FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Transcribed Image Text:4

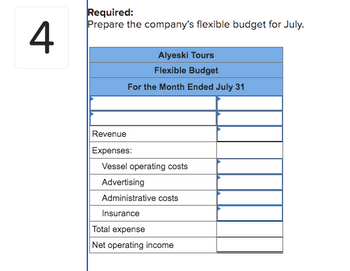

Required:

Prepare the company's flexible budget for July.

Alyeski Tours

Flexible Budget

For the Month Ended July 31

Revenue

Expenses:

Vessel operating costs

Advertising

Administrative costs

Insurance

Total expense

Net operating income

Transcribed Image Text:4

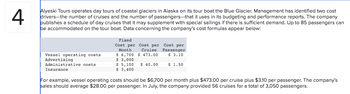

Alyeski Tours operates day tours of coastal glaciers in Alaska on its tour boat the Blue Glacier. Management has identified two cost

drivers-the number of cruises and the number of passengers-that it uses in its budgeting and performance reports. The company

publishes a schedule of day cruises that it may supplement with special sailings if there is sufficient demand. Up to 85 passengers can

be accommodated on the tour boat. Data concerning the company's cost formulas appear below:

Vessel operating costs.

Advertising

Administrative costs

Insurance

Fixed

Cost per Cost per

Month Cruise

$ 6,700 $ 473.00

$3,000

$ 5,100

$ 3,400

$ 40.00

Cost per

Passenger

$ 3.10

$ 1.50

For example, vessel operating costs should be $6,700 per month plus $473.00 per cruise plus $3.10 per passenger. The company's

sales should average $28.00 per passenger. In July, the company provided 56 cruises for a total of 3,050 passengers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Theater Arts Guild of Dallas (TAG-D) employs 5 people in its Publication Department. These people lay out pages for pamphlets, brochures, magazines, and other publications for the TAG-D productions. The pages are delivered to an outside company for printing. The company is considering an outside publication service for the layout work. The outside service is quoting a price of $21 per layout page. The budget for the Publication Department for the current year is as follows: Salaries $332,600 Benefits 75,600 Supplies 40,300 Office expenses 50,400 Office depreciation 45,400 Computer depreciation 30,200 Total $574,500 The department expects to lay out 24,000 pages for the current year. The Publication Department office space and equipment would be used for future administrative needs, if the department's function were purchased from the outside. a. Prepare a differential analysis dated February 22 to determine whether TAG-D should Lay Out Pages Internally…arrow_forwardDazzle Party is a small business that produces decorative balloons for events. Dazzle Party uses normal costing and assigns manufacturing overhead (MOH) costs using labour hours as the allocation base. Budgeted and actual production data for the year 2023 is provided below. Budget $60,000 120,000 Actual $52,000 MOH costs Labour-hours 110,000 Required: Calculate the difference between the allocated MOH cost and the actual MOH cost incurred in 2023. Clearly state whether this difference represents a case of under-allocation or over-allocation of MOH.arrow_forwardChocolate Bars, Inc. (CBI), manufactures creamy deluxe chocolate candy bars. The firm has developed three distinct products: Almond Dream, Krispy Krackle, and Creamy Crunch. CBI is profitable, but management is quite concerned about the profitability of each product and the product costing methods currently employed. In particular, management questions whether the overhead allocation base of direct labor-hours accurately reflects the costs incurred during the production process of each product. In reviewing cost reports with the marketing manager, Steve Hoffman, who is the cost accountant, notices that Creamy Crunch appears exceptionally profitable and that Almond Dream appears to be produced at a loss. This surprises both him and the manager, and after much discussion, they are convinced that the cost accounting system is at fault and that Almond Dream is performing very well at the current market price. Steve decides to hire Jean Sharpe, a management consultant, to study the…arrow_forward

- Sterling Hotel uses activity-based costing to determine the cost of servicing customers. There are three activity pools: guest check-in, room cleaning, and meal service. The activity rates associated with each activity pool are $8.10 per guest check-in, $24.00 per room cleaning, and $4.00 per served meal (not including food). Tara Stone visited the hotel for a 4-night stay. Tara had 5 meals in the hotel during the visit. Determine the total activity-based cost for Stone's visit during the month. Round your answer to the nearest cent.$fill in the blank 1arrow_forwardThermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has designed an activity-based costing system with the following activity cost pools and activity rates: Activity Coat Pool Supporting direct labor Order processing Custom design processing Customer service Management would like an analysis of the profitability of a particular customer, Big Sky Outfitters, which has ordered the following products over the last 12 months: Number of gliders Number of orders Number of custom designs Direct labor-houra per glider Activity Rate $ 20 per direct labor-hour $ 198 per order $267 per custom design $ 420 per customer Selling price per glider Direct materials cost per glider The company's direct labor rate is $20 per hour. Customer margin Standard Model 14 2 0 27.50 $1,875 $ 472 Custom Design 2 2 2 34.00 $ 2,490 $586 Required: Using the company's…arrow_forwardThermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has designed an activity-based costing system with the following activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Order processing Custom design processing Customer service Management would like an analysis of the profitability of a particular customer, Big Sky Outfitters, which has ordered the following products over the last 12 months: Number of gliders Number of orders Number of custom designs Direct labor-hours per glider Activity Rate $18 per direct labor-hour $ 192 per order $ 256 per custom design $432 per customer Selling price per glider Direct materials cost per glider The company's direct labor rate is $22 per hour. Customer margin Standard Model 12 2 0 28.50 $ 1,800 $456 Custom Design 3 3 3 32.00 $ 2,480 $ 576 Required: Using the company's…arrow_forward

- Alyeski Tours operates day tours of coastal glaciers in Alaska on its tour boat the Blue Glacier. Management has identified two cost drivers-the number of cruises and the number of passengers-that it uses in its budgeting and performance reports. The company publishes a schedule of day cruises that it may supplement with special sailings if there is sufficient demand. Up to 88 passengers can be accommodated on the tour boat. Data concerning the company's cost formulas appear below: Vessel operating costs Advertising Administrative costs Insurance Fixed Cost per Cost per Month $ 6,400 Cruise $ 479.00 Cost per Passenger $ 3.40 $ 2,900 $ 5,700 $ 3,800 $ 38.00 $ 1.50 For example, vessel operating costs should be $6,400 per month plus $479.00 per cruise plus $3.40 per passenger. The company's sales should average $32.00 per passenger. In July, the company provided 50 cruises for a total of 3,150 passengers. Required: Prepare the company's flexible budget for July. Alyeski Tours Flexible…arrow_forwardMilano Pizza is a small neighborhood pizzeria that has a small area for in-store dining as well as offering take-out and free home delivery services. The pizzeria's owner has determined that the shop has two major cost drivers-the number of pizzas sold and the number of deliveries made. The pizzeria's cost formulas appear below: Fixed Cost per Month Pizza ingredients Kitchen staff Utilities Delivery person Delivery vehicle Equipment depreciation Rent Miscellaneous Pizzas Deliveries Revenue Pizza ingredients Kitchen staff Utilities Delivery person Delivery vehicle Equipment depreciation Rent $ 5,910 $ 610 Miscellaneous $ 630 $ 400 $ 1,870 $ 730 In November, the pizzeria budgeted for 1,560 pizzas at an average selling price of $15 per pizza and for 220 deliveries. Data concerning the pizzeria's actual results in November appear below: Actual Results. 1,660 200 $ 25,450 $ 7,210 $ 5,850 $ 885 $ 620 $ 986 $ 400 Cost per Pizza $ 4.40 $ 1,870 $ 790 $ 0.30 Cost per Delivery $ 0.15 $ 3.10 $…arrow_forwardCathy, the manager of Cathy’s Catering, Inc., uses activity-based costing to compute the costs of her catered parties. Each party is limited to 20 guests and requires 5 people to serve and clean up. Cathy offers two types of parties—an afternoon picnic and an evening formal dinner. The breakdown of the costs follows. Activities (and cost drivers) Afternoon Picnic Formal Dinner Advertising (parties) $ 81 per party $ 81 per party Planning (parties) $ 54 per party $ 124 per party Renting equipment (parties, guests) $ 49 per party plus $12 per guest $ 71 per party plus $23 per guest Obtaining insurance (parties) $ 220 per party $ 355 per party Serving (parties, servers) $ 58 per server per party $ 70 per server per party Preparing food (guests) $ 18 per guest $ 31 per guest Per party costs do not vary with the number of guests. Required: a. Compute the cost of a 20-guest afternoon picnic. b. Compute the cost of a 20-guest evening formal dinner. c. How much…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education