Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

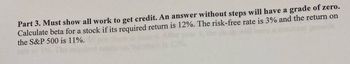

Transcribed Image Text:Part 3. Must show all work to get credit. An answer without steps will have a grade of zero.

Calculate beta for a stock if its required return is 12%. The risk-free rate is 3% and the return on

the S&P 500 is 11%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Please answer multi-choice question in photo.arrow_forwardJaiLai Cos. stock has a beta of 0.9, the current risk-free rate is 5.5 percent, and the expected return on the market is 10 percent. What is JaiLai's cost of equity? (Round your answer to 2 decimal places.) Cost of equity % ces MacBook Airarrow_forwardIntro Amazon has a beta of 0.8. The risk-free rate is 2.9% and the expected return on the S&P500 is 4%. Part 1 What is Amazon's cost of equity? 4+ decimals Submit Part 2 Now assume that the expected market risk premium is 4%. What is Amazon's cost of equity? 3+ decimals Submitarrow_forward

- Suppose the market risk premium is 5% and the risk-free interest rate is 5%. Using the data in the table here, a. Starbucks's stock. b. Hormel's stock. c. Avis Budget Group's stock. Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Hormel 0.16 Avis Budget Group 2.55 Beta Starbucks 1.05 X " calculate the expected return of investing inarrow_forwardZacher Co.'s stock has a beta of 1.28, the risk-free rate is 4.25%, and the market risk premium is 5.50%. What is the firm's required rate of return? Select the correct answer. a. 10.09% b. 10.49% c. 11.29% d. 10.89% e. 11.69%arrow_forwardThe risk-free rate of return is 3 percent, and the expected return on the market is 7 percent. Stock A has a beta coefficient of 1.3, an earnings and dividend growth rate of 5 percent, and a current dividend of $2.10 a share. Do not round intermediate calculations. Round your answers to the nearest cent. What should be the market price of the stock? $ If the current market price of the stock is $91.00, what should you do? The stock -Select-shouldshould notItem 2 be purchased. If the expected return on the market rises to 13.1 percent and the other variables remain constant, what will be the value of the stock? $ If the risk-free return rises to 4.5 percent and the return on the market rises to 13.9 percent, what will be the value of the stock? $ If the beta coefficient falls to 1.2 and the other variables remain constant, what will be the value of the stock? $ Explain why the stock’s value changes in c through e. The increase in…arrow_forward

- JaiLai Cos. stock has a beta of 0.8, the current risk-free rate is 6.6 percent, and the expected return in the market is 10 percent. What is JaiLai's cost of equity/arrow_forwardAssume that if M launches a new e-trading platform, its price will go up to $261. Else, M price will go down to $62. You are aware that M shares are being traded at $162. You also know that the risk-free rate is 5%.What is the probability that M price will go down?***Please round your answer to the nearest three decimals (i.e. 0.512)arrow_forwardCAN I GET HELP as soon as possible please Explain your answer for each of them. Show all your work. The required return on ABC stock is 14%. The risk-free rate of return is 4% and the real rate of return is 2%. How much are investors requiring as compensation for risk? A) 8% B) 10% C) 12% D) 14% The efficient market hypothesis suggests thatA) investors should not try to outguess the market by constantly buying and selling securities. B) investors do better on average if they adopt a "buy and hold" strategy.C) buying into a mutual fund is a sensible strategy for a small investor.D) all of the above are sensible strategies.E) only A and B of the above are sensible strategies.arrow_forward

- Please complete in Excel (and show work)arrow_forwarda. Compute the expected rate of return for Intel common stock, which has a 1.5 beta. The risk-free rate is 4 percent and the market portfolio (composed of New York Stock Exchange stocks) has an expected return of 14 percent. b. Why is the rate you computed the expected rate?arrow_forwardDiddy Corp. stock has a beta of 1.3, the current risk-free rate is 7 percent, and the expected return on the market is 12.50 percent. What is Diddy's cost of equity? (Round your answer to 2 decimal places.) Cost of equity esarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education