Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

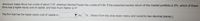

Transcribed Image Text:Aluminum maker Alcoa has a beta of about 1.07, whereas Hormel Foods has a beta of 0.84. If the expected excess return of the market portfolio is 5%, which of these

firms has a higher equity cost of capital, and how much higher is it?

The firm that has the higher equity cost of capital is

%. (Select from the drop-down menu and round to two decimal places.)

by

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Kaiser Aluminum has a beta of 0.70. If the risk-free rate (Res) is 5.0%, and the market risk premium (RPM) is 7.4%, what is the firm's cost of equity from retained earnings based on the CAPM? Your answer should be between 8.70 and 11.25, rounded to 2 decimal places, with no special characters.arrow_forwardA manager believes his firm will earn a return of 12.50 percent next year. His firm has a beta of 1.40, the expected return on the market is 10.50 percent, and the risk-free rate is 3.50 percent. Compute the return the firm should earn given its level of risk. (Round your answer to 2 decimal places.) Required return % Determine whether the manager is saying the firm is undervalued or overvalued. O overvalued O undervaluedarrow_forwardThe Swanson Corporation's common stock has a beta of 1.8. If the risk-free rate is 4.9 percent and the expected return on the market is 11 percent, what is the company's cost of equity capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Cost of equity capital %arrow_forward

- The Up and Coming Corporation's common stock has a beta of 1.29. If the risk-free rate is 0.04 and the expected return on the market is 0.08, what is the company's cost of equity capital? Enter the answer with 4 decimals (e.g. 0.1234).arrow_forwardPlease complete in Excel (and show work)arrow_forwardHR Corporation has a beta of 2.0, while LR Corporation's beta is 0.5. The risk-free rate is 10 percent, and the required rate of return on an average stock is 15 percent. Now the risk-free rate falls by 3 percentage points, the required return on the market falls to 11 percent, and the betas remain constant. When all of these changes are made, what will be the difference in the required returns on HR's and LR's stocks?arrow_forward

- What is the beta for Ford Motors Corporation? Briefly interpret what the number means. What is the unit of it? Percentage? Dollar? For instance, if you find it to be 0.8, is it 0.8%, 80%, $0.8, or something else? What do we compare it to, to determine the riskiness of Ford Motors Company's stocks?arrow_forwardWhat is the market return if the company's cost of equity is 11.68% and the company has a beta coefficient of 1.8. The expected risk free return is 5.25%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education