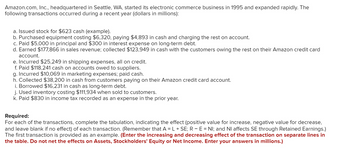

Transcribed Image Text:Amazon.com, Inc., headquartered in Seattle, WA, started its electronic commerce business in 1995 and expanded rapidly. The

following transactions occurred during a recent year (dollars in millions):

a. Issued stock for $623 cash (example).

b. Purchased equipment costing $6,320, paying $4,893 in cash and charging the rest on account.

c. Paid $5,000 in principal and $300 in interest expense on long-term debt.

d. Earned $177,866 in sales revenue; collected $123,949 in cash with the customers owing the rest on their Amazon credit card

account.

e. Incurred $25,249 in shipping expenses, all on credit.

f. Paid $118,241 cash on accounts owed to suppliers.

g. Incurred $10,069 in marketing expenses; paid cash.

h. Collected $38,200 in cash from customers paying on their Amazon credit card account.

i. Borrowed $16,231 in cash as long-term debt.

j. Used inventory costing $111,934 when sold to customers.

k. Paid $830 in income tax recorded as an expense in the prior year.

Required:

For each of the transactions, complete the tabulation, indicating the effect (positive value for increase, negative value for decrease,

and leave blank if no effect) of each transaction. (Remember that A = L + SE; R – E = NI; and NI affects SE through Retained Earnings.)

The first transaction is provided as an example. (Enter the increasing and decreasing effect of the transaction on separate lines in

the table. Do not net the effects on Assets, Stockholders' Equity or Net Income. Enter your answers in millions.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At year-end 2002, Yung.com had notes payable of $1200, accounts payable of $2400, and long- term debt of $7000. Corresponding entries for 2003 are $1600, $2000, and $2000. Asset values are below. During 2003, Yung.com had sales of $10000, cost of goods sold of $400, depreciation of $100, and interest paid of $150. The (average) tax rate is 21%, and all taxes are paid currently. The company has 100 shares of common stock outstanding with a stock price of $15 at the end of 2003. Total dividends paid is $120 in 2003. Current Asset Cash Accounts receivable Marketable securities 400 Inventory Fixed Assets 2002 Net Fixed Asset (Plant&Equipment) $800 900 1800 2003 $900 300 800 2000 $2000 $9000 In 2003, the Market-value-to-Book-value ratio is %arrow_forwardPepsiCo, Inc., the parent company of Frito-Lay snack foods and Pepsi beverages, had the following current assets and current liabilities at the end of two recent years: Current Year(in millions) Previous Year(in millions) Cash and cash equivalents $8,721 $10,610 Short-term investments, at cost 272 8,900 Accounts and notes receivable, net 7,142 7,024 Inventories 3,128 2,947 Prepaid expenses and other current assets 2,630 1,546 Accounts payable 18,112 15,017 Other short-term liabilities 4,026 5,485 a. Determine the (1) current ratio and (2) quick ratio for both years. Round answers to one decimal place. Current Year Previous Year 1. Current ratio fill in the blank 1 fill in the blank 2 2. Quick ratio fill in the blank 3 fill in the blank 4 b. The liquidity of PepsiCo has over this time period. The current ratio has and the quick ratio has .arrow_forwardnces Blooming Flower Company was started in Year 1 when it acquired $60,500 cash from the issue of common stock. The following data summarize the company's first three years' operating activities. Assume that all transactions were cash transactions. Purchases of inventory Sales Cost of goods sold Selling and administrative expenses Income Statements Required: Prepare an income statement (use multistep format) and balance sheet for each fiscal year. (Hint: Record the transaction data for each accounting period in the accounting equation before preparing the statements for that year.) Complete this question by entering your answers in the tabs below. Balance Sheets Assets Cash Merchandise inventory Prepare a balance sheet for each fiscal year. (Hint: Record the transaction data for each accounting period in the accounting equation before preparing the statements for that year.) Total assets Liabilities Stockholders' equity Common stock Retained earnings Year 1 $ 22,200 26,400 12,500…arrow_forward

- Sherwood, Inc., the parent company of Frito-Lay snack foods and Sherwood beverages, had the following current assets and current liabilities at the end of two recent years: Current Year(in millions) Previous Year(in millions) Cash and cash equivalents $3,155 $3,047 Short-term investments, at cost 2,241 5,659 Accounts and notes receivable, net 7,123 5,803 Inventories 1,445 1,926 Prepaid expenses and other current assets 481 712 Short-term obligations 385 4,089 Accounts payable 9,245 9,101 a. Determine the (1) current ratio and (2) quick ratio for both years. Round to one decimal place. Current Year Previous Year 1. Current ratio 2. Quick ratioarrow_forward10. The Hopewell Pharmaceutical Company's balance sheet and income statement for last year are as follows: CHALLENGE Balance Sheet (in Millions of Dollars) Assets Liabilities and Equity Cash and marketable $1,100 Accounts payable*** $900 securities Accounts receivable* 1,300 Accrued liabilities Inventories** 800 (salaries and benefits) 300 Other current assets 200 Other current liabilities 700 Total current assets $3,400 Total current liabilities $1,900 Plant and equipment (net) 2,300 Long-term debt and other Other assets 1,000 liabilities 1,000 Total assets $6,700 Common stock 1,800 Retained eamings 2,000 Total stockholders" equity $3,800 Total liabilities and equity $6,700 *Assume that average accounts receivable are the same as ending accounts receivable. **Assume that average inventory over the year was the same as ending inventory. ***Assume that average accounts payable are the same as ending accounts payable. Income Statement (in Millions of Dollars) Net sales $6,500 Cost of…arrow_forwardChandler Sporting Goods produces baseball and football equipment and lines of clothing. This year the company had cash and marketable securities worth $335,485, accounts payables worth $1,159,357, inventory of $1,651,599, accounts receivables of $1,488,121, short-term notes payable worth $313,663, and other current assets of $121,427. What is the company's net working capital? $3,596,632 $1,801,784 $2,123,612 $1,673,421arrow_forward

- ASSETS Current assets: Cash MANGO INC.. CONSOLIDATED BALANCE SHEET September 30, 2017 (dollars in millions) Short-term investments Accounts receivable Inventories Other current assets Total current assets Long-term investments Property, plant, and equipment, net Other noncurrent assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable Accrued expenses Unearned revenue. Short-term notes payable Total current liabilities Long-term debt Other noncurrent liabilities Total liabilities. Stockholders' equity: Common stock ($0.00001 per value) Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and shareholders' equity Assume that the following transactions fin $ 14,024 11,377 17,681 2,134 24,141 69,357 131,732 20,873 12,676 $234,638 $ 30,563 18,679 8,599 6,385 64,226 29,344 28,196 121,766 1 25,212 87,659 112,872 $234,638arrow_forwardHello, I need help pleasearrow_forwardNordstrom, Inc. operates department stores in numerous states. Selected hypothetical financial statement data (in millions) for 2022 are presented below. End of Year Beginning of Year Cash and cash equivalents $ 1,441 $137 Accounts receivable (net) 3,900 3,700 Inventory 1,700 1,700 Other current assets 619 576 Total current assets $7,660 $6,113 Total current liabilities $3,830 $3,042 For the year, net credit sales were $15,580 million, cost of goods sold was $10,200 million, and net cash provided by operating activities was $1,273 million. Compute the current ratio, accounts receivable turnover, average collection period, inventory turnover, and days in inventory for the current year. (Round Current ratio to 2 decimal places, e.g. 1.62 and all other answers to 1 decimal place, e.g. 1.6.) Current ratio Accounts receivable turnover Average collection period Inventory turnover Days in inventory :1 times days times daysarrow_forward

- Sherwood, Inc., had the following current assets and current liabilities at the end of two recent years: Year 2(in millions) Year 1(in millions) Cash and cash equivalents $4,165 $4,528 Short-term investments, at cost 2,958 8,408 Accounts and notes receivable, net 9,404 8,624 Inventories 1,771 787 Prepaid expenses and other current assets 590 291 Short-term obligations (liabilities) 315 3,342 Accounts payable and other current liabilities 7,453 6,813 a. Determine the (1) current ratio and (2) quick ratio for both years. Round to one decimal place. Year 2 Year 1 Current ratio fill in the blank 1 fill in the blank 2 Quick ratio fill in the blank 3 fill in the blank 4arrow_forwardAssume that the following transactions (in millions) occurred during the next fiscal year (ending on September 26, 2020): Borrowed $18,279 from banks due in two years. Purchased additional investments for $22,200 cash; one-fifth were long term and the rest were short term. Purchased property, plant, and equipment; paid $9,584 in cash and signed a short-term note for $1,422. Issued additional shares of common stock for $1,481 in cash; total par value was $1 and the rest was in excess of par value. Sold short-term investments costing $19,021 for $19,021 cash. Declared $11,138 in dividends to be paid at the beginning of the next fiscal year. Prepare a classified balance sheet for Orange at September 26, 2020, based on these transactions. please complete this with working and show how did you get the number with other work answer in text thanksarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education