Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

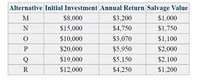

Consider the 6 divisible investment alternatives shown below. The planning horizon is 8 years. The MARR is 15%. $60,000 is available for investment. Solve, a. What proportion of each investment is to be included in the optimum investment portfolio? b. Solve part a when full or partial investment cannot be made in more than 3 of the investments. c. Solve part a when investments P and R are mutually exclusive.

Transcribed Image Text:Alternative Initial Investment Annual Return Salvage Value

M

$8,000

$3,200

$1,000

$15,000

$4,750

$1,750

$10,000

$3,070

$1,100

P

$20,000

$5,950

$2,000

Q

$19,000

$5,150

$2,100

R

$12,000

$4,250

$1,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (Use Calulator or Formula Approach) You are offered an investment that will pay you $200 in one year, $400 the next year, $600 the next year and $800 at the end of the fourth year. You can earn 12 percent on very similar investments. What is the most you should pay for this one?arrow_forwardConsider the three small mutually exclusive investment alternatives in the table below. The feasible alternative chosen must provide service for a 10-year period. The MARR is 12% per year, and the market value of each is 0 at the end of useful life. State all assumptions (repeatablity/co-terminated at 5 year study period) you make in your analysis. Which alternative should be chosen? A B Capital Investment PhP 2,000 PhP 8,000 PhP 20,000 Use IRR (FW equation) analysis. Annual revenues less expenses 600 2,200 3,600 Useful life (years) 5 5 10 ANSWER: IRRA = 15.24% ; IRRB = 11.65% ; IRRC = Blank 3% ; Choose alternative Blank 4 %3D %3D Do not use comma and any unit of measure. Use two decimal places in the Final answer.arrow_forwardYou’re trying to choose between two different investments, both of which have upfront costs of K75,000. Investment G returns K135,000 in six years. Investment H returns K195,000 in 10 years. Which of these investments has the higher return?arrow_forward

- An investment offers the following: a series of $1000 annual payments, starting one year from now, for a total of 12 payments. If your opportunity cost (as an EAR) is 5%, what is the investment worth to you today? Group of answer choices $11,079.20 $9,214.56 $10,103.26 $8,863.25 $10,241.19 Give typing answer with explanation and conclusionarrow_forwardAn investment advisor has recommended a R50,000 portfolio containing assets R, J, and K; R25,000 will be invested in asset R, with an expected annual return of 12 percent; R10,000 will be invested in asset J, with an expected annual return of 18 percent; and R15,000 will be invested in asset K, with an expected annual return of 8 percent. What is the expected annual return of this portfolio? What is the correct answer? A. 12.01% B. 12.00% C. 11.98% D. 12.93%arrow_forwardAssume you invest $5,100 today in an investment that promises to return $6,928 in exactly 10 years. a. Use the present-value technique to estimate the IRR on this investment. b. If a minimum annual return of 9% is required, would you recommend this investment? #69 Part 1 a. The IRR of the investment is enter your response here%. (Round to the nearest whole percent.) Part 2 b. If a minimum return of 9% is required, would you recommend this investment? (Select the best choice below.) A. No, because this investment yields less than the minimum required return of 9%. B. Yes, because a minimum required return of 9% does not compensate for an investment that lasts longer than one year. C. No, because a minimum required return of 9% is an arbitrary choice for an investment of this risk level. D. Yes, because this investment yields more than the minimum required return of 9%arrow_forward

- Compare alternatives A and B with the present worth method if the MARR is 14% per year. Which one would you recommend? Assume repeatability and a study period of 16 years. Capital Investment Operating Costs The PW of Alternative A is $ - 108236. (Round to the nearest dollar.) The PW of Alternative B is $ -95429. (Round to the nearest dollar.) Alternative B should be selected. A $55,000 $6,000 at end of year 1 and increasing by $600 per year thereafter $6,000 every 4 years 16 years $12,000 if just overhauled Overhaul Costs Life Salvage Value Click the icon to view the interest and annuity table for discrete compounding when the MARR is 14% per year. B $15,000 $12,000 at end of year 1 and increasing by $1,200 per year thereafter None 8 years negligible Darrow_forwardAn investment will pay $150 at the end of each of the next 3 years, $200 at the end of Year 4, $400 at the end of Year 5, and $500 at the end of Year 6. If other investments of equal risk earn 4% annually, what is its present value? Its future value? Do not round intermediate calculations. Round your answers to the nearest cent. Present value: $ Future value: $arrow_forwardAn investment will pay $21,600 at the end of the first year, $31,600 at the end of the second year, and $51,600 at the end of the third year. (FV of $1. PV of $1. EVA of $1, and PVA of $1) Note: Use the appropriate factor(s) from the tables provided. Required: Determine the present value of this investment using a 9 percent annual interest rate. Note: Round your intermediate calculations and final answer to nearest whole dollar. Present value of investmentarrow_forward

- 4. You have to select only one of the following projects (ie. They are mutually exclusive.) Project #1 is 4 years long and has an NPV of $140,000. Project #2 is 6 years long and has an NPV of $180,000. The required rate of return is 10%. Which project should you take using the EAA approach?arrow_forwardTrestle Corporation wants to purchase a new finishing machine. They currently have an old machine, which is operable for five more years and is expected to have a zero-disposal value at the end of five years. If the company buys the new machine, the old machine will be sold now for $95,000 (book value is $75,000). The new machine will cost $635,000 and will be depreciated for tax purposes on a straight-line basis over its useful life of 5 years. The new machine will not have a salvage value and will not be sold after its useful life. An additional cash investment in working capital of $25,000 will be required if the new machine is purchased. The investment is expected to net $80,000 in before tax cash inflows during the first year of operation and $235,000 each additional year of use. These cash flows do not include depreciation and are recognized at the end of each year. The working capital investment will not be recovered at the end of the asset's life. The company's tax rate is 32%.arrow_forwardYou are offered an investment with returns of $ 2,213 in year 1, $ 4,670 in year 2, and $ 3,184 in year 3. The investment will cost you $ 6,506 today. If the appropriate Cost of Capital is 7.6 %, what is the Net present Value of the investment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education