Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

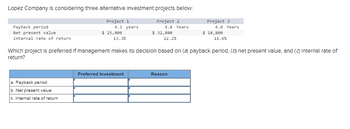

Transcribed Image Text:Lopez Company is considering three alternative Investment projects below:

Project 2

4.8 Years

Project 1

4.3 years

$ 25,800

13.3%

Payback period

Net present value.

Internal rate of return

a. Payback period

b. Net present value

c. Internal rate of return

$ 32,800

Preferred Investment

12.2%

Project 3

4.0 Years

Which project is preferred if management makes its decision based on (a) payback period, (b) net present value, and (c) Internal rate of

return?

Reason

$ 18,800

11.6%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (Payback period, net present value, profitability index, and internal rate of return calculations) You are considering a project with an initial cash outlay of $72,000 and expected cash flows of $20,880 at the end of each year for six years. The discount rate for this project is 10.8 percent. a. What are the project's payback and discounted payback periods? b. What is the project's NPV? c. What is the project's PI? d. What is the project's IRR? a. The payback period of the project is years. (Round to two decimal places.)arrow_forwardConsider the two mutually exclusive projects described in the table below. the question requires a step by step excel solutionFor any positive value of the MARR, divide the possible MARR values into ranges with different decisions;describe and discuss what decision would be made in each range and why. You will need to calculate the crossover rate to determine the precise MARR where the decision changes. Include an NPV profile table and chart to illustrate your answer.Year Cash Flow Project A Cash Flow Project B0 -450,000 -700,0001 200,000 200,0002 150,000 200,0003 100,000 200,0004 100,000 200,0005 75,000 200,000arrow_forwardSuppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 14 percent, and that the maximum allowable payback and discounted payback statistic for the project are 2 and 3 years, respectively. Time 0 1 2 3 4 5 6 Cash Flow −1,010 110 490 690 690 290 690 Use the payback decision rule to evaluate this project; should it be accepted or rejected? Multiple Choice 4.00 years, reject 0 years, accept 2.59 years, reject 1.16 years, acceptarrow_forward

- Lopez Industries has identified the following two mutually exclusive capital investment projects: Year Project A Project B 0 -16000 -15500 1 400 12500 2 800 8000 3 13000 800 4 14000 800 If the required return is 11%, what is the NPV for each of these projects? Which project should the firm accept if they apply the NPV rule?arrow_forwardZiege Systems is considering the following independent projects for the coming year: Project RequiredInvestment Rate ofReturn Risk A $4 million 14.75% High B 5 million 12.25 High C 3 million 10.25 Low D 2 million 9.5 Average E 6 million 13.25 High F 5 million 13.25 Average G 6 million 7.5 Low H 3 million 11.75 Low Ziege's WACC is 10.75%, but it adjusts for risk by adding 2% to the WACC for high-risk projects and subtracting 2% for low-risk projects. Which projects should Ziege accept if it faces no capital constraints? Project A -Select-AcceptRejectItem 1 Project B -Select-AcceptRejectItem 2 Project C -Select-AcceptRejectItem 3 Project D -Select-AcceptRejectItem 4 Project E -Select-AcceptRejectItem 5 Project F -Select-AcceptRejectItem 6 Project G -Select-AcceptRejectItem 7 Project H -Select-AcceptRejectItem 8 If Ziege can only invest a total of $13 million, which projects should it accept? Project A -Select-AcceptRejectItem 9 Project B…arrow_forwardWhat is Correct optionarrow_forward

- Compute the MIRR statistic for the following project and indicate whether the firm should accept or reject this project if the appropriate cost of capital is 8.5%. Project cash flows Time 0 1 2 3 4 5 Cash flow -4800 3000 2200 1600 -500 -1000arrow_forwardhow would i solve this problemarrow_forwardThe net present value (NPV) rule is considered one of the most common and preferred criteria that generally lead to good investment decisions. Consider this case: Suppose Black Sheep Broadcasting Company is evaluating a proposed capital budgeting project (project Beta) that will require an initial investment of $2,500,000. The project is expected to generate the following net cash flows: Year Cash Flow Year 1 $325,000 Year 2 $500,000 Year 3 $475,000 Year 4 $425,000 Black Sheep Broadcasting Company’s weighted average cost of capital is 9%, and project Beta has the same risk as the firm’s average project. Based on the cash flows, what is project Beta’s NPV? -$638,127 -$788,127 -$1,113,127 $1,386,873 Please solve using excelarrow_forward

- The net present value (NPV) rule is considered one of the most common and preferred criteria that generally lead to good investment decisions. Consider this case: Suppose Happy Dog Soap Company is evaluating a proposed capital budgeting project (project Beta) that will require an initial investment of $3,000,000. The project is expected to generate the following net cash flows: Year Cash Flow Year 1 $300,000 Year 2 $400,000 Year 3 $400,000 Year 4 $500,000 Happy Dog Soap Company’s weighted average cost of capital is 7%, and project Beta has the same risk as the firm’s average project. Based on the cash flows, what is project Beta’s NPV? -$1,662,284 -$1,362,284 -$1,262,284 -$1,994,741 Making the accept or reject decision Happy Dog Soap Company’s decision to accept or reject project Beta is independent of its decisions on other projects. If the firm follows the NPV method, it should project Beta. Suppose your boss…arrow_forwardThe net present value (NPV) rule is considered one of the most common and preferred criteria that generally lead to good investment decisions. Consider this case: Suppose Hungry Whale Electronics is evaluating a proposed capital budgeting project (project Alpha) that will require an initial investment of $500,000. The project is expected to generate the following net cash flows: Year Cash Flow Year 1 $300,000 Year 2 $475,000 Year 3 $500,000 Year 4 $400,000 Hungry Whale Electronics’s weighted average cost of capital is 9%, and project Alpha has the same risk as the firm’s average project. Based on the cash flows, what is project Alpha’s net present value (NPV)? $344,489 $844,489 $1,319,489 $971,162 Making the accept or reject decision Hungry Whale Electronics’s decision to accept or reject project Alpha is independent of its decisions on other projects. If the firm follows the NPV method, it should project Alpha.…arrow_forwardConsider the following list of projects: Project Investment ($) 135,000 200,000 125,000 150,000 175,000 75,000 80,000 A B C D E F G H O O Assuming that your capital is constrained, which investment tool should you use to determine the correct investment decisions? Incremental IRR IRR 200,000 50,000 Profitability Index NPV NPV ($) 6000 30,000 20,000 2000 10,000 10,000 9000 20,000 4000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education