Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

I just need the table filled

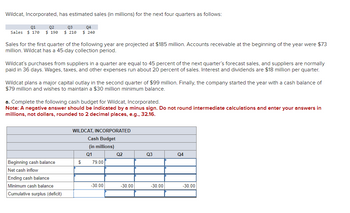

Transcribed Image Text:Wildcat, Incorporated, has estimated sales (in millions) for the next four quarters as follows:

Q1

Q2

Q3

Sales $ 170 $ 190 $210

Q4

$ 240

Sales for the first quarter of the following year are projected at $185 million. Accounts receivable at the beginning of the year were $73

million. Wildcat has a 45-day collection period.

Wildcat's purchases from suppliers in a quarter are equal to 45 percent of the next quarter's forecast sales, and suppliers are normally

paid in 36 days. Wages, taxes, and other expenses run about 20 percent of sales. Interest and dividends are $18 million per quarter.

Wildcat plans a major capital outlay in the second quarter of $99 million. Finally, the company started the year with a cash balance of

$79 million and wishes to maintain a $30 million minimum balance.

a. Complete the following cash budget for Wildcat, Incorporated.

Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in

millions, not dollars, rounded to 2 decimal places, e.g., 32.16.

WILDCAT, INCORPORATED

Cash Budget

(in millions)

Q1

Q2

Q3

Q4

Beginning cash balance

$

79.00

Net cash inflow

Ending cash balance

Minimum cash balance

-30.00

-30.00

-30.00

-30.00

Cumulative surplus (deficit)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Halifax Shoes has 30% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $75,000 in June, $65,000 in July, and $90,000 in August?arrow_forwardRanger Industries has provided the following information at June 30: Other information: Average selling price, 196 Average purchase price per unit, 110 Desired ending inventory, 40% of next months unit sales Collections from customers: In month of sale20% In month after sale50% Two months after sale30% Projected cash payments: Inventory purchases are paid for in the month following acquisition. Variable cash expenses, other than inventory, are equal to 25% of each months sales and are paid in the month of sale. Fixed cash expenses are 40,000 per month and are paid in the month incurred. Depreciation on equipment is 2,000 per month. REQUIREMENT You have been asked to prepare a master budget for the upcoming quarter (July, August, and September). The components of this budget are a monthly sales budget, a monthly purchases budget, a monthly cash budget, a forecasted income statement for the quarter, and a forecasted September 30 balance sheet. The worksheet MASTER has been provided to assist you. Ranger Industries desires to maintain a minimum cash balance of 8,000 at the end of each month. If this goal cannot be met, the company borrows the exact amount needed to reach its goal. If the company has a cash balance greater than 8,000 and also has loans payable outstanding, the amount in excess of 8,000 is paid to the bank. Annual interest of 18% is paid on a monthly basis on the outstanding balance.arrow_forwardWildcat, Inc., has estimated sales (in millions) for the next four quarters as follows: Q1 Q2 Q3 Q4 Sales $ 180 $ 200 $ 220 $ 250 Sales for the first quarter of the following year are projected at $195 million. Accounts receivable at the beginning of the year were $77 million. Wildcat has a 45-day collection period. Wildcat’s purchases from suppliers in a quarter are equal to 50 percent of the next quarter’s forecast sales, and suppliers are normally paid in 36 days. Wages, taxes, and other expenses run about 25 percent of sales. Interest and dividends are $10 million per quarter. Wildcat plans a major capital outlay in the second quarter of $85 million. Finally, the company started the year with a $81 million cash balance and wishes to maintain a $40 million minimum balance. b-1. Complete the following short-term financial plan assuming that Wildcat maintains a minimum cash balance of $20 million.…arrow_forward

- Wildcat, Incorporated, has estimated sales (in millions) for the next four quarters as follows: Q1 Q2 Q3 Sales $ 125 $ 145 $ 165 Q4 $ 195 Sales for the first quarter of the following year are projected at $140 million. Accounts receivable at the beginning of the year were $55 million. Wildcat has a 45-day collection period. Wildcat's purchases from suppliers in a quarter are equal to 45 percent of the next quarter's forecast sales, and suppliers are normally paid in 36 days. Wages, taxes, and other expenses run about 20 percent of sales. Interest and dividends are $10 million per quarter. Wildcat plans a major capital outlay in the second quarter of $81 million. Finally, the company started the year with a cash balance of $70 million and wishes to maintain a $30 million minimum balance. a. Complete the following cash budget for Wildcat, Incorporated. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in millions,…arrow_forwardWildcat, Inc., has estimated sales (in millions) for the next four quarters as follows: Q1 Q2 Q3 Q4 Sales $170 $185 $200 $225 Sales for the first quarter of the following year are projected at $180 million. Accounts receivable at the beginning of the year were $71 million. Wildcat has a 45-day collection period. Wildcat's purchases from suppliers in a quarter are equal to 45 percent of the next quarter's forecast sales, and suppliers are normally paid in 36 days. Wages, taxes, and other expenses run about 25 percent of sales. Interest and dividends are $14 million per quarter. Wildcat plans a major capital outlay in the second quarter of $85 million. Finally, the company started the year with a $54 million cash balance and wishes to maintain a $30 million minimum balance. a. Complete the following cash budget for Wildcat, Inc. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in millions, not dollars, rounded to 2…arrow_forwardWildcat, Incorporated, has estimated sales (in millions) for the next four quarters as follows: Q1 Q2 Q3 Q4 Sales $ 140 $ 160 $ 180 $ 210 Sales for the first quarter of the following year are projected at $155 million. Accounts receivable at the beginning of the year were $61 million. Wildcat has a 45-day collection period. Wildcat’s purchases from suppliers in a quarter are equal to 45 percent of the next quarter’s forecast sales, and suppliers are normally paid in 36 days. Wages, taxes, and other expenses run about 25 percent of sales. Interest and dividends are $10 million per quarter. Wildcat plans a major capital outlay in the second quarter of $76 million. Finally, the company started the year with a $73 million cash balance and wishes to maintain a $40 million minimum balance. a-1. Assume that Wildcat can borrow any needed funds on a short-term basis at a rate of 3 percent per quarter and can invest any excess funds in…arrow_forward

- Wildcat, Incorporated, has estimated sales (in millions) for the next four quarters as follows: Q1 Q2 Q3 Q4 Sales $ 180 $ 200 $ 220 $ 250 Sales for the first quarter of the year after this one are projected at $195 million. Accounts receivable at the beginning of the year were $77 million. Wildcat has a 45-day collection period. Wildcat’s purchases from suppliers in a quarter are equal to 50 percent of the next quarter’s forecast sales, and suppliers are normally paid in 36 days. Wages, taxes, and other expenses run about 25 percent of sales. Interest and dividends are $10 million per quarter. Wildcat plans a major capital outlay in the second quarter of $85 million. Finally, the company started the year with a cash balance of $81 million and wishes to maintain a minimum balance of $40 million. a-1. Assume that Wildcat can borrow any needed funds on a short-term basis at a rate of 3 percent per quarter and can invest any excess…arrow_forwardWildcat, Incorporated, has estimated sales (in millions) for the next four quarters as follows: Q1 Q2 Q3 Q4 Sales $ 105 $ 125 $ 145 $ 175 Sales for the first quarter of the following year are projected at $120 million. Accounts receivable at the beginning of the year were $47 million. Wildcat has a 45-day collection period. Wildcat’s purchases from suppliers in a quarter are equal to 45 percent of the next quarter’s forecast sales, and suppliers are normally paid in 36 days. Wages, taxes, and other expenses run about 20 percent of sales. Interest and dividends are $11 million per quarter. Wildcat plans a major capital outlay in the second quarter of $60 million. Finally, the company started the year with a cash balance of $66 million and wishes to maintain a $30 million minimum balance. a. Complete the following cash budget for Wildcat, Incorporated. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers…arrow_forwardWildcat, Incorporated, has estimated sales (in millions) for the next four quarters as follows: Q1 Q2 Q3 Q4 Sales $ 110 $ 130 $ 150 $ 180 Sales for the first quarter of the following year are projected at $125 million. Accounts receivable at the beginning of the year were $49 million. Wildcat has a 45-day collection period. Wildcat's purchases from suppliers in a quarter are equal to 40 percent of the next quarter's forecast sales, and suppliers are normally paid in 36 days. Wages, taxes, and other expenses run about 20 percent of sales. Interest and dividends are $11 million per quarter. Wildcat plans a major capital outlay in the second quarter of $78 million. Finally, the company started the year with a cash balance of $67 million and wishes to maintain a $30 million minimum balance. a. Complete the following cash budget for Wildcat, Incorporated. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in millions, not…arrow_forward

- Wildcat, Incorporated, has estimated sales (in millions) for the next four quarters as follows: Q1 Q2 Q3 Q4 Sales $170 $185 $200 $225 Sales for the first quarter of the year after this one are projected at $180 million. Accounts receivable at the beginning of the year were $71 million. Wildcat has a 45-day collection period. Wildcat's purchases from suppliers in a quarter are equal to 45 percent of the next quarter's forecast sales, and suppliers are normally paid in 36 days. Wages, taxes, and other expenses run about 25 percent of sales. Interest and dividends are $14 million per quarter. Wildcat plans a major capital outlay in the second quarter of $85 million. Finally, the company started the year with a $54 million cash balance and wishes to maintain a $30 million minimum balance. Assume that Wildcat can borrow any needed funds on a short-term basis at a rate of 3 percent per quarter and can Invest any excess funds in short-term marketable securities at a rate of 2 percent per…arrow_forwardWildcat, Inc., has estimated sales (in millions) for the next four quarters as follows: Q1 Q2 Q3 Q4 Sales $155 $175 $195 $225 Sales for the first quarter of the year after this one are projected at $170 million. Accounts receivable at the beginning of the year were $67 million. Wildcat has a 45-day collection period. Wildcat's purchases from suppliers in a quarter are equal to 45 percent of the next quarter's forecast sales, and suppliers are normally paid in 36 days. Wages, taxes, and other expenses run about 20 percent of sales. Interest and dividends are $15 million per quarter. Wildcat plans a major capital outlay in the second quarter of $93 million. Finally, the company started the year with a cash balance of $76 million and wishes to maintain a $30 million minimum balance. a. Complete the following cash budget for Wildcat, Inc. (Enter your answers in millions. Negative amounts should be indicated by a minus sign. Do not round intermediate calculations and round your final…arrow_forwarda-2. What is the net cash cost for the year under this target cash balance? (Negative amount should be indicated by a minus sign. Enter your answer in millions. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Net cash cost b-1. Complete the following short-term financial plan assuming that Wildcat maintains a minimum cash balance of $20 million. (Enter your answers in millions. Negative amounts should be indicated by a minus sign. Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Short-Term Financial Plan WILDCAT, INC (in millions) Q1 Q3 Q4 $20.00 $ 20.00 $20.00 $20.00 Target cash balance Net cash inflow New short-term investments Income on short-term investments Short-term investments sold New short-term borrowing Interest on short-term borrowing Short-term borrowing repaid Ending cash balance Minimum cash balance Cumulative…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning